🚨Key Highlights

$5.8B of hotel CMBS and CLO loans matured in 2024, with similar volumes due in 2025 (JLL).

8%: current hotel lending rates, roughly double the 4–5% coupon vintage loans face at maturity.

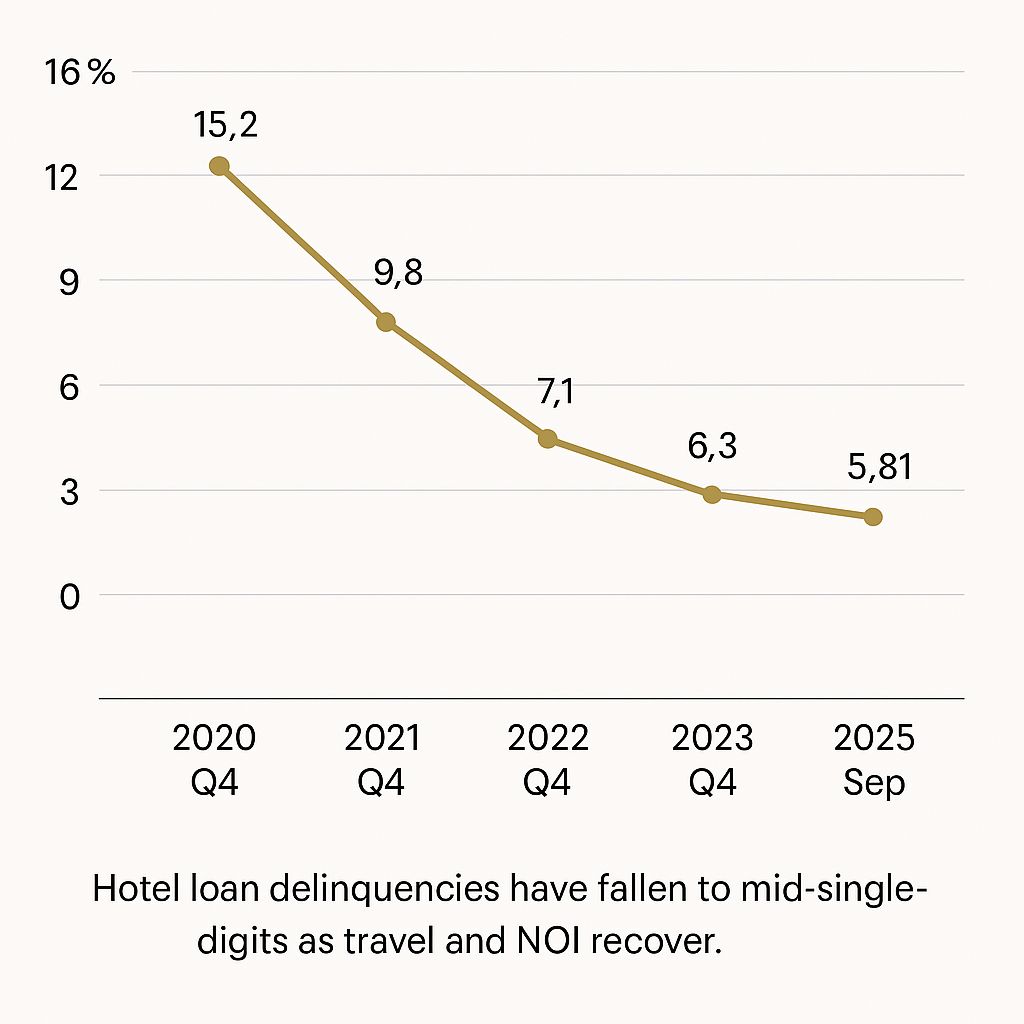

5.8%: lodging CMBS delinquency in Sept 2025—down 73 bps MoM, lowest since Mar 2024 (Trepp).

–19%: discount on UC Berkeley hotel sale vs. 2023 appraisal (SFYIMBY).

9–10%: average loan rate offered by debt funds for transitional hotel assets.

Signal

The hotel sector’s comeback is colliding with a refinancing wall. Roughly $5.8 billion of hotel CMBS and CLO loans matured in 2024, with a similar wave ahead through 2026. Owners who financed at 4–5% debt now face refinancing near 8%—a gap few balance sheets can absorb without new equity. Yet, operating metrics tell a different story: RevPAR is back to 95–100% of 2019 levels, and delinquency rates are at 18-month lows. The contradiction defines today’s hospitality market—cash flow resilience meeting capital structure strain.

Debt Pressure Meets Operating Strength

Thousands of 2013–2016 vintage loans are hitting maturity just as hotel cash flows normalize. For most, current debt yields under 8% can’t justify fresh senior loans at today’s higher coupons. As a result, lenders are tightening loan proceeds or demanding paydowns. Some banks are extending short-term—one to three years—while waiting for rate relief. Meanwhile, CMBS special servicers are pragmatic: extending limited-service assets with steady cash flow but foreclosing on underperforming urban hotels. Still, performance matters. September’s 5.8% delinquency rate—down from 6.5%—shows borrowers are catching up.

New Capital Steps In

Debt funds and private credit platforms are stepping into the gap, offering 9–10% financing for transitional properties. This liquidity comes at a cost: higher interest burdens that erode owner returns. Nonetheless, it keeps viable assets out of foreclosure. Equity investors, sensing distress, are circling. Nahla Capital’s $270 million takeover of Miami’s Raleigh Hotel and BRE Hotels’ $300 million EAST Miami acquisition highlight opportunistic repositioning plays. Pension funds and universities are joining too—the University of California bought its Berkeley hotel 19% below appraisal, banking on patient, long-term value creation.

Transaction Market Reprices Reality

Despite operational recovery, values remain below pre-pandemic highs. Bay Area hotels trade 10–30% below 2019 pricing; luxury Florida resorts buck the trend with premiums above replacement cost. The UC Berkeley deal at $175.8 million—about $531k per key—reflects recalibration, not collapse. Buyers now underwrite forward-looking 8–10% cap rates to offset expensive debt. Family offices and owner-operators dominate bidding, while hotel REITs and private equity remain cautious amid capital-raising constraints. Brand-aligned buyers are selectively acquiring to reflag or renovate, aided by corporate partnerships.

Capital Stack Adjustments

In practice, owners face three options: inject equity, stack mezzanine/preferred equity, or negotiate extensions. The most disciplined employ all three. Some are accepting bridge debt, betting on a 100 bps rate drop by late 2026. Others sell rather than refinance. Banks quietly prefer extension over foreclosure; CMBS servicers remain formulaic. The emerging hybrid model—short-term, high-yield private loans—marks a shift toward bespoke capital solutions that blend real estate and operating business credit.

Hospitality’s story through 2026 is twofold: operational optimism and financial friction. Leisure demand remains durable, and group travel is returning. Yet margin recovery lags as labor and insurance costs rise. The next 18 months will test balance-sheet discipline—roughly half of all 2025 maturities still lack refinancing solutions. Expect a rise in note sales, recapitalizations, and selective foreclosures. For well-capitalized investors, this is the entry window: buying below replacement cost with improving fundamentals. For lenders, it’s a test of patience and policy alignment in a rate-elevated environment.

Rescue capital defines this cycle—the next wave of hospitality growth will be financed, not found.

JLL — U.S. Hotel Loan Maturity Outlook 2025 (Sep 2025) — jll.com Trepp — Lodging CMBS Delinquency Report (Oct 2025) — trepp.com Commercial Observer — Raleigh Hotel Transaction Coverage (Sep 2025) — commercialobserver.com SFYIMBY — Residence Inn Berkeley Sale Analysis (Aug 2025) — sfyimby.com