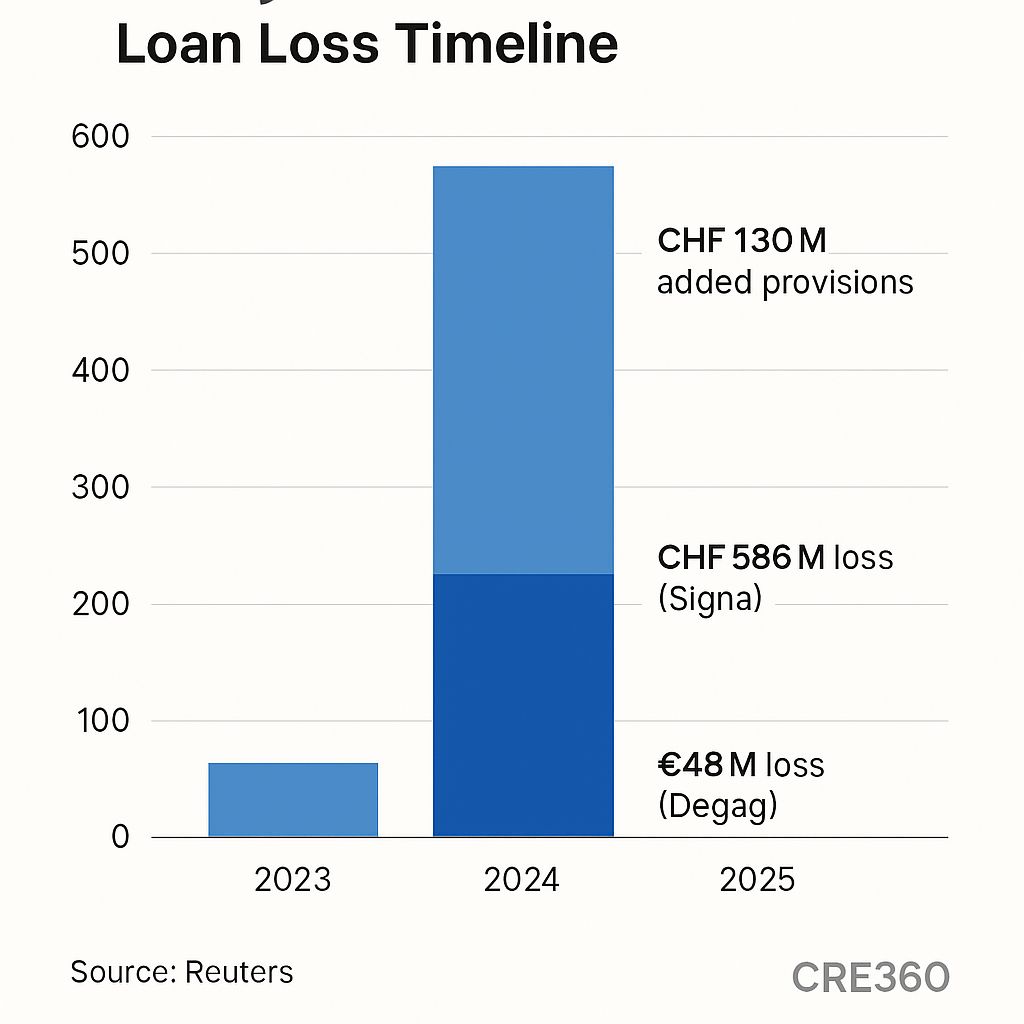

🚨Swiss private bank Julius Baer disclosed a €48 million loss from Germany’s Degag Group insolvency — its largest German exposure and another blow after the CHF 586 million Signa write-off last year [Source: Reuters]. The hit erases its 2023 German profit and highlights developer risk as property values slide. Across Europe, lenders are tightening credit standards amid soaring rates and rising defaults, with loan-to-value caps and sponsor due diligence under renewed scrutiny in CRE finance.

Julius Baer loss on Degag exposure: €48 million (≈ $56 M, 2025) — [Source: Reuters].

Prior Signa loan loss: CHF 586 million (2024) — [Source: Reuters].

Additional loan-loss provisions: CHF 130 million added in May 2025 — [Source: Reuters].

Degag Group debt load: ≈ €1.1 billion at insolvency — [Source: Reuters].

Loan Performance. Losses signal failed stress testing on exit liquidity and high-LTV loans. Tightening LTV limits (<55%) and requiring recourse would cushion future DSCR pressure.

Demand Dynamics. German housing demand remains solid but credit rationing slows starts and transfers pricing risk to equity. Stabilized NOI assets retain financing access; development is frozen.

Asset Strategies. Prioritize core stabilized acquisitions over leveraged build-outs. Phase capex and align draws to verified pre-leases or pre-sales.

Capital Markets. Private credit and Pfandbrief banks still lend to low-risk multifamily at spreads ~180–220 bps over mid-swaps. CLO/CMBS channels remain subdued; senior tranches demand over-collateralization.

Rising rates expose over-levered developers.

Prime core housing holds bid; spec development stalls.

Banks pivot to risk-light wealth and covered-bond lending.

Credit spreads stay wide pending policy easing.

🛠 Operator’s Lens

Refi. Expect refinance tests to price LTV ≤ 60% with strict pre-lease tests; caps through 2026 vital.

Value-Add. Stage capex by tenant milestones and build 10–15% contingency for cost overruns.

Development. Run exit sensitivities at –25% value shock; funding delays likely without recourse guarantees.

Lender POV. EU banks price risk via tight covenants and frequent audits; private credit fills gaps at double-digit IRRs.

ECB scrutiny of bank CRE exposure will intensify; new capital buffers could limit developer loans. Degag asset liquidations may reset German residential pricing benchmarks. Secondary loan sales by Julius Baer could attract distress funds, pressuring pricing for similar credits through 2026.

Reuters — “Julius Baer Hit by German Property Loan Collapse” (Oct 2025). https://www.reuters.com Dataset — Reuters Company Filings (2024–2025). https://www.reuters.com