🚨Zillow Group’s business model is under siege from regulators, competitors, and investors. The FTC and five states have sued Zillow and Redfin, alleging a $100 million “pay-to-play” pact that suppressed competition in rental listings. Simultaneously, CoStar is suing Zillow for over $1 billion in copyright damages, accusing it of republishing proprietary listing photos. These twin threats hit the market hard—Zillow shares dropped nearly 4% in a day—as investors reassessed the regulatory and litigation risks surrounding its data-driven monetization model. The fallout could redefine how U.S. housing platforms syndicate, price, and profit from listings—affecting CRE data flows and valuation transparency across the sector.

FTC + State Lawsuit Value: $100 million rental listings deal under antitrust scrutiny CoStar Copyright Claim: $1 billion in alleged IP damages

Zillow Traffic Lead: ~104 M monthly unique visitors vs. Homes.com ~95 M (Q1 2025)

Zillow Stock Reaction: –3.9% on FTC filing day

Loan Performance. Proptech-linked REIT and CMBS exposure remains limited, but if legal outcomes compress Zillow’s ad revenue, related debt coverage ratios could weaken for digital real-estate-backed ventures. Platform volatility also impacts underwriting confidence in portal-linked bridge lending (brokerage/lead-gen receivables).

Demand Dynamics. Reduced ad pricing power may temporarily benefit multifamily owners and property managers through lower marketing costs. Yet uncertainty around data visibility could deter institutional leasing strategies reliant on Zillow’s analytics feeds.

Asset Strategies. Brokerage and operator clients should diversify listing exposure—maintain presence across Zillow, CoStar, and MLS systems—to mitigate traffic concentration risk. Expect digital ad ROI variance through year-end as legal noise affects consumer traffic patterns.

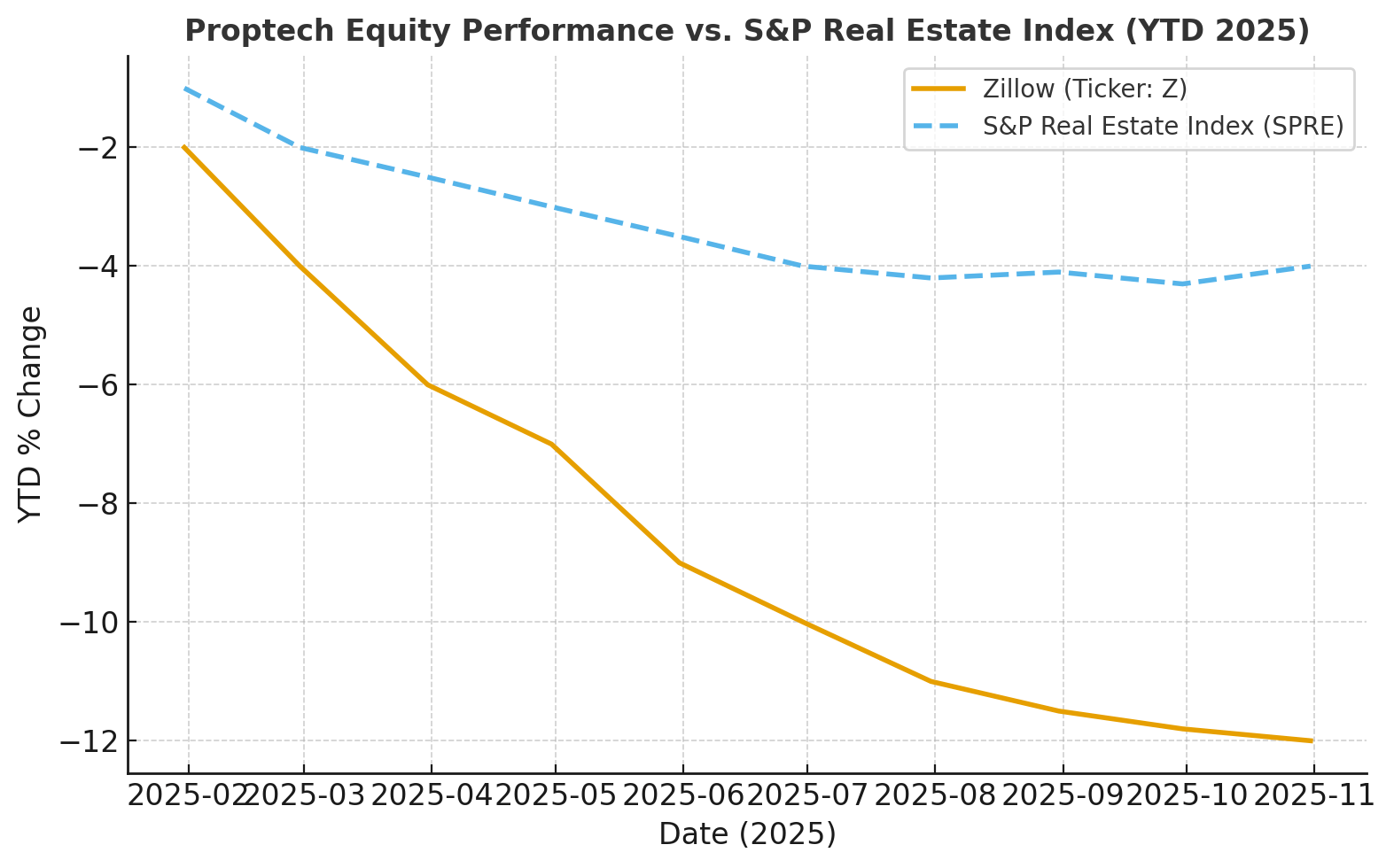

Capital Markets. Tech-adjacent CRE equities (Z, CSGP, OPEN) are underperforming the S&P Real Estate Index by ≈ –8 pps YTD. If FTC or CoStar suits tighten data monopolies, valuations could shift toward firms emphasizing verified inventory over lead-gen margin.

Regulatory risk now priced into proptech valuations.

Listings transparency may expand—reducing portal pricing power.

Competitive ad fee compression favors landlords and brokers short term.

Proptech-linked CRE equities remain defensive until court clarity.

🛠 Operator’s Lens

Refi. Expect stable digital-marketing costs; limited direct rate impact.

Value-Add. Use legal lull to test alternate traffic sources (Homes.com, LoopNet residential).

Development. Adjust lease-up pro formas if portal exposure costs fall ≥ 10%.

Lender POV. Banks view portal firms as elevated legal risk; spreads for tech-backed debt up 25–40 bps since September.

FTC hearings begin Q1 2026; injunction could unwind Zillow-Redfin pact. CoStar’s copyright trial discovery phase runs through mid-2026. Watch for expanded DOJ/NAR overlap on commission transparency—potential to reshape agent-fee models and MLS feed access.

FTC — Complaint v. Zillow & Redfin (Sept 2025). https://www.ftc.gov CoStar Group — Complaint v. Zillow (2025). https://www.costargroup.com Bloomberg — “Zillow Shares Drop After FTC Suit” (Sept 30 2025). https://www.bloomberg.com Redfin — SEC Filing 8-K (Feb 2025). https://investors.redfin.com CoStar Earnings Call Transcript (Q1 2025). https://investors.costargroup.com