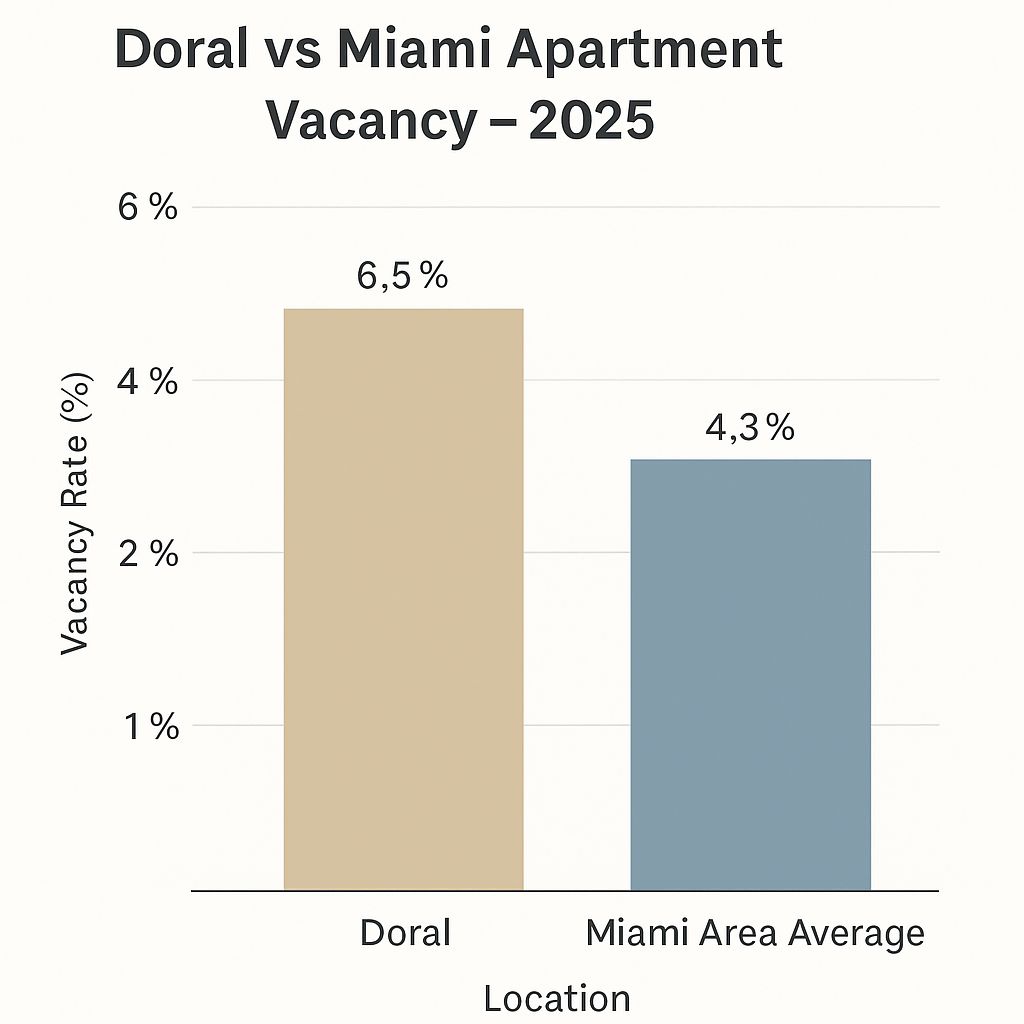

🚨Localized migration shocks are rippling through Florida’s rental markets. In Doral, FL, apartment vacancy surged from 5.6% to 6.5% YoY — the highest in a decade — as Venezuelan tenants exit following non-renewal of Temporary Protected Status . Across Florida, formerly red-hot rent growth has flatlined. Miami rents are down ~8% YoY, and statewide rent projections for 2025 sit at just +0.8% [Source: John Burns Consulting]. Despite stable macro demand, rising insurance and tax burdens are eroding landlord margins and tightening underwriting.

FTC + State Lawsuit Value: $100 million rental listings deal under antitrust scrutiny CoStar Copyright Claim: $1 billion in alleged IP damages

Zillow Traffic Lead: ~104 M monthly unique visitors vs. Homes.com ~95 M (Q1 2025)

Zillow Stock Reaction: –3.9% on FTC filing day

Loan Performance. NOI pressure intensifies as flat rents and elevated OpEx (insurance/taxes) strain DSCR. Class A assets in lease-up face higher breakevens; weak concessions can distort underwritten income.

Demand Dynamics. Doral’s migrant-dependent tenant base revealed occupancy fragility. Across Florida, renter fatigue and SFR competition limit pricing power. Class A sees absorption drag; Class B/C hold stronger.

Asset Strategies. Operators push renewals at flat rates to stem turnover. Amenities, employer partnerships, and energy retrofits are being used to reduce OPEX or maintain occupancy.

Capital Markets. Exit cap rates widened 100 bps from 2021 lows (~5.25% avg). Buyer underwriting now assumes flat or negative Yr1 rent growth and +25–50 bps cap exit. Some deals assume existing debt to preserve cash-on-cash.

Rent growth cooled. From +20% in 2021 to ~0% in 2025.

Submarket divergence rising. Doral vacancies at decade high vs Miami avg ~4.3%.

OpEx pressure persistent. Insurance and tax hikes hinder margin expansion.

Selective investment. Buyers cautious but active, focused on long-term positioning.

🛠 Operator’s Lens

Refi. Fixed-rate assumptions preferred; interest carry too high on new originations.

Value-Add. Focus shifts to NOI defense: LED retrofits, utility savings, tenant loyalty programs.

Development. Slower permit pace post-2023; soft absorption in Class A lease-ups.

Lender POV. Lenders pricing Florida risk via higher expense load assumptions; coastal exposure and insurance availability now key diligence points.

2026 re-acceleration likely as current supply wave is absorbed and starts drop.

Policy watch: Insurance market reforms or climate risk shocks could drive CapEx needs or underwriting spreads.

Capital inflection: If Fed cuts by mid-2026, expect cap rate compression and deal velocity rebound.

Wall Street Journal — Miami Housing Exodus (Sept 29, 2025). https://www.wsj.com/articles/miami-housing-exodus-venezuela-doral-immigration John Burns Consulting — Florida Rent Projections (2025). https://jbrec.com/research Axios Miami — Doral Migration Trends (Sept 30, 2025). https://www.axios.com/local/miami