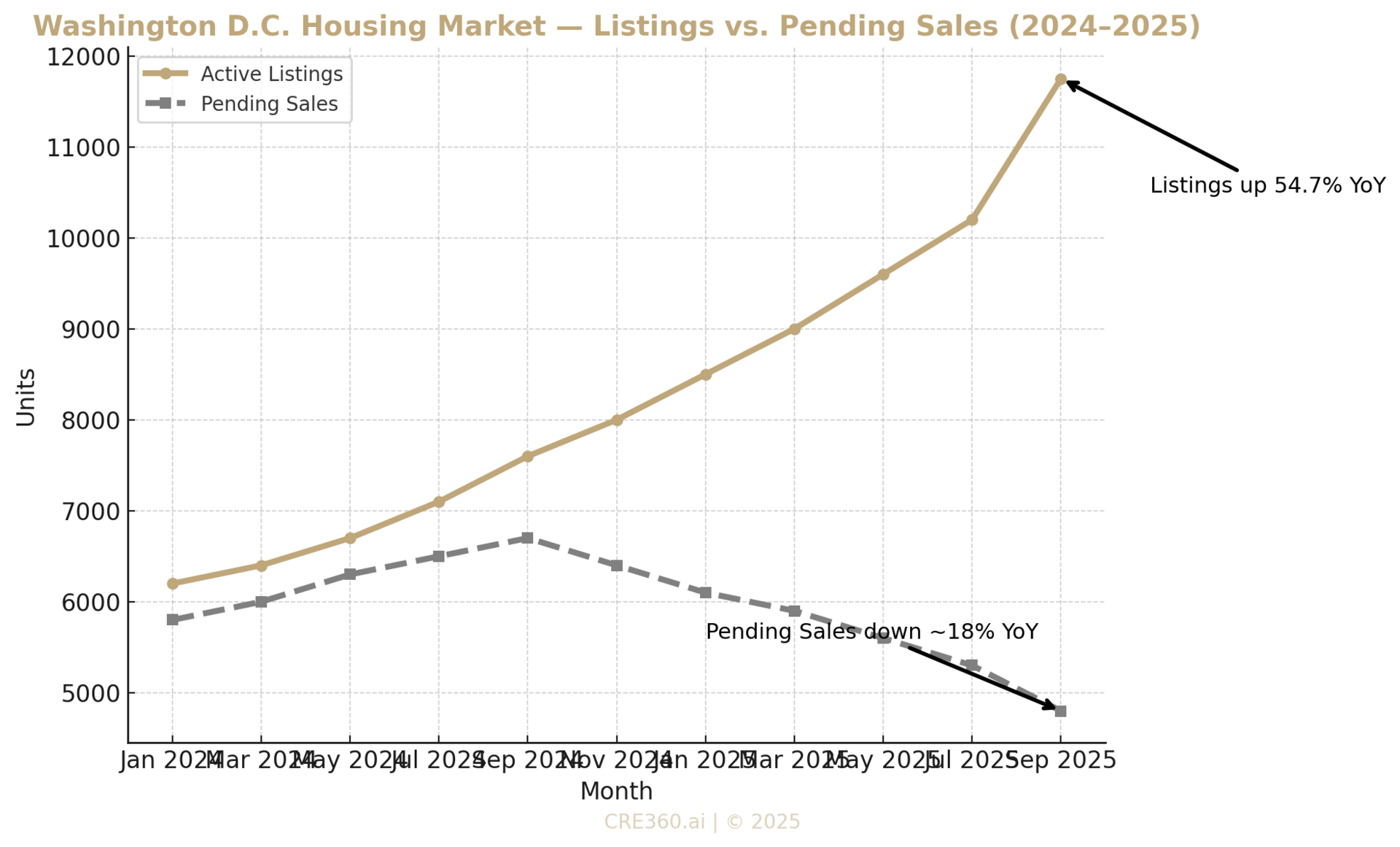

🚨Washington’s housing market is flashing stress signals as the ongoing federal shutdown disrupts both employment and income stability across the region. Listings have jumped ~55% year-over-year, driven by former federal workers whose severance payments have expired and current employees facing missed paychecks. Yet demand has softened sharply — with open house traffic and pending sales declining as mortgage-qualified buyers adopt a wait-and-see stance. The capital’s housing cycle, once buoyed by government payrolls, is shifting toward a buyer’s market for the first time in years.

Active listings: +54.7% YoY (Bright MLS, Sept 2025)

Pending home sales: Down ~12% MoM during shutdown weeks

Mortgage applications in D.C. region: –8% MoM (Sept 2025)

Loan Performance. While delinquencies remain stable for now, prolonged income disruption among federal workers could trigger short-term distress, particularly for FHA borrowers with minimal reserves.

Demand Dynamics. Buyer hesitation reflects job insecurity; listings are increasingly composed of involuntary sellers exiting due to income loss. Showings and offers per listing are trending down sharply.

Asset Strategies. Developers should delay premium launches and offer concessions on existing inventory; reposition mid-market units to attract stable private-sector tenants.

Capital Markets. Regional lenders are tightening underwriting on owner-occupant loans tied to federal employment; appraisal discounts are emerging on listings with long market durations.

Shutdown-induced liquidity stress is tilting D.C. housing toward buyers.

Expect near-term price softening in mid-tier and suburban submarkets.

Mortgage originations likely to dip through Q4 as uncertainty lingers.

Rebound potential exists post-shutdown once back pay and confidence return.

🛠 Operator’s Lens

Refi. Avoid refinancing during shutdown volatility; spreads could widen temporarily.

Value-Add. Focus on adaptive reuse or rental conversions while sales momentum stalls.

Development. Phase new housing starts cautiously; monitor labor availability linked to federal contracts.

Lender POV. Temporary pullback in risk appetite; expect extended approval timelines for borrowers with federal income.

If the shutdown extends beyond mid-October, price cuts and days-on-market will likely rise further. Watch for a rebound in listings absorption once pay resumes — but structural job reductions could mark a longer-term shift in D.C.’s housing equilibrium.

Bright MLS — D.C. Market Watch Report (Sept 2025). https://www.brightmls.com Mortgage Bankers Association — Weekly Applications Survey (Oct 2025). https://www.mba.org/news-and-research Economic Times — Federal Turmoil Triggers Housing Cooldown (Oct 2025). https://economictimes.com