📢Good morning,

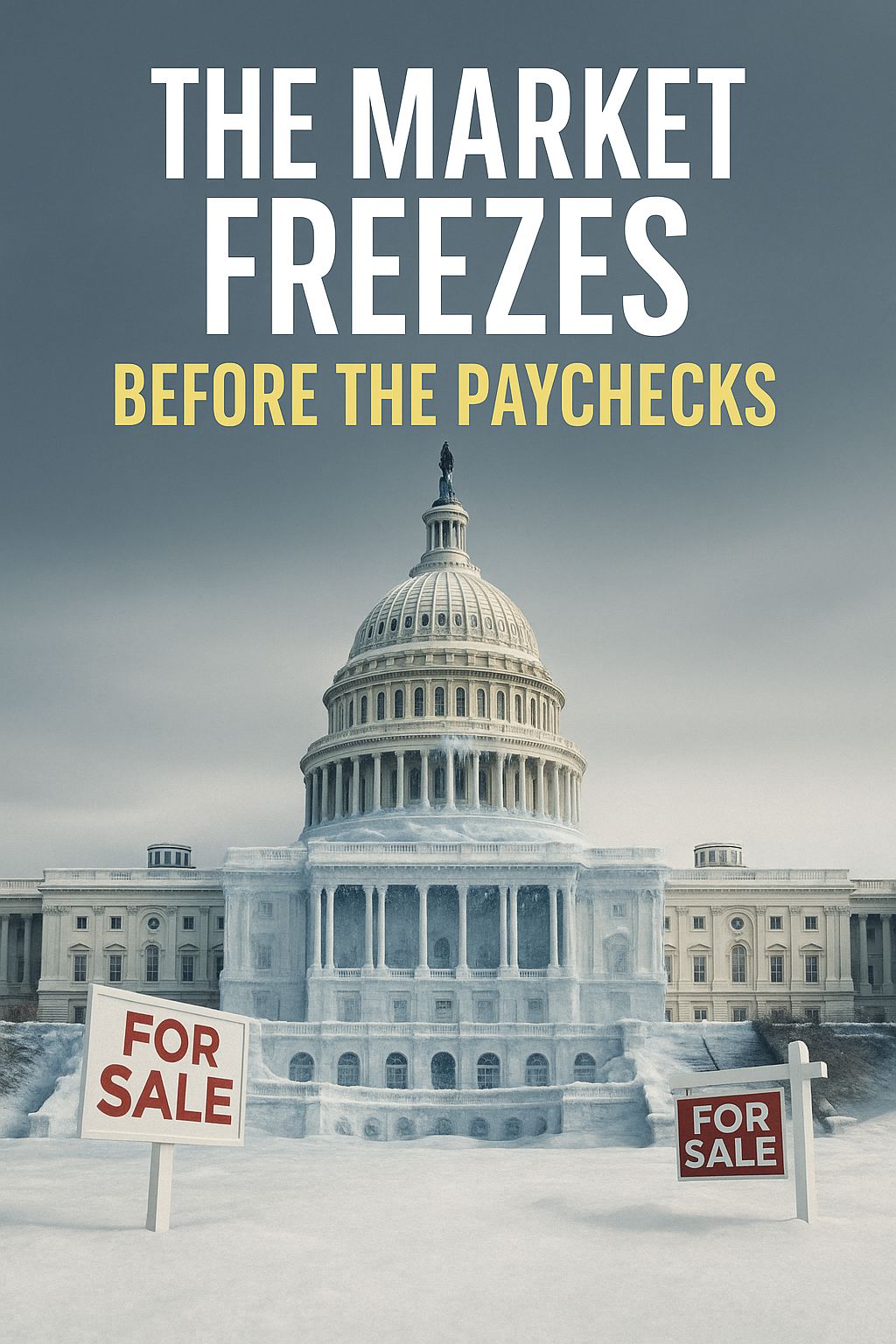

A partial federal shutdown is cooling the Washington, D.C. housing market faster than expected. With federal salaries frozen and “buyout” payments for laid-off employees expiring, listings have surged while buyer sentiment slumps. The capital’s unique exposure to government payrolls means even short disruptions can ripple quickly through prices, absorption, and consumer confidence.

📊 Quick Dive

Listings spike: Active for-sale inventory up ~54–55% YoY, one of the largest gains nationwide (Bright MLS).

Demand cools: Buyer showings and new purchase contracts both trending lower as job insecurity weighs on sentiment.

Market tilt: Economists expect temporary softening in prices and longer days on market until the shutdown is resolved.

Read the full Signal

Financial Firms as Industrial-Scale Landlords

Institutional investors now control about 17% of prime U.S. logistics properties, deploying roughly $88 billion in Q1 2025 alone. By blending debt-equity structures and partnering with 3PLs, financial firms have become dominant landlords in industrial real estate. With vacancy below 5% and cap rates near 5.2%, logistics assets are behaving like fixed-income instruments — stable, low-volatility, and coveted by capital allocators. Read Full Signal →

Global Real Estate Value Tops $393 Trillion, Outpacing Gold & Equities

Real estate remains the planet’s largest asset class at $393.3 trillion, roughly four times global GDP and twenty times the total value of all gold ever mined. U.S. commercial property alone represents about $19.4 trillion, reaffirming America’s global weight in CRE. Despite China’s housing slowdown, the sector’s sheer scale reinforces property as the world’s ultimate store of wealth Read Full Signal →

Cushman & Wakefield Wins Back ing for Bermuda Redomiciliation

Proxy advisers ISS and Glass Lewis urged shareholders to approve Cushman & Wakefield’s move from the U.K. to Bermuda. The firm cites simplified compliance, governance modernization, and ~$3 million in annual cost savings on $9 billion revenue. The vote on October 16 is expected to pass, positioning C&W for leaner operations and greater alignment with its U.S. investor base Read Full Signal →

Zillow’s Turbulent Month: FTC Lawsuit, CoStar Copyright Battle & Competitive Threats

The FTC and five states have sued Zillow and Redfin, alleging a $100 million “pay-to-play” deal to eliminate rental-listing competition. Simultaneously, CoStar is pursuing a $1 billion copyright claim against Zillow for using protected photos. Combined with Compass and class-action lawsuits, the barrage shaved nearly 4% off Zillow’s stock in a single day. Analysts warn that legal and compliance costs could squeeze margins across the real-estate-tech sector. Read Full Signal →

For practitioners, the D.C. housing freeze underscores how government volatility translates directly into liquidity risk. Markets tied to public-sector payrolls behave differently: when confidence in paycheck stability falters, listings surge before prices fall. Investors and lenders should treat this as a stress-test for other politically exposed metros — think Northern Virginia, Maryland, and even markets like Austin or Sacramento with heavy federal or tech-contractor payrolls.

Beyond D.C., the week’s Signals highlight a split market narrative: capital is flowing toward stable, bond-like assets (industrial, data centers) while legal and policy shocks pressure residential and proptech valuations. The real lesson — resilience follows cash flow visibility, not headline optimism.

Federal budget talks: A shutdown resolution could quickly revive D.C. housing sentiment.

Industrial repricing: Watch Q4 data for whether institutional buying slows amid tight yields.

CRE valuations: Global real estate’s $393T base magnifies even small cap-rate shifts.

Tech & regulation: Ongoing FTC and CoStar litigation could redefine portal monetization models.