➤ Key Highlights

Nonresidential planning momentum has stopped accelerating after an extended surge

Construction input costs remain elevated and sticky, not correcting

Labor availability is structurally tight, despite softer hiring signals

Project risk is shifting from market timing to execution discipline

Nonresidential construction planning activity has stabilized at elevated levels following a multi-year expansion, while cost inputs remain firm and labor availability constrained. Current conditions do not indicate a contraction in development activity; rather, they reflect a normalization of risk tolerance and capital pacing. Over the near term, project outcomes will be driven less by market timing and more by execution quality, procurement discipline, and scheduling conservatism.

1. Planning Activity: Elevated Levels with Reduced Acceleration

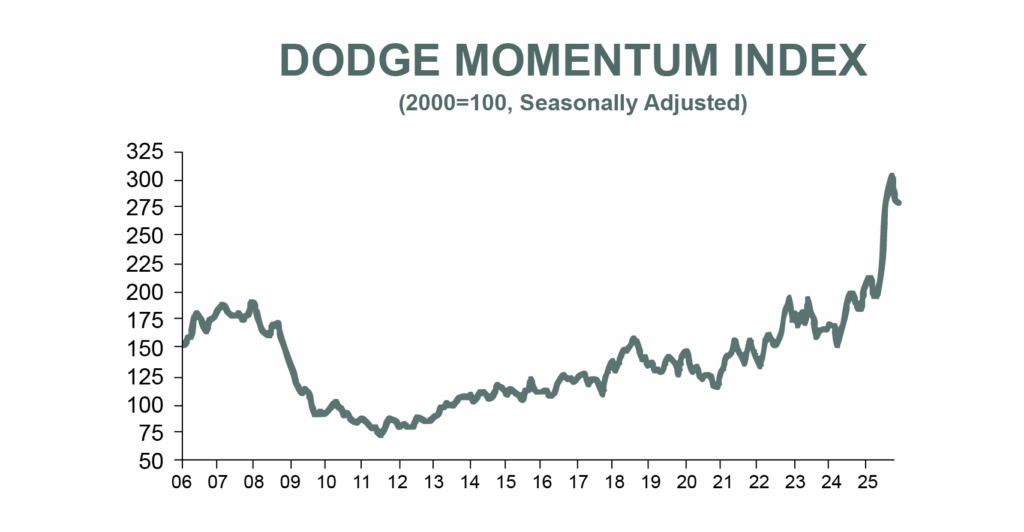

Recent readings of the Dodge Momentum Index (DMI) indicate a modest decline from cyclical highs, representing the first sustained deceleration following an extended period of growth in nonresidential project planning.

Despite the pullback, planning activity remains materially above prior-year levels, suggesting that underlying demand for development has not deteriorated. The slowdown is concentrated within select segments—most notably institutional, hospitality, and warehouse development—while other asset types continue to demonstrate planning stability.

The observed deceleration appears to reflect increased capital selectivity and extended decision cycles rather than a withdrawal of capital from the sector.

Implications:

Developers continue to advance projects, but at a slower cadence. Longer preconstruction phases, increased scope refinement, and heightened value-engineering efforts should be expected as sponsors reassess feasibility under current cost and financing conditions.

2. Materials Pricing: Stability at Elevated Cost Levels

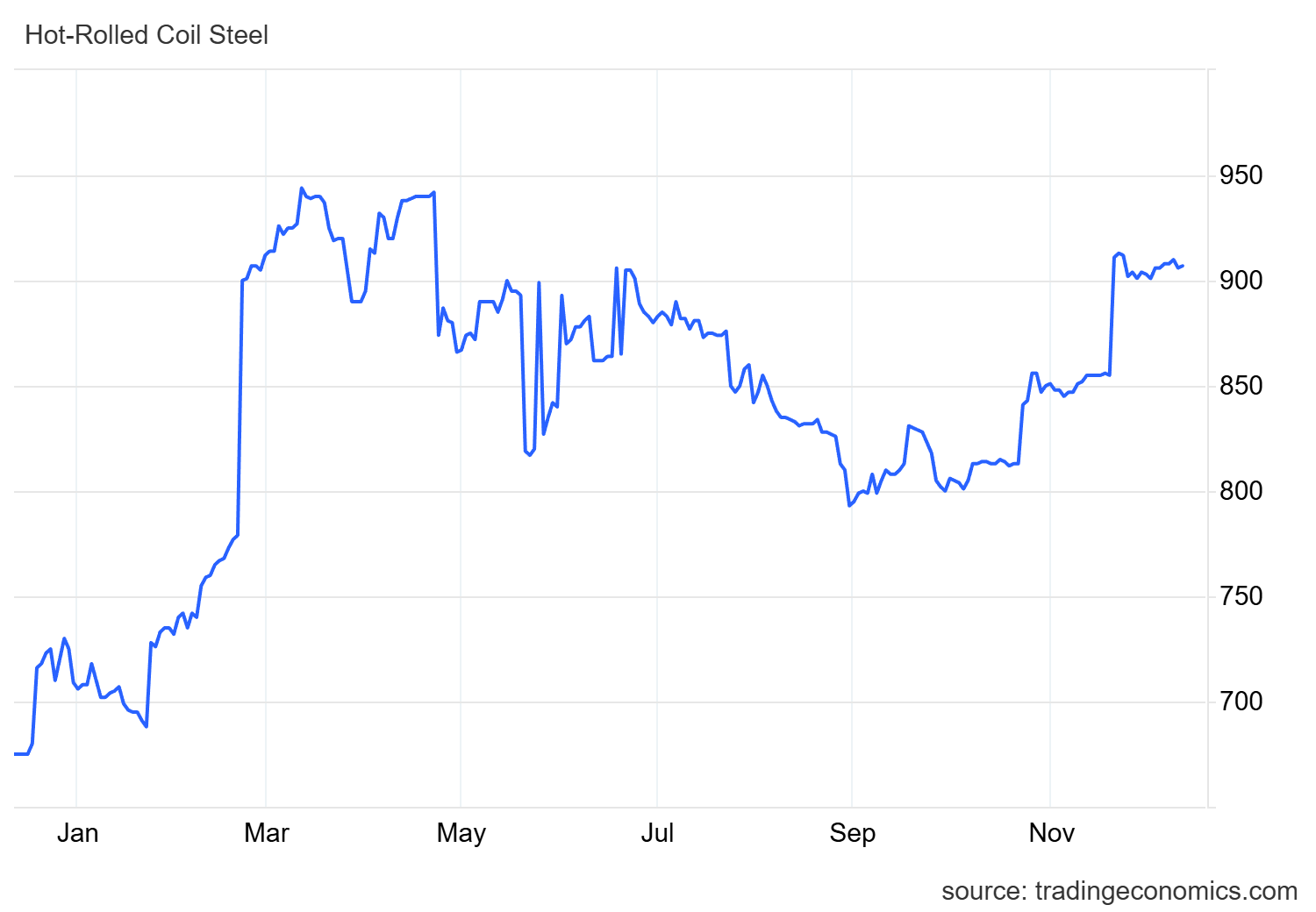

Construction material prices remain broadly stable but elevated relative to pre-2023 benchmarks.

Steel pricing continues to trade above historical averages, indicating limited near-term downside despite reduced volatility. Copper prices remain supported by structural demand drivers, including data center development and ongoing electrification initiatives. Lumber prices have stabilized above mid-year lows, reducing short-term price swings but maintaining upward pressure on total project costs.

Implications:

The current environment does not support expectations of broad construction cost deflation. Procurement strategy remains a key determinant of project performance, and deferring commitments in anticipation of material price resets introduces additional risk without a clear basis.

as of 12/11/25 2:38 PM CT

3. Labor Conditions: Moderating Demand with Persistent Supply Constraints

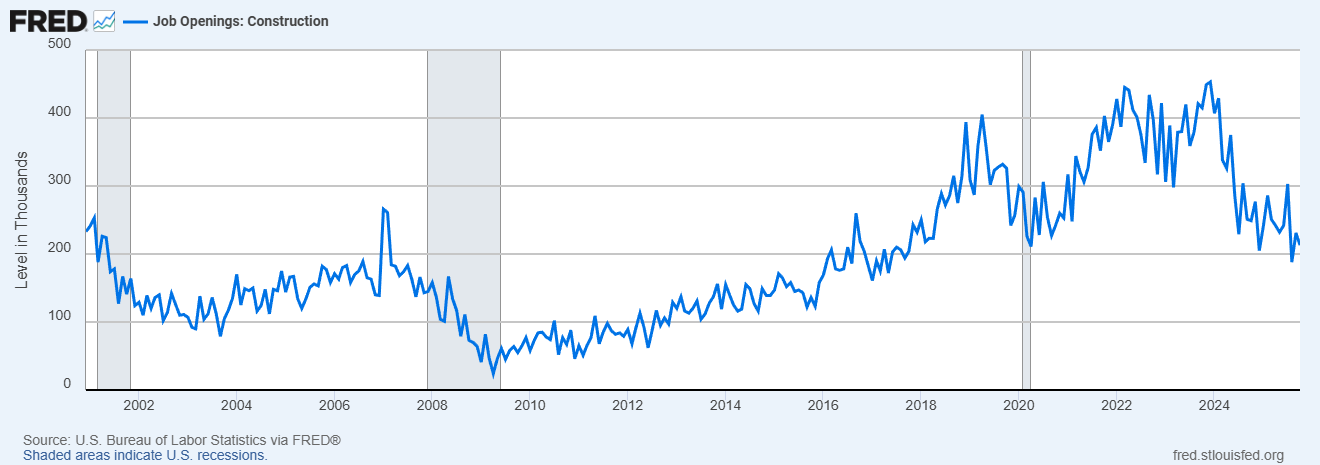

Construction job openings have declined from recent peaks; however, this reduction has not translated into a commensurate increase in labor availability.

The decline in posted positions reflects softer demand rather than a material improvement in workforce supply. Skilled labor shortages persist due to demographic trends, trade specialization, and geographic mismatches. Contractors with established labor relationships and stable crews continue to hold a relative execution advantage.

Implications:

Labor constraints remain a secondary but persistent execution risk. The primary impact is expected to manifest through schedule compression and sequencing challenges rather than immediate cost escalation.

Dec 9, 2025 9:10 AM CST

Stop Reading Headlines

Start Understanding the Market

➤ TAKEAWAY

The current operating environment disadvantages projects characterized by:

High leverage and speculative underwriting

Deferred procurement strategies

Insufficient preconstruction rigor and contingency planning

Conversely, projects are better positioned when supported by:

Early subcontractor and material commitments

Conservative scheduling assumptions

Demonstrated execution capability and operational control

This phase does not represent a cyclical peak in construction activity; however, it does represent a period in which weaker projects are increasingly exposed through delays, margin erosion, and feasibility challenges rather than abrupt market dislocation.

DODGE Construction