🚨Key Highlights

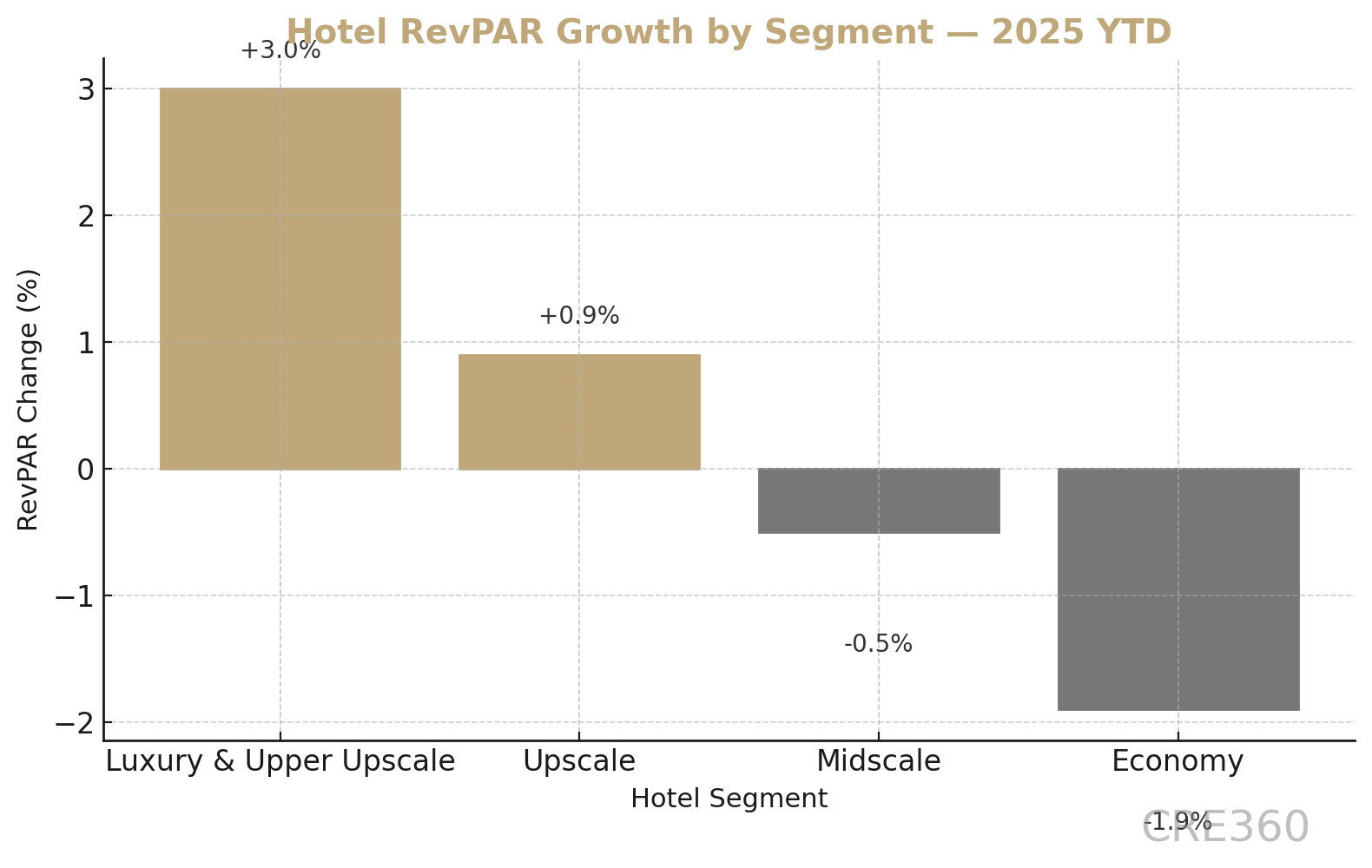

-0.1% RevPAR (2025F): U.S. hotel revenue per available room expected essentially flat YoY.

+3% Luxury RevPAR: High-end hotels post the only real gains; economy RevPAR –1.9%.

62.5% Occupancy: National rate dips slightly amid soft business and group travel.

+15% Insurance Costs: Expense inflation squeezes margins, midscale GOP –7.8% YoY.

40% Bookings < 4 Days Out: Short windows pressure forecasting and rate discipline.

Signal

A $40 billion takeover of Aligned Data Centers by a consortium of BlackRock, Nvidia, and Microsoft has reset the scale of capital in digital infrastructure. The transaction—three times larger than 2021’s CyrusOne deal—anchors a new phase of cross-industry investment in AI capacity. For real estate capital markets, it’s a structural signal: tech and institutional capital now co-own the power grid of the digital economy. “Every megawatt is a lease on the future,” one infrastructure fund manager said. The consortium’s $30 billion equity base and up to $70 billion debt facility position Aligned as the first AI-era platform with $100 billion of capital at its disposal.

Capital Scale and Structure

The consortium’s blend—75% equity, 25% debt—marks a departure from the high-leverage playbook common in prior cycles. By starting equity-heavy, the group can fund construction before securitizing cash flows. On balance, lenders welcome the discipline: loan spreads under 200 bps over Treasuries reflect investment-grade confidence in data center credit. Still, as rates decline, expect a refinancing wave toward 50–60% debt ratios, freeing tens of billions for new builds. The structure also underscores a macro pivot — capital treating digital infrastructure as core, not alternative.

Tech Meets Real Assets

By contrast with prior cycles driven by REITs and private equity, today’s leaders are tech operators seeking control of capacity. Nvidia secures processing real estate for its AI clients; Microsoft locks in cloud footprint; BlackRock converts global savings into hard assets with yield visibility. This triangulation blurs sector lines — energy, data, and real estate now co-define infrastructure value. Still, it poses a question for traditional players: how do REITs compete when the tenants become owners?

Valuation and Market Signal

At ~30× EBITDA, the price establishes a new benchmark for institutional valuation — equivalent to a cap rate near 5%. Investors interpreted it as a vote of confidence in durable AI demand; public data center REITs rallied up to 6% on announcement day. Meanwhile, credit markets reacted with tightening spreads on existing debt. In turn, other operators like Digital Realty and Equinix face a repricing moment — their portfolios are worth more, but so are their growth expectations. Valuation discipline will matter as cap-rate compression meets rising build costs.

Competition and Consolidation

Still, the mega-deal creates an imbalance. Mid-tier operators may pivot toward niche markets or position themselves as targets. Expect follow-on transactions in the $10–15 billion range as private capital chases scale. Meanwhile, construction pipelines in Texas, Ohio, and the Nordics will surge to absorb fresh capital. In practice, the deal signals an era where platform value equals power capacity, not square footage. For smaller firms, the edge will be speed, specialization, or access to power grids the giants overlook.

Credit and Underwriting Discipline

Even with bullish sentiment, underwriting guardrails remain critical. Analysts model AI workload growth above 20% CAGR, but fill-up rates must be tempered to 70–85%. Energy pass-through and tenant credit quality dominate risk models, with power costs often >20% of OpEx. For now, banks price top-tier data center loans like infrastructure — long tenors, tight spreads. But execution risk is real: integration costs, supply-chain constraints, and regulatory reviews could delay deployment. The deal is as much about discipline as ambition.

The next phase is stability, not surge. Forecasts suggest RevPAR +3–5% by 2026 as global travel normalizes and inbound tourism returns. Luxury will continue to outperform, while select-service assets undergo consolidation or conversion. Supply growth remains below trend (<1%), cushioning occupancy through 2025. Should rates ease, cap rates could compress ~50 bps, rekindling portfolio M&A. Yet macro risks persist: slower GDP and fragile household spending may extend the plateau another year. Ultimately, hotels positioned for agility—cost control below, experience premium above—will define the cycle’s winners.

Hospitality’s new rule: experience earns pricing power, efficiency preserves it.

Bisnow — Luxury Segment Defies Broader Hotel Slowdown (Sept 2025) — https://bisnow.com Hotel Dive — U.S. Hotel Performance Forecast 2025 (Oct 2025) — https://hoteldive.com STR / PwC Hospitality Outlook (2025 Forecast) — https://str.com HotStats — U.S. Hotel Profit Margins 2025 (Sept 2025)