🚨Key Highlights

5.8% vacancy (Q3 2025): Flat QoQ, +50 bps YoY (Cushman & Wakefield).

–20% valuation example: Knollwood Center (MN) sold for $85.25 M vs. $106.7 M in 2015.

Retail CMBS delinquency 6.76%: Below multifamily and far below office (Trepp).

Cap rates ~6.9%: +60 bps YoY, still 200 bps above multifamily.

Debt available @ 55–65% LTV: Assumable 5–6% loans support pricing.

Signal

The U.S. retail property market has quietly achieved something elusive in commercial real estate this cycle: equilibrium. National vacancy of 5.8% is essentially flat year-over-year, rents are inching higher in prime centers, and dealmaking continues—albeit at newly disciplined prices. Retail has absorbed its structural reset from e-commerce and COVID disruptions and is now repriced for yield rather than hope. In the words of one Midwest broker, “We’re finally trading cash flow, not dreams.” That distinction defines 2025’s capital behavior.

Value Reset, Confidence Rebuilt

Recent sales show a measured repricing rather than distress. The Shoppes at Knollwood in Minnesota sold for $85.25 M—about 20% below its 2015 price—reflecting higher cap rates and tenant turnover. Across the country, similar centers trade 15–30% below mid-2010s levels, aligning with 6–7% retail loan rates. Buyers are underwriting cash flow durability, not just basis value. In practice, this reset has drawn yield-focused capital back to a sector long written off as mature.

Debt Access and Pricing Discipline

Retail remains financeable. Banks and CMBS lenders are offering 55–65% LTV for strong grocery-anchored assets, and assumable loans at 5–6% coupons have become a quiet market advantage. In the Knollwood deal, the buyer assumed a 5.67% loan due 2030 — a built-in pricing subsidy. Lenders are also extending performing loans, recognizing steady NOI growth. By contrast to office, refinancing risk in retail is low; capital is still available for proven formats.

Tenant Evolution and Operational Resilience

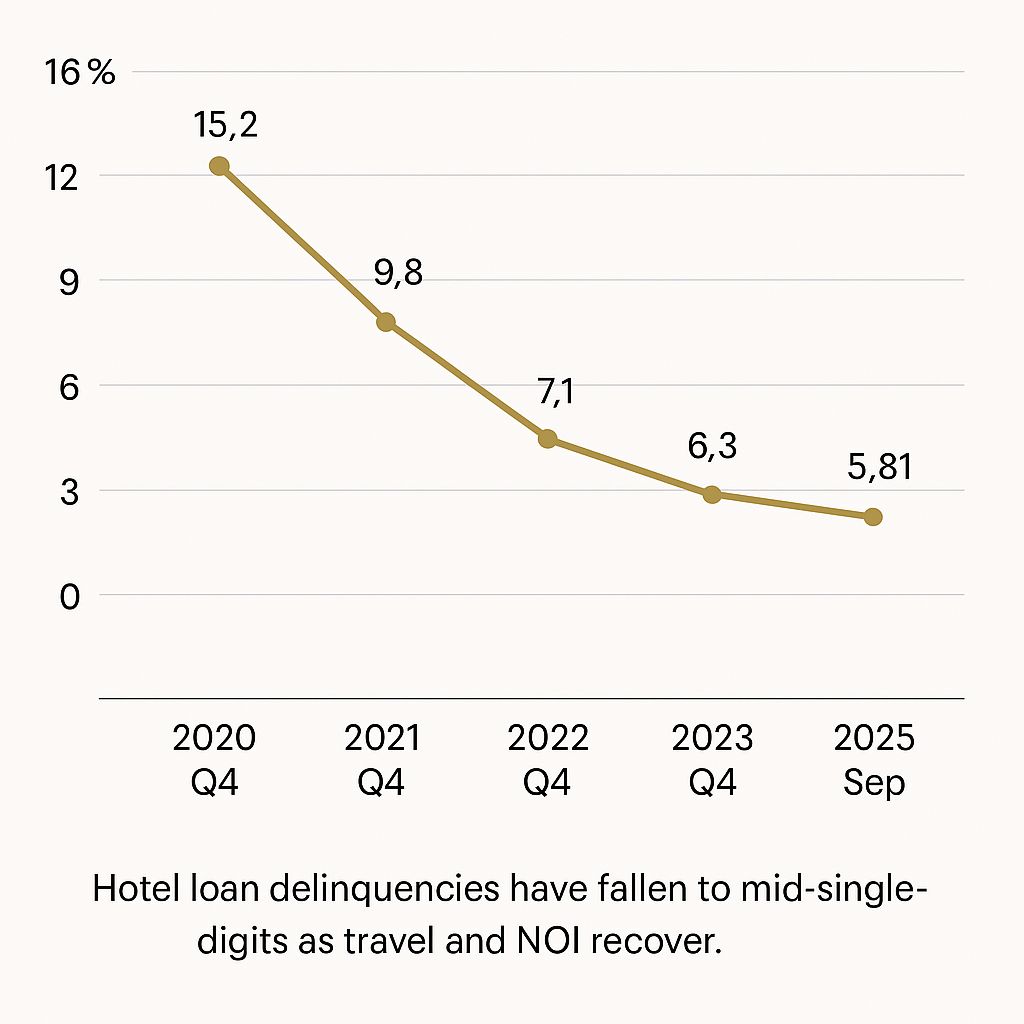

Credit mix is shifting toward experiential and service users — medical clinics, fitness, and entertainment — which diversify income and extend lease terms. Open-air centers are 90% + occupied, and many B-malls have stabilized after closures in prior years. Retail CMBS delinquency at 6.76% remains well below office and has already cleared its legacy distress. Net operating incomes are rising in low-single digits—sufficient to maintain DSCRs even at higher rates. Still, the sector’s durability depends on credit tenants that draw consistent foot traffic. Discipline now sustains stability.

Investment Market and Cap Rates

Capital is re-engaging. Institutional investors that avoided retail are back, lured by yields in the high-6% range (~6.96% for net-lease retail in Q1 2025). That spread over multifamily and industrial is compelling in a normalized rate environment. REITs are targeting open-air centers, private equity is chasing value-add plays, and high-net-worth buyers view single-tenant net-lease as bond substitutes. Retail deal volume is down 10–15% YoY — a modest dip relative to office’s collapse. Competition is healthy for quality assets, while secondary malls still trade above 9% cap rates. Caution remains, but confidence is back.

Retail’s recovery is measured but durable. Expect flat-to-positive rent growth and steady occupancy through 2026 as supply and demand stay balanced. If base rates decline, cap rates could compress slightly, rewarding 2025 buyers. Performance will remain format-specific: grocery-anchored and lifestyle centers in growth markets should outperform, while obsolete malls face redevelopment. Underwriting focus must stay on tenant credit, lease rolls, and service-oriented resilience. With values reset and credit flows open, retail is no longer the problem child of CRE—it’s the benchmark for disciplined normalization.

Stability isn’t relief — it’s discipline priced in.

Cushman & Wakefield — U.S. Retail MarketBeat (Q3 2025) Finance & Commerce — Shoppes at Knollwood Sale (Sept 2025) Trepp — CMBS Delinquency Report (Sept 2025) CommercialSearch — Net-Lease Retail Cap Rate Survey (Q1 2025)