📢Good morning,

Developers have launched 4.1 million sq. ft. of office-to-residential conversions in 2025, the fastest pace since 2008. About 25 additional buildings (8.8M sq. ft.) are in the pipeline, signaling a major structural shift in Manhattan’s real estate. New York policymakers are backing conversions with tax abatements and zoning reforms as office vacancy sits at ~22.6%.

📊 Quick Dive

4.1M sq. ft. of office conversions underway in 2025 (vs. ~1.2M annual avg. pre-2020).

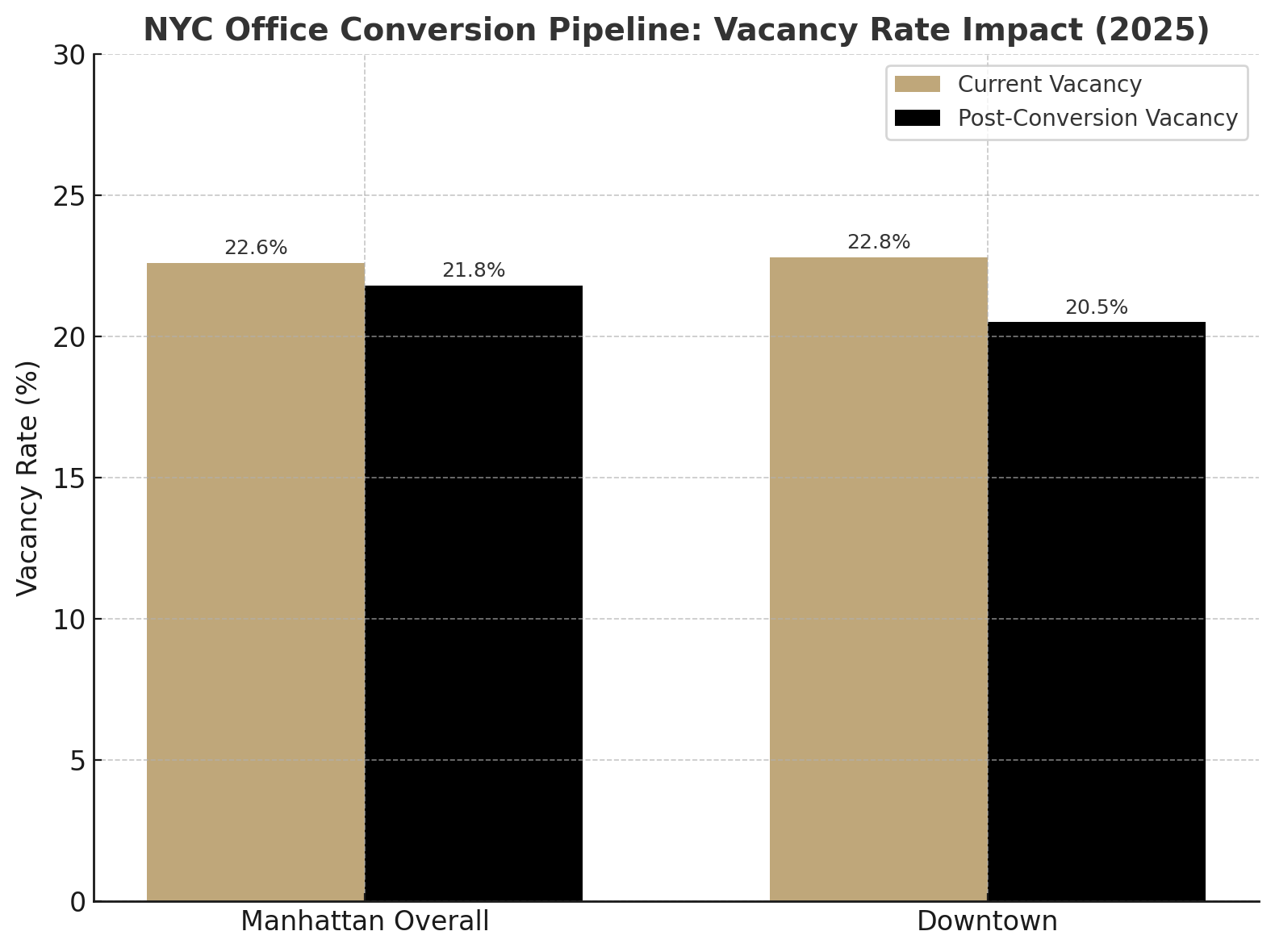

Pipeline could shave office vacancy from 22.6% → 21.8% citywide, with Downtown dropping to 20.5%.

Class A offices now make up one-third of conversions, compared to just 5.5% pre-2020.

Dallas Retail Center Snapped Up by 1031 Buyer

Square 67, a 183,253 sq. ft. multi-tenant retail center in Dallas, traded hands in a Marcus & Millichap deal. The Houston-based buyer used a 1031 exchange, attracted by the center’s 99% occupancy and upside from below-market leases and pad-site potential. The deal closed just 42 days after contract signing, underscoring liquidity in high-growth Sunbelt retail. [Read Full Signal → link]

Georgia Daycare Sale Highlights Net Lease Demand

A 13,579 sq. ft. childcare center in Locust Grove, GA, leased to Childcare Network, sold within 42 days to a repeat private buyer. The tenant just extended its lease another 10 years, with corporate backing from Child Development Schools. Net-lease investors are flocking to early education assets, which often trade at 6–7% cap rates, 50–100 bps higher than typical net-lease retail. [Read Full Signal → link]

U.S. CRE Deal Flow Steady Despite Macro Headwinds

August saw 865 CRE transactions, including 47 trophy deals ($100M+) — unchanged from July. Mid-cap deals ($50–100M) dipped slightly but remain 12% above 2025 averages. LightBox’s Activity Index stayed in expansionary territory at 104.8, marking its 7th straight month above 100. Market analysts say CRE is “catching its breath, not losing steam.” [Read Full Signal → link]

Green Buildings Deliver Premiums, Not Just PR

A World Economic Forum report shows green offices command 7–12% higher rents globally, with London topping +11%. Yet only 34% of future tenant demand for sustainable offices will be met by today’s pipeline. Retrofits can cut energy demand ~12%, boost NOI, and unlock financing incentives. Investors increasingly view “brown discounts” as real risks to valuation. [Read Full Signal → link]

Conversions are moving from “niche play” to mainstream — and New York is the testing ground. For investors, this means underperforming office assets may no longer be dead weight, but raw material for multifamily pipelines. Yet execution is everything: conversion costs in Manhattan run $200–$300+ per sq. ft., with 15–20% contingencies required.

Retail and net lease show the flip side: stable, income-oriented demand from 1031 buyers and private capital that is still highly liquid. For operators, this is a market of bifurcation — obsolete assets must be repositioned, while stabilized, necessity-based properties are commanding premiums.

NYC conversions: Watch for Albany to expand incentives in 2026; pipeline already 8.8M sq. ft..

Retail resilience: Expect Dallas and other Sunbelt markets to push rents higher as vacancies hold <5%.

Capital flows: Q4 typically brings a deal surge; steady late-summer data suggests buyers are gearing up.

Sustainability shift: Expect widening rent/value premiums for certified vs. “brown” buildings as 2030 compliance deadlines approach.

Moody’s Analytics / CBRE / CoStar, Trepp / Yardi Research + Moody’s Analytics

Chart of Day: 📊 NYC Office Conversion Pipeline vs. Vacancy Impact (2025)

Shows how Manhattan’s vacancy could dip from 22.6% → 21.8% overall, and Downtown from 22.8% → 20.5%, if the 8.8M sq. ft. conversion pipeline completes.