🚨Key Highlights

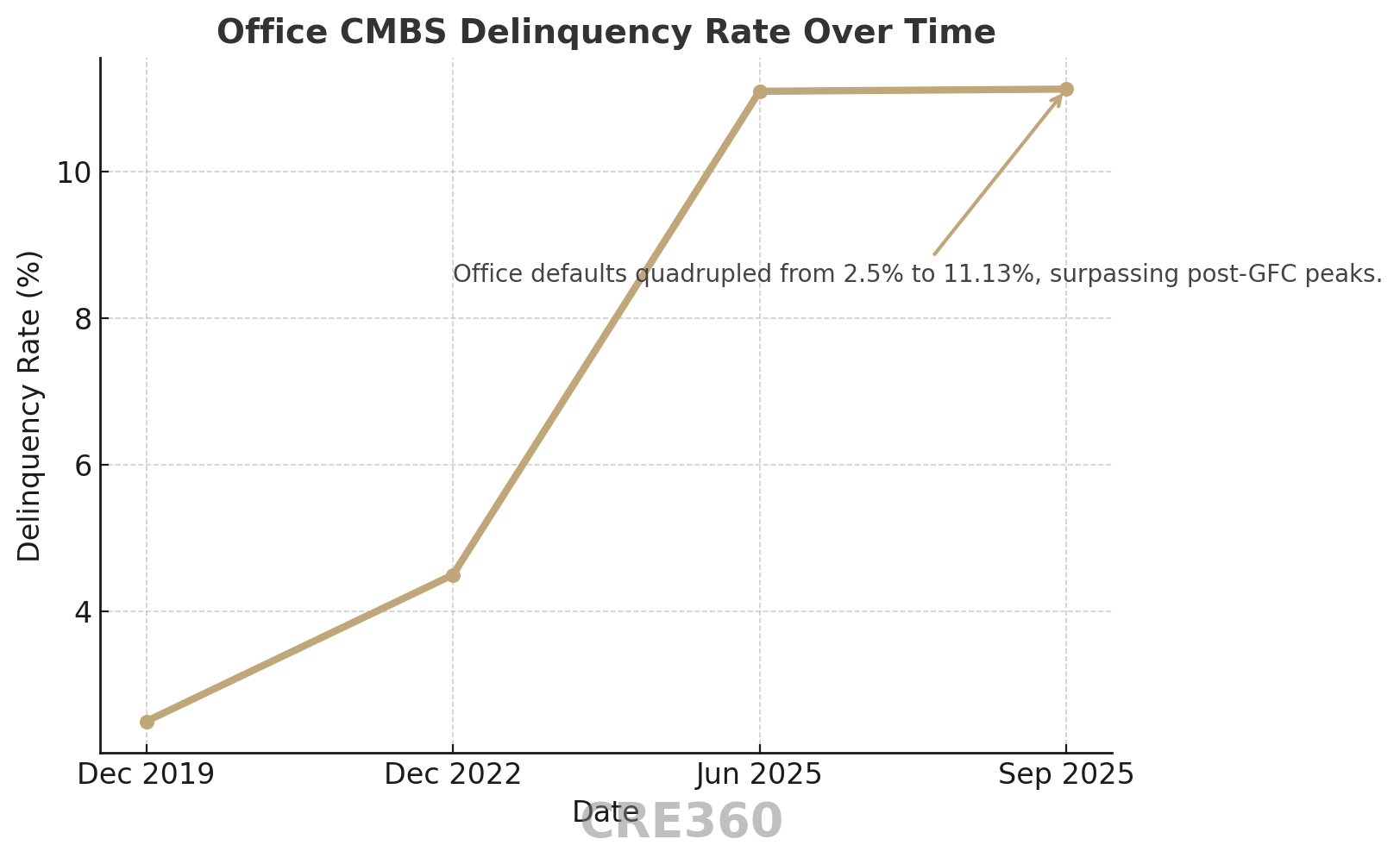

11.13 % office CMBS delinquent in Sept 2025 — triple pre-pandemic levels.

10 %+ of office loans in special servicing — highest since 2013.

$190 B in office mortgages mature in 2025 amid refi stress.

Loan mods +66 % YTD as lenders extend terms to avoid foreclosure.

Distressed sales at 50–70 % discounts reset market values.

Lending spreads diverge: prime 6 % vs secondary 10 %+ office debt.

Signal

The office market’s credit crisis has entered a new phase. Delinquencies at 11.13 % — nearly quadruple 2019 levels — confirm that even major owners can’t refinance at today’s values. With tenancy fragile and capital scarce, the sector faces a systemic repricing of risk and asset value rather than a temporary cycle. Refinancing has become triage.

Defaults Go Mainstream

A wave of defaults has swept from fringe to flagship borrowers. Brookfield’s foreclosure of Arlington Square at $14.9 M — a 58 % value plunge — illustrates how core markets are no longer immune. Portfolio occupancy barely topped 54 %. By contrast, in 2019 office delinquencies were below 5 %. Now over one in ten CMBS loans is in workout, the highest stress since 2013. Each default feeds comparable price declines, forcing new mark-to-market losses across banks and funds.

Refinancing Wall Meets Negative Equity

Roughly $190 billion in office loans mature next year — about 20 % of the 2025 CRE maturity wall. Many borrowers face loan-to-value ratios above 100 %. Loan modifications have jumped 66 % YTD, but most extensions are short-term and repriced at higher rates. For owners with vacancies or expiring leases, cash flow cannot support refi debt service. In practice, “extend and pretend” is buying time — not solvency.

Structural and Cyclical Pressure

Office demand remains half its pre-COVID norms; average utilization hovers 50–60 %. As NOI falls 20–30 % in 1980s-vintage buildings and floating rates double, debt-service coverage ratios collapse. Lenders are sorting assets: viable projects get extensions; hopeless towers head to foreclosure. Recent sales — Houston’s Energy Corridor at $75/sf and a Chicago Loop tower at an 80 % discount — are establishing new land-value pricing. Still, select Class A assets retain liquidity as tenants trade up.

Capital Retreat and Selective Return

Traditional banks and insurers have retreated from office lending; Fed surveys show 70 % of banks tightened standards in 2025. CMBS issuance is minimal and excludes office collateral. Meanwhile, debt funds fill a narrow void at 9–12 % rates for survivor assets, requiring fresh equity. Opportunistic capital is patient, waiting for capitulation. On balance, risk pricing has re-stratified the market: prime Manhattan towers finance at ~6 %, while secondary markets face double-digit debt costs. This gap defines who refinances and who relinquishes.

Through 2026, office distress will intensify as the $1.5 trillion CRE debt wall rolls. More REO assets will enter lender balance sheets, and distressed sales will anchor new valuation benchmarks. Conversion and adaptive-reuse capital will emerge, but urban budgets will strain under falling assessments. Underwriting discipline must assume 20 %+ vacancy and elevated rates. Only growth-market Class A offices show stabilization signs. For the rest, recovery hinges on deleveraging and re-tenanting — a multi-year process echoing the early 1990s workout cycle.

Rescue capital can bridge gaps in debt — but not in discipline.

Trepp (Sept 2025) | CREFC (2025 Debt Maturity Report) | Commercial Observer | CRE Daily | Multifamily Dive.