🚨Key Highlights

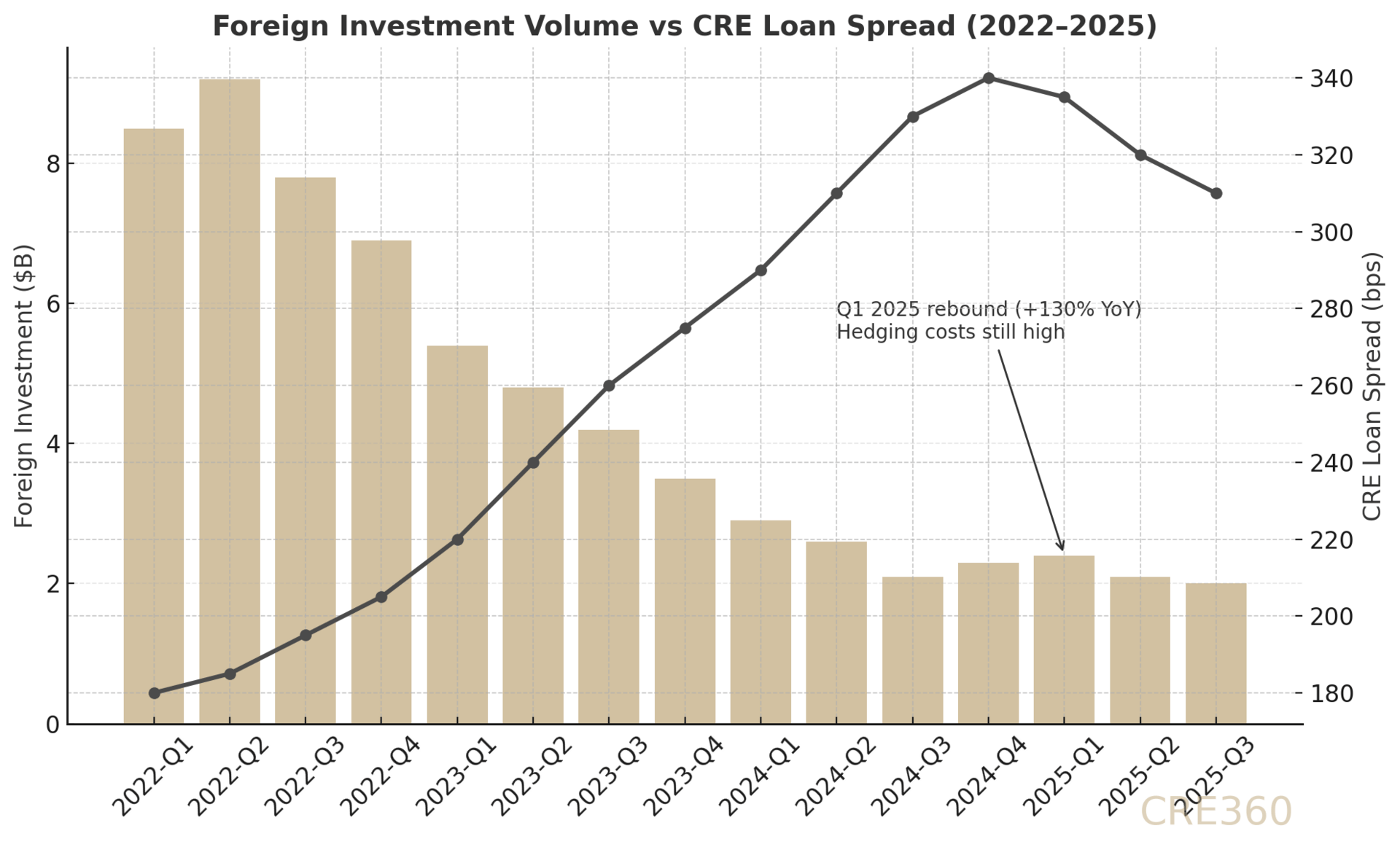

$2.4 B in Q1 2025 cross-border U.S. CRE investment (+130 % YoY).

52 % of global investors reduced U.S. purchases mid-year ( JBRec ).

Canadian buyers ≈ 33 % of foreign volume; industrial + multifamily lead.

Foreign buyers pay ~3.5 × more per CBD asset than domestic counterparts (Invesco).

Average foreign leverage ≤ 60 % LTV; hedging costs trim yields 30–60 bps.

Signal

After two quiet years, international capital is creeping back into U.S. commercial real estate —but under very different rules. Foreign investment hit $2.4 billion in Q1 2025 (up 130 % YoY), yet flows flattened by mid-year as rates and currency volatility rose. The revival reveals selective discipline: institutional capital still trusts U.S. real estate’s rule of law and scale, but underwrites through a new lens of hedging costs, ESG criteria, and geopolitical risk. The result is a smaller but sharper foreign footprint — anchored in industrial and multifamily rather than trophy offices.

1 Selective Re-Entry

Early-year data signaled renewed interest as macro stability returned. Still, by mid-2025 more than half of surveyed foreign investors (52 %) had curbed U.S. acquisitions. Canadian and Singaporean funds continued deploying in apartments and logistics, while European pensions paused office purchases pending FX clarity. On balance, capital is flowing to markets with transparent valuation and scale — New York, Dallas, and Miami — not simply “safe havens.” A Singaporean fund’s equity stake in a Miami multifamily project illustrates this shift toward durable income over headline assets.

2 Underwriting Guardrails

Foreign capital arrives with tight constraints. Currency hedging adds 30–60 bps to costs, forcing higher yield targets or lower pricing. Most institutional buyers cap leverage around 50–60 % LTV — far below domestic averages — and price to stable, core cash flows. Their due-diligence models embed stress tests for FX and vacancy. German pension funds, for instance, now assume 10 % longer lease-up durations than pre-2020 to satisfy home-country regulators. ESG criteria have become quantitative inputs, with capex reserves earmarked for retrofits to maintain green-label eligibility. In practice, discipline is their risk premium.

3 Operator Dynamics

For U.S. operators, global partners mean longer horizons and stricter governance. Quarterly reporting cycles, board-level approvals, and asset-management audits have become standard in foreign joint ventures. In Los Angeles, a local developer noted that its Canadian equity partner “funds every capital item but expects every line explained.” The trade-off is stability: steady capital for improvements and lower refinancing risk. Nonetheless, decision velocity slows — a factor that can strain competitive bidding windows in hot markets. Still, for core assets, patience is a feature, not a flaw.

4 Capital Context

Global flows remain cyclical. 2025 opened with renewed momentum — Norges Bank (NBIM) took a 45 % stake in a $3.27 B U.S. logistics portfolio (Reuters) — but the pace tempered as U.S. rates rose and Europe’s market reopened. Middle Eastern sovereign funds kept prospecting trophy hotels and offices, though valuation gaps blocked many sales. Meanwhile, Chinese capital remains largely absent under tight controls. Even so, foreign buyers still account for roughly 8–10 % of total U.S. CRE volume — a share small in flow but outsized in price signal. Where they buy, pricing stabilizes.

5 Behavioral Premium

Over the past decade, foreign investors paid on average 3.5 × more per CBD office asset than domestic buyers (Invesco). That premium was once driven by prestige; today it reflects process confidence and currency math. The U.S. offers institutional transparency and tenant diversity that few markets match. As rates normalize, the behavioral premium may narrow but endure. Foreign capital is not chasing yield —it’s buying predictability. For U.S. markets navigating domestic credit tightening, that discipline remains welcome liquidity.

With the dollar off recent highs and Treasury yields easing modestly, cross-border capital faces its best entry window since 2019. If U.S. policy rates stabilize near 4 %, hedging costs could compress and open the door to a new cycle of foreign allocations. Expect ESG-compliant industrial and multifamily assets in gateway markets to lead that re-engagement. However, geopolitical risk and home-market yields will still filter decisions. Capital discipline — not sentiment — will define the next wave of international investment in U.S. CRE.

Global capital still trusts U.S. discipline — but trust now demands underwriting proof.

SIOR — “Global Investment Pulse Q1 2025” — https://sior.com JB Research — “Foreign Investor Sentiment Survey Mid-2025” — https://jbrec.com Invesco Global Real Assets — “Cross-Border Capital Flows 2025 Update” — https://invesco.com Reuters — “NBIM Takes Stake in $3.27 B U.S. Logistics Portfolio” (Apr 2025) — https://reuters.com