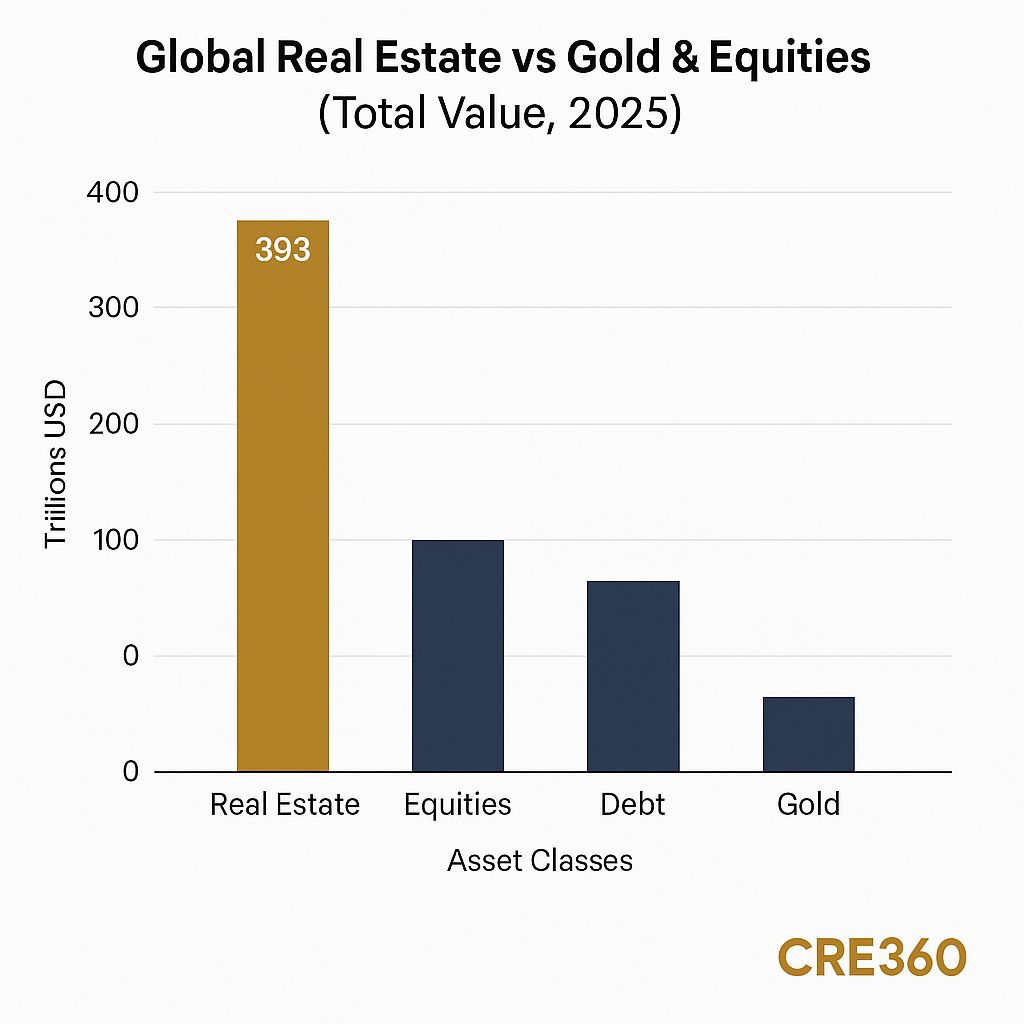

🚨Global real estate has reached a staggering $393.3 trillion valuation in 2025, underscoring its role as the planet’s dominant wealth reservoir. Despite a minor 0.5% pullback in 2024 — largely from China’s housing slump — the sector’s aggregate value now exceeds global equities and debt combined. For capital allocators, this means even marginal valuation shifts (±50 bps in cap rates) can reprice trillions in stored wealth — far beyond the scale of equity market swings.

Total Global Real Estate Value: $393.3 T (2025)

U.S. Share: ~$80 T total; ~$19.4 T commercial

China Share: ~$92 T (23.5% of global)

Gold Market Value: $20.2 T (≈ 5% of real estate)

Loan Performance. Real estate’s magnitude drives systemic risk exposure. Even small repricings in commercial cap rates cascade through global credit markets, affecting DSCR covenants and bank LTV compliance.

Demand Dynamics. The $287 T residential base anchors long-term savings behavior; China’s slowdown only marginally dents global housing wealth. U.S. multifamily and industrial remain stable wealth conduits.

Asset Strategies. Institutional investors treat real estate as “quasi-fixed income” — using core assets as inflation buffers while rotating into higher-yield private credit.

Capital Markets. The $58.5 T global commercial property segment continues to attract structured capital. Private debt and REITs are scaling exposure as bond yields stabilize near 4–5%.

Real estate is the dominant global asset, eclipsing all others.

Even modest revaluations equate to trillions in nominal change.

Capital prefers tangible, income-producing assets over volatile equities.

Institutional balance sheets remain overweight property, sustaining liquidity.

🛠 Operator’s Lens

Refi. Expect lenders to favor core stabilized assets; refinancing spreads compress where collateral carries institutional credit.

Value-Add. Rising global base values sustain construction financing appetite, particularly for ESG or adaptive-reuse projects.

Development. Margins remain thin but risk-adjusted returns still beat sovereign debt.

Lender POV. Global property stability underpins credit risk appetite — banks view CRE as balance-sheet ballast.

Monitor China’s housing reform trajectory and global cap-rate elasticity to rate moves.

Watch institutional reallocations from public equities into private CRE debt/equity funds.

Risk: valuation correlation across geographies increases systemic exposure during downturns.

Savills — World Real Estate Value Report 2025 (Sept 2025). [savills.com] MSCI — Global CRE Market Size Update (June 2025). [msci.com] World Gold Council — Total Above-Ground Gold Estimates (2025). [gold.org] World Bank — Global GDP 2025 Outlook. [worldbank.org]