🚨Key Highlights

$270 M in fraudulent CRE loans linked to one borrower triggered $160 M losses at two banks. Regional bank stocks fell ~10% in a week, credit spreads widened ~40 bps. Regional lenders’ CRE exposure ≈ 25–30% of assets (vs ~12% for large banks). Lawsuits allege collateral misrepresentation and hidden junior liens. Regulators now probing “extend-and-pretend” risk in bank CRE portfolios.

Signal

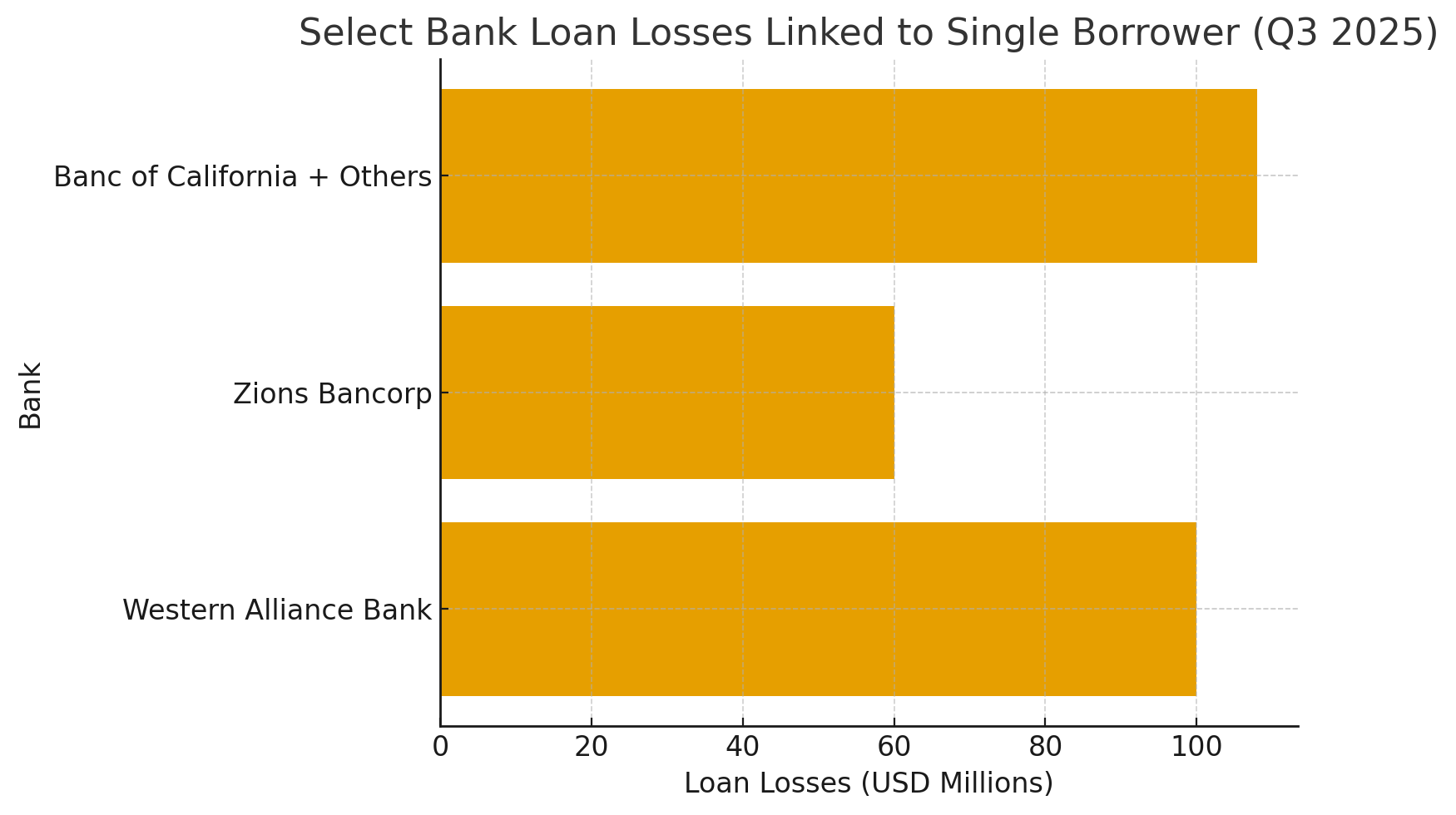

A quiet California borrower’s alleged $270 million web of falsified guarantees has rippled through America’s regional banking system. At least five lenders—including Western Alliance and Zions Bancorp—have disclosed surprise losses totaling $160 million. The revelation erased ~$20 billion in regional bank equity within days, reviving fears of hidden landmines in commercial-property credit. In CRE finance terms, this marks the first major fraud cluster of the current cycle—an episode where one sponsor’s deception exposed the structural over-concentration that defines mid-tier banks.

Concentration Risk Revealed

Regional lenders entered 2025 with commercial real-estate loans averaging 27% of total assets—double the ratio of money-center peers. That leverage turned a single borrower’s failure into a systemic event. “When you see one cockroach, there are probably more,” JPMorgan CEO Jamie Dimon warned, summarizing the sentiment that drove investors to dump regional bank shares (–10% week over week).

The data point is simple: a small number of sponsors can define a region’s risk curve. In practice, one over-levered developer in California can force capital repricing across Utah or Arizona.

Fraund Meets Extend_and_Pretend

Court filings suggest the borrower pledged the same assets multiple times while concealing junior liens—a breach made possible by weak collateral verification. Banks had already been quietly extending maturities on troubled loans to avoid markdowns. Now, this scandal converts “pretend” risk into real loss. The incident punctures confidence in paper workouts and pressures boards to verify that every extension still rests on valid collateral.

Meanwhile, credit default swap (CDS) spreads for regional-bank debt widened ~45 bps in the week following disclosures, implying investors are re-pricing opaque loan books.

Legal and Capital Repercussions

Five lawsuits are pending across California and Utah. Legal discovery will drag through 2026, but the accounting consequences are immediate. Institutions are raising loan-loss reserves—Western Alliance added $45 million in Q3, Zions $35 million. As litigation proceeds, recoveries could prove slim if collateral is encumbered.

In turn, credit-rating agencies are re-evaluating smaller banks’ CRE exposure. A one-notch downgrade can add 60–80 bps to funding costs—erasing spreads on clean loans and chilling new originations.

Operators and Borrowers in the Crossfire

For property owners, the effect is indirect but tangible. Regional banks finance roughly 45% of U.S. construction and small-balance acquisition loans. As those lenders pivot from growth to survival, underwriting will harden. Borrowers should expect deeper background checks, third-party lien audits, and delayed approvals. Honest operators—often the majority—will bear higher documentation burdens.

Nonetheless, opportunistic buyers may benefit. As banks triage portfolios, distressed notes could trade 20–40% below par. Local operators with management capacity could partner to take over troubled projects—if they verify titles first.

Market Sentiment and Systemic Containment

The sell-off in regional-bank equities stabilized after three days as analysts emphasized that big banks’ diversified CRE books (~12% of loans) insulate the system. Still, regulators are on alert. The Fed and FDIC are preparing targeted exams of banks with >25% CRE concentration and have signaled fresh guidance on single-borrower exposure caps.

By contrast, the private-credit market sees opportunity: several distressed-debt funds are already marketing vehicles to purchase non-performing CRE notes from regional banks at steep discounts.

Expect two quarters of heightened caution. Regional banks will tighten credit, lengthen approvals, and boost reserves. CRE lending spreads for non-core borrowers could widen 50–150 bps by Q2 2026. Meanwhile, some institutions may quietly sell off distressed positions to rebalance capital before year-end.

Regulators’ next moves—particularly on disclosure of sponsor cross-liens—will shape how quickly trust returns. The lesson is less about one fraudulent actor than about portfolio design: concentration, not credit, is the hidden contagion.