🚨Key Highlights

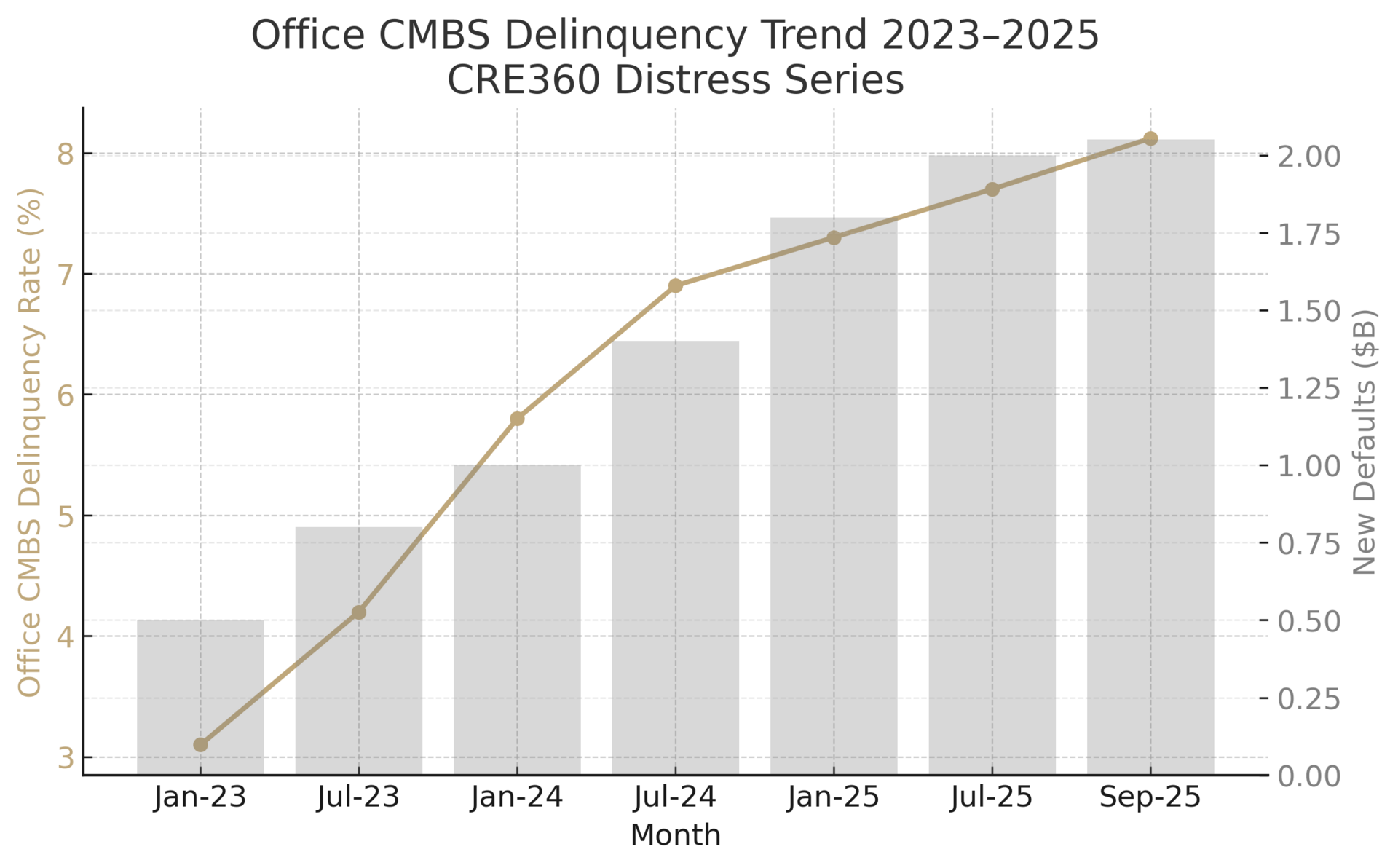

8.12% office CMBS delinquency, up 42 bps MoM – highest since 2020.

$180 M NYC loan default alone added 0.3 pp to national delinquency.

Office share 51% of new CMBS delinquencies ($2.05 B total).

Special servicing rate ~11%, signaling credit triage.

Cap-rate reset +100 bps in CBD valuations (≈ 20–30% value drop).

$1 T CRE maturities by 2025 keep refi risk elevated.

Signal

September’s 8.12% office delinquency rate (60+ days past due) marks a structural break in the “extend-and-pretend” era. A $180 million maturity default at 261 Fifth Avenue in Manhattan pushed the figure up 42 bps month-over-month, signaling that lenders are finally calling time on unrefinanceable loans. For the first time in two years, office defaults now dominate new CMBS distress volumes ($1.05 billion of $2.05 billion total). What was once a slow bleed is becoming a credit event.

Breaking the Extension Habit

Fitch Ratings calls it the “end of extend-and-pretend.” Two years of temporary extensions kept office loan defaults muted; those loans are now hitting maturity walls at 8%+ refinance rates. At 261 Fifth Avenue, the borrower walked away despite a prime address – a reminder that even trophy assets can fail if cash flow is thin. CityPlace I in Hartford ($79 million) added to the list, proof that distress is no longer confined to gateway cities. As a result, special servicers are absorbing a record load of office credits, and lenders are moving from workout to write-off.

Underwriting in Reverse

Capital behavior is adjusting fast. New office loan models now apply NOI haircuts of 10–20% and stress refinancing at 65% LTV with 8% coupons – tests that many 2018–2019 vintage deals fail. Add $10–15/SF for tenant improvements and leasing commissions, and the math rarely works. Exit cap rates have risen ~100 bps since 2019 (5% to 6%), implying 20–25% value erosion. In practice, this means sponsors must infuse fresh equity or cede the keys. Underwriting discipline is back – but it comes after the losses.

Selective Capital, Bifurcated Risk

Meanwhile, debt for offices has gone barbell. Private credit funds will lend to strong Class A assets at L+400–500 bps; regional banks have largely withdrawn. For Class B/C stock, financing is nearly nonexistent. Transaction data confirm the reset: Manhattan’s 1740 Broadway sold at a 70% loss. Such sales establish a clearing price but also anchor appraisal markdowns system-wide. Distress buyers see opportunity, yet bid-ask spreads of 30–50% keep volumes thin. Still, price discovery is the first step toward stability.

Operators in Survival Mode

On the ground, office operators face a different battle. Leasing teams are cutting rents and offering six-month free periods just to keep occupancy near 70–80%. A Midtown manager put it plainly: “Every renewal we keep is a win.” Capital for tenant improvements is scarce, so owners are re-using fit-outs and repurposing vacant suites into co-working formats. Cash management is defensive: every extra basis point of DSCR preserves negotiating leverage with lenders. In practice, survival means operating for occupancy, not yield.

Systemic Ripples

On balance, office stress is now a banking story. Roughly $1 trillion in CRE debt matures by end-2025, and offices form the most exposed slice. Large banks have reserved heavily; regionals face tighter capital ratios. Should defaults reach 10% in 2026, policy support or temporary regulatory relief could follow – not as bailouts, but to manage valuation shocks. Nonetheless, credit discipline is winning: the market is re-pricing risk in real time rather than deferring it further.

Expect office delinquencies to climb toward 10% through mid-2026 as maturities roll through. Foreclosures and note sales will increase, but so will adaptive reuse efforts as cities streamline conversion rules. The best 20% of office stock – amenitized, green, and well-located – should stabilize cap rates and see renewed institutional interest once pricing clarifies. Lower-tier buildings may transition to alternate uses or remain stranded. Capital will flow again, but only where value has been proven through discipline, not hope.

Discipline is now the only bridge between loss recognition and renewed lending. Credit cycles don’t end with defaults – they reset through them.

Reuters (Oct 2025); Fitch Ratings CMBS Update (Sept 2025); Trepp Delinquency Report (Sept 2025); Bisnow; Multifamily Dive.