🚨Key Highlights

Houston retail vacancy steady at 5.7%, unchanged in four years.

Dallas multifamily occupancy rose to 94.3%, up 40 bps QoQ.

Retail rents flat at $20.46 / SF (–1.2% YoY); Dallas apartment rents +0.4% QoQ.

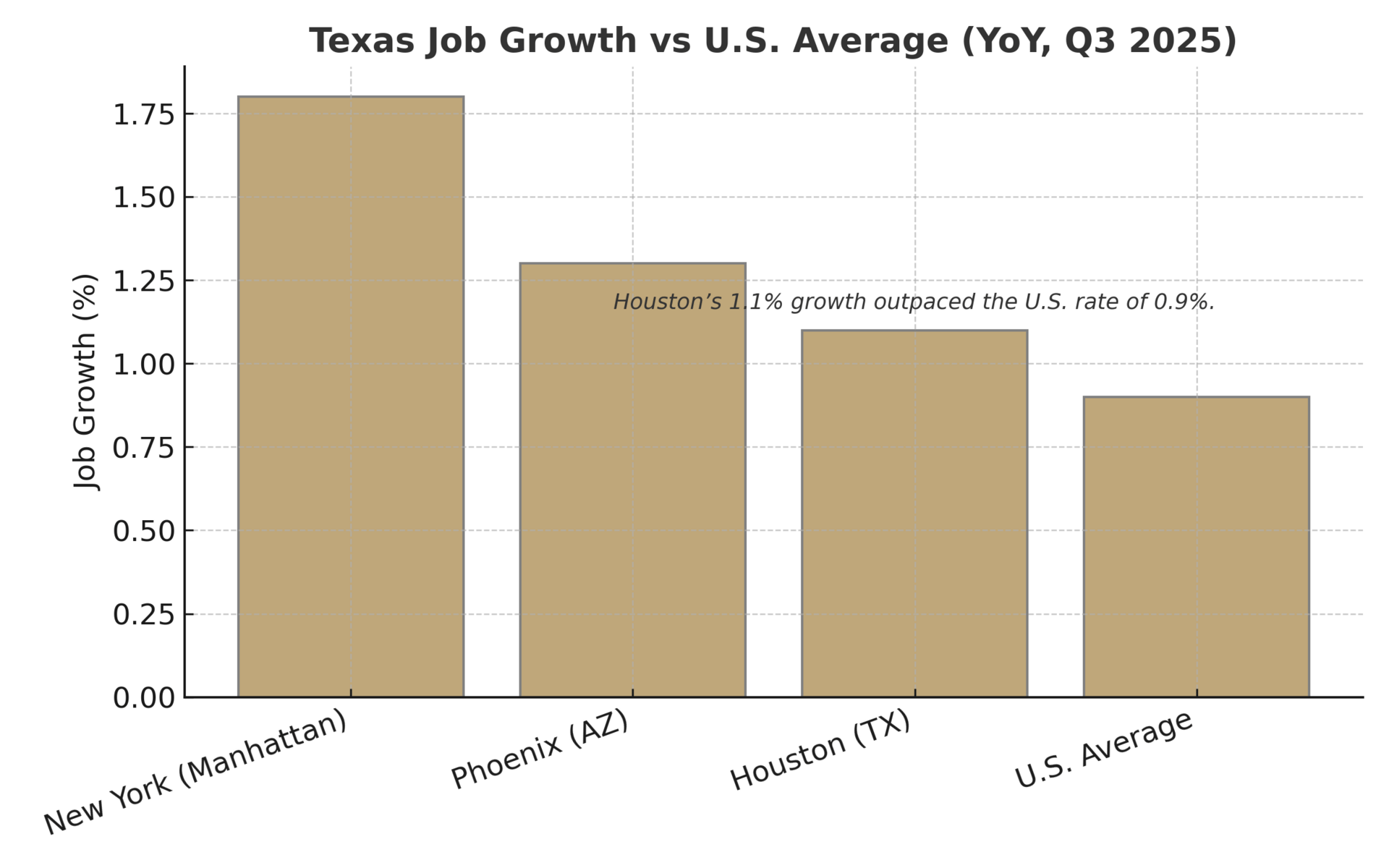

Houston job growth +1.1% YoY, beating the U.S. rate of 0.9%.

DFW investment volume $3.05 B in Q2, up $1 B QoQ, highest in the nation.

Signal

Texas commercial real estate is holding its line. Across Houston, Dallas, and Austin, leasing remains robust even as rent growth moderates and new supply tapers. The state’s economic engine — anchored in population inflow and job creation — continues to draw capital. “We’re underwriting stability, not surge,” said one Dallas multifamily lender, describing the shift toward conservative revenue assumptions. In a higher-rate era, Texas looks less like a boom state and more like a case study in disciplined expansion.

Occupancy First

Houston’s retail vacancy was 5.7% in Q3, nearly identical to 2021 levels, with absorption (~0.8 MSF) almost matching new deliveries. That equilibrium highlights tenant stickiness in daily-needs and experiential formats. Meanwhile, Dallas-Fort Worth apartments absorbed 8,691 units in Q2 while only 5,336 units delivered, pushing occupancy to 94.3%. Landlords are prioritizing filled space over rent escalation. In both metros, the operational mantra is: keep tenants, keep income. Rent spreads have flattened, but steady occupancy sustains NOI. For lenders, this predictability is underwriting gold.

Moderating Rent Growth

Rent growth across major Texas markets has cooled without collapsing. Houston retail rents slipped 1.2% YoY to $20.46 per SF, while Dallas apartment rents edged up just 0.4% QoQ to about $1,551. By contrast, 2022–2023 saw double-digit rent gains. The moderation reflects a normalization of demand and a deliberate pivot by owners to retention. Still, these plateaued rents sit atop a much higher baseline—roughly 20–25% above 2019 levels. In underwriting models, rent assumptions are now flat to low-single-digit, a guardrail that aligns with lender caution and higher debt costs.

Economic Bedrock

Job creation remains the backbone. Houston’s employment rose 1.1% YoY (Q3 2025), beating the national average (0.9%) and trailing only Phoenix (1.3%) and New York City (1.8%). That labor resilience feeds household formation and retail spending. Texas also leads the U.S. in net in-migration, extending the demographic dividend that underpins absorption across sectors. Industrial operators report stable throughput, while self-storage and retail centers benefit from population churn. On balance, the state’s economic diversity — energy, logistics, healthcare, tech — insulates CRE cash flows from isolated shocks.

Operator Lens

In practice, property operators are defensive on rent yet aggressive on occupancy. DFW multifamily owners are offering modest concessions to secure renewals, keeping turnover low. Retail landlords, facing 37.6% YoY declines in new construction, are backfilling space quickly rather than chasing record rents. Operating expenses are being trimmed, but not at the expense of service or tenant retention. “Every occupied space is a hedge,” a Houston center manager noted. The focus on cash flow continuity over rent inflation has turned operational discipline into Texas’ new growth model.

Capital Context

Capital remains firmly engaged. CBRE’s mid-year survey shows 70% of investors plan to expand Sun Belt holdings in 2025. Dallas-Fort Worth ranked #1 U.S. metro for CRE investment for the fourth consecutive year. Transaction volume rebounded to $3.05 billion in Q2, up $1 billion quarter-over-quarter, led by multifamily portfolios and open-air retail centers. Cap rates in favored sectors hover in the mid-5% range, with value-add opportunities commanding modest premiums. Lenders are still selective but active, especially local and regional banks comfortable with market fundamentals. Compared with coastal metros still digesting value declines, Texas offers relative yield and liquidity — a pairing increasingly rare in 2025.

The coming quarters will test whether Texas’ resilience can outlast high borrowing costs. With construction starts easing and absorption holding, vacancy drift should remain limited. Rent growth is expected to trail inflation, but employment and migration fundamentals remain strong. Financing discipline will shape outcomes: conservative leverage, stable occupancy, and realistic rent assumptions are keeping distress muted. Should rates begin easing in 2026, well-capitalized owners in Texas will be positioned to capture upside without overexposure. The region’s value proposition — steady income, population inflow, and policy stability — remains intact.

Resilience isn’t acceleration—it’s confidence priced in.

Cushman & Wakefield — Houston Retail Snapshot (Q3 2025); Cushman & Wakefield — U.S. Employment Tracker (Q3 2025); CRE Daily — Dallas Multifamily Report (Q2 2025); Matthews — DFW Multifamily Absorption Data (Q3 2025); CBRE — Investor Intentions Survey (2025).