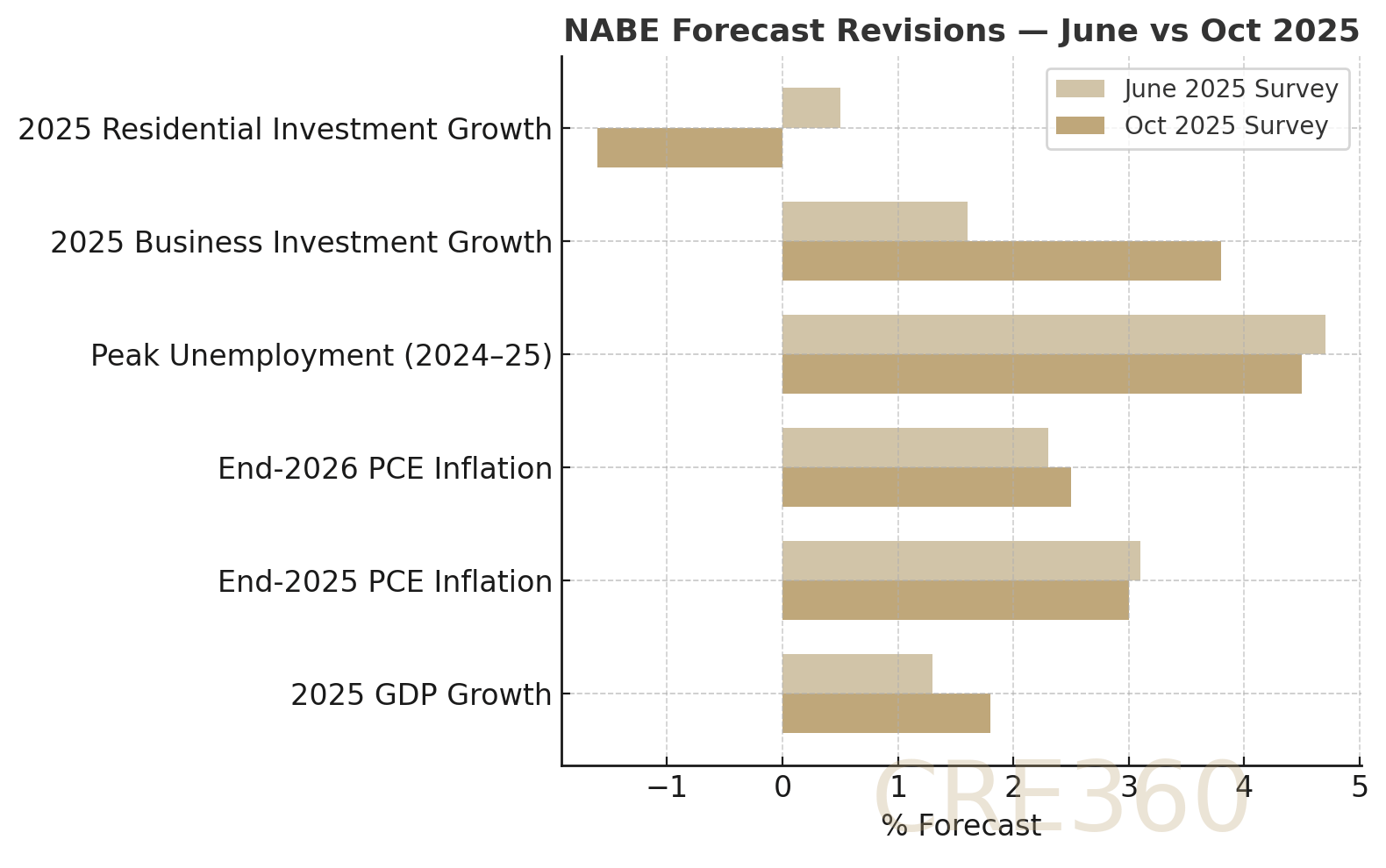

🚨U.S. GDP growth for 2025 has been revised up to 1.8% (from 1.3%) on strong business investment, led by AI and computing sectors [Source: Reuters; NABE]. Inflation remains stubborn at ~3.0% PCE, prompting expectations for only one more Fed cut this year. For CRE, this confirms a “higher-for-longer” rate regime — steady fundamentals, but little relief on financing costs. Housing stays weak ( –1.6% investment forecast ) while tech-related sectors underpin resilience in leasing and development.

2025 GDP Growth Forecast: 1.8% ( ↑ from 1.3% in June ) — [Source: Reuters/NABE].

End-2025 PCE Inflation: 3.0% ( vs 3.1% prior ) — [Source: Reuters/NABE].

2025 Business Investment Growth: 3.8% ( ↑ from 1.6% ) — [Source: Reuters/NABE].

2025 Residential Investment Growth: –1.6% ( vs +0.5% prior ) — [Source: Reuters/NABE].

Loan Performance. Sticky inflation sustains 6–7% CRE debt costs; DSCRs remain tight. Cap/floor resets less favorable; extensions still common.

Demand Dynamics. Office and multifamily leasing trail GDP as hiring slows (~29 k avg monthly jobs). AI-driven logistics and data assets outperform.

Asset Strategies. Operators prioritize OPEX control and longer lease terms; defer nonessential capex. Inflation clauses regain appeal in leases.

Capital Markets. Credit remains selective: core, well-leased assets still financeable; CMBS/CLO tone cautious. Cap rates aligned with 10Y ≈ 4.5%.

Economic upside offset by inflation drag.

Data-center and industrial demand outpace job-linked sectors.

Underwriting must price current rates, not hoped-for cuts.

Spreads stable; structure remains lender-friendly.

🛠 Operator’s Lens

Refi. Size at today’s rates + 25–50 bps cushion; limited prepay flexibility.

Value-Add. Build in 3%+ OPEX/TI inflation; protect contingencies.

Development. Phase builds; model 7% mortgage environment through 2026.

Lender POV. Banks price conservatively; Fed easing slower = no compression in DSCR tests.

Watch Q4 PCE and FOMC minutes — confirmation of slow-easing bias.

Monitor tariff impacts on construction inputs and trade-linked logistics.

CMBS and core fund flows should confirm stabilization, not expansion.

Risk: inflation plateau → possible Fed pause, delaying rate relief further.

Reuters — “U.S. Growth Forecasts Revised Up as Business Spending Booms” (Oct 2025). https://www.reuters.com NABE — “October 2025 Outlook Survey.” https://www.nabe.com FRED — “10-Year Treasury Constant Maturity Rate.” https://fred.stlouisfed.org Green Street — “Commercial Property Price Index and Cap Rate Data (2025).” https://www.greenstreet.com