🚨Key Highlights

$1.1 B loan refinances the office portion of Deutsche Bank Center.

66.7% LTV on a $1.65 B valuation signals durable prime-asset pricing.

Deutsche Bank leases 93.5% of space through 2041 – a 20-year income anchor.

GIC and ADIA own 96% of the asset, boosting credit perception.

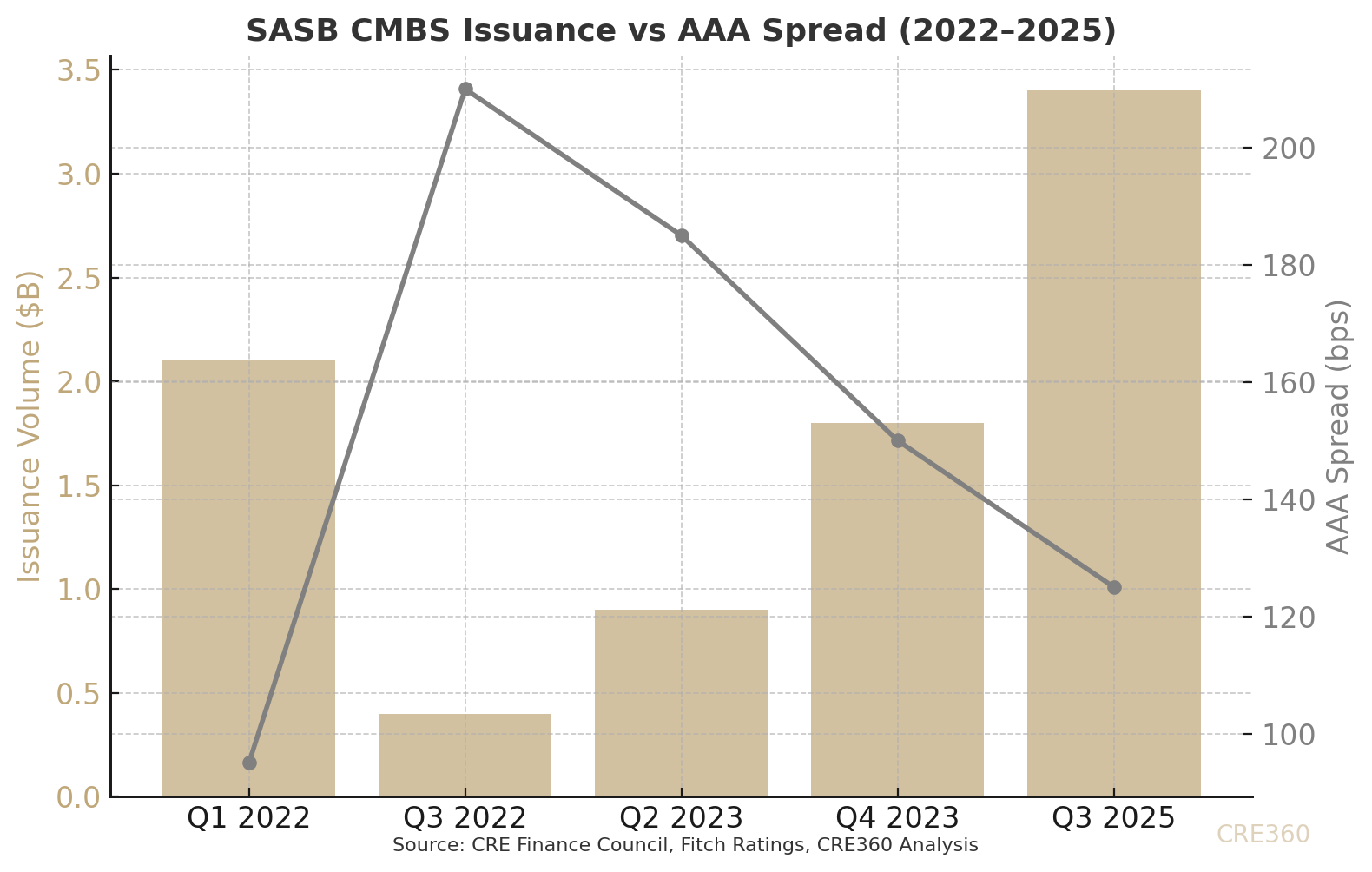

SASB CMBS spreads (~+120 bps) now price tighter than conduit peers.

Signal

Manhattan’s credit barometer just blinked green. A $1.1 billion refinance of the office portion of Deutsche Bank Center is set to close, backed by sovereign wealth capital from Singapore (GIC) and Abu Dhabi (ADIA). Two years after a $1.5 billion attempt collapsed amid market stress, the same asset is now drawing lender competition. This signals that top-tier New York offices – if anchored by long-term, investment-grade tenants – can once again access large-scale CMBS financing. Confidence has a price: structure first, spread second.

Sovereign Backing as Credit Enhancement

The deal’s ownership composition is its underwriting story. GIC and ADIA hold a combined 96% stake; Related Companies retains 3%. For bond investors, sovereign participation translates to “implicit recourse.” Such backing compresses credit spreads and enables a 66.7% loan-to-value ratio with an implied debt yield above 10%. In practice, global capital is replacing rating agencies as the arbiter of trust. Fitch’s pre-sale endorsement is supportive, but the sovereign names carry the real weight. In turn, their presence validates New York as a long-duration income market, not a trading venue.

Lease Duration as Bond Substitute

Deutsche Bank occupies 93.5% of the tower on a lease to 2041 with a renewal option through 2061. That 20-year term transforms rental income into an annuity. CMBS buyers now treat the loan less like a real estate credit and more like a corporate bond indexed to Deutsche Bank’s own credit. As a result, AAA tranches of this SASB issue could price around +120 bps over Treasuries – 50 bps tighter than conduit deals still exposed to vacant offices. The behavior shift is clear: duration and tenant strength are now the new liquidity.

Adaptation After the 2022 Failure

When the original $1.5 billion refi collapsed in 2022, it was a symbol of capital gridlock. By reducing proceeds to $1.1 billion and waiting for spread stability, the sponsors reset market expectations without conceding on valuation. This time, the loan carries a two-year term plus extensions – a bridge to rate normalization rather than a permanent fix. Still, the structure works: interest-only payments, ample cash flow coverage, and room for refinance in 2027. The lesson for other borrowers: patience and equity beat urgency and leverage.

CMBS Market Thaw and Capital Segmentation

Meanwhile, the CMBS market is reopening – but selectively. SASB (single-asset, single-borrower) issuance has risen 30% year-to-date, while conduit volumes with office exposure remain down 70%. Investors prefer what they can model: one tower, one tenant, one story. That bifurcation creates a pricing paradox – prime offices can borrow cheaper today than secondary ones could in 2021. In practice, capital is migrating from diversified risk to concentrated clarity. Still, if the benchmark Deutsche Bank Center deal trades well, conduit lenders may follow with their own trophy-focused pools.

Global Capital’s Re-Entry Pattern

Foreign institutions are using debt as their re-entry vehicle into U.S. CRE. After two years of equity retreat, sovereign funds now prefer hybrid positions – quasi-lender, quasi-owner. This $1.1 billion refi embodies that strategy. For GIC and ADIA, it is less about yield than duration hedging – owning a dollar asset with bond-like income in a deflationary currency cycle. For U.S. markets, their return anchors pricing psychology across the capital stack. On balance, this marks a quiet vote of confidence in Manhattan’s longevity.

If the Deutsche Bank Center CMBS prices successfully, expect copycat refis within six months – Hudson Yards, Midtown East, possibly West Coast trophy assets with similarly credit-anchored leases. SASB issuance could rise to $20 billion in 2026, with AAA spreads normalizing near +110 bps. But the bar will stay high: LTV ≤ 65%, debt yield ≥ 10%, and sponsor net-worth in the billions. Meanwhile, older or partially vacant offices will face higher refinancing spreads (+200–250 bps), keeping distress workouts busy. Capital discipline is back – and for Manhattan, that may be the most constructive recovery yet.

If rates ease, discipline – not optimism – will decide who refinances next.

Bisnow (Oct 2025); Fitch Ratings Pre-Sale (Oct 2025); CRE Finance Council Data (2022–2025).

(Mode B v7 — CRE360 Editorial )