🚨Key Highlights

37,700 BTR units underway in the South region (+2.3% since June).

Phoenix leads with 10,000 + units, the nation’s Build-to-Rent epicenter.

Las Vegas visitation down ~8 % YoY, pressuring hotel underwriting.

Phoenix employment +1.3 % YoY, supporting resilient leasing.

Multifamily cap rates ~5.3 %, up ≈130 bps from 2022.

Debt costs >6 %, prompting conservative leverage and selective capital.

Signal

The Southwest’s growth corridor—anchored by Phoenix and Las Vegas—remains a study in contrast.

Developers keep building and capital keeps flowing, yet underwriting and hospitality metrics reveal caution creeping in.

Phoenix’s 10 k-plus BTR units and sub-6 % retail vacancy prove demographic momentum still dominates, even as rising rates force investors to price discipline back into deals.

Pipeline and Population

Phoenix’s position as the Build-to-Rent capital of the United States underscores how housing demand continues to pull construction capital southward.

The South region’s 37,700 units under construction—more than the other three regions combined—represent developers’ conviction that migration and affordability will sustain rent rolls.

Meanwhile, Phoenix’s +1.3 % YoY job growth and continued in-migration from coastal metros underpin absorption.

Yet the pace borders on exuberant: with interest rates roughly 300 bps higher than at origination, lenders are stress-testing deals for thinner cushions.

In practice, the pipeline keeps advancing, but at a measured tempo rather than the breakneck expansion of 2022–2023.

Hospitality Crosswinds

Las Vegas, long the Southwest’s economic barometer, is flashing mixed signals.

Through the first half of 2025, the market recorded 22.3 million occupied room-nights, a –5.9 % YoY decline.

Operators responded with targeted discounts and promotional campaigns, stabilizing occupancy near 79 %.

Tourism officials expect a sharp rebound as the Formula 1 Grand Prix and the Super Bowl draw international traffic, but underwriters have tightened coverage ratios and widened exit yields.

On balance, Vegas is a reminder that regional optimism still depends on discretionary travel—and that debt markets now price that volatility explicitly.

Operators in Adjustment

Across the corridor, property operators describe a pragmatic equilibrium.

Phoenix apartment and BTR managers report mid-90 % occupancy and steady leasing, though concessions are inching up as renter budgets stretch.

Retail operators cite durable traffic in grocery-anchored centers, while Las Vegas hotel managers recalibrate staffing for event-driven surges.

Industrial landlords, meanwhile, remain the region’s most confident class: Greater Phoenix logistics vacancies stay in single digits, with rents still rising ~4–5 % YoY.

For now, operators are optimizing service and pricing agility—protecting occupancy even at the cost of modest rent deceleration.

Capital Flows and Guardrails

The capital story is equally bifurcated.

Investors chase growth in logistics, data centers, and rental housing, often through joint-venture equity or debt-fund construction loans priced above 6 %.

Cross-regional capital from California continues to migrate east, drawn by yields 100–150 bps higher than coastal markets.

Foreign investment, once a defining Phoenix trait, has slowed; Canadian institutions remain cautious amid currency and rate volatility.

Underwriters, sensing both risk and resilience, are embedding stricter DSCR thresholds (≥1.35×) and higher exit cap assumptions (~5.5–6 %) into models.

This recalibration hasn’t frozen deals—it’s filtered them.

Projects with demonstrable demand pipelines still clear committee, while marginal concepts now stall early in underwriting.

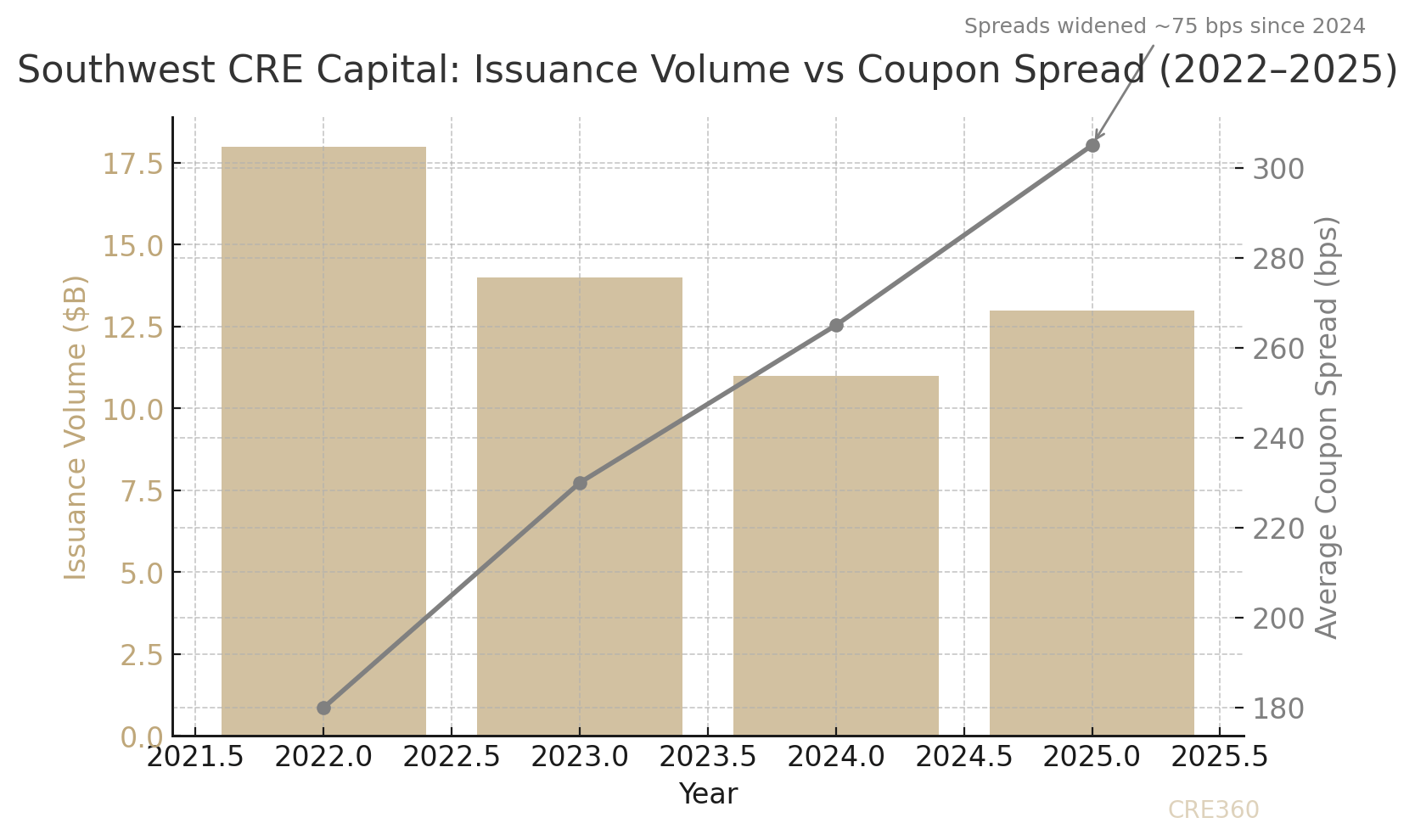

Pricing and Risk Premiums

Market pricing reflects this newfound discipline.

Multifamily cap rates that once hovered near 4 % now average ~5.3 %, while prime industrial trades still command low-5 % yields.

Office and urban hospitality assets face steeper hurdles; some Vegas hotel valuations have fallen 10–15 % from 2023 levels.

Debt spreads, meanwhile, have widened by 50–75 bps YoY as lenders prioritize credit quality.

Still, with regional banks and debt funds competing for seasoned sponsors, liquidity hasn’t vanished—it has simply become more conditional.

Ultimately, pricing is rediscovering balance: yield compression has given way to underwriting realism.

Into 2026, the Southwest will test whether growth alone can offset capital’s new cost.

Supply pipelines remain active, especially in Phoenix BTR and industrial, but rising operating costs and slower migration could thin margins.

Las Vegas hospitality may rebound sharply if event-driven demand endures, yet investors will demand at least two strong quarters before re-entering at scale.

Expect lenders to remain selective: debt will favor income-producing housing and logistics, while hospitality and retail expansion rely on proven sponsors.

If inflation eases and rates stabilize, cap-rate expansion may plateau—allowing transaction velocity to recover modestly.

The region’s advantage remains its demographic engine, but sustaining capital confidence will require measured growth and disciplined underwriting.

Resilience draws capital—but discipline keeps it.

credaily.com (Sept 2025 BTR data); cdcgaming.com (Oct 2025 tourism updates); rgj.com (H1 2025 hotel occupancy); CREFC Debt Maturity Monitor (2025 Q3); Cushman & Wakefield (2025 market reports).