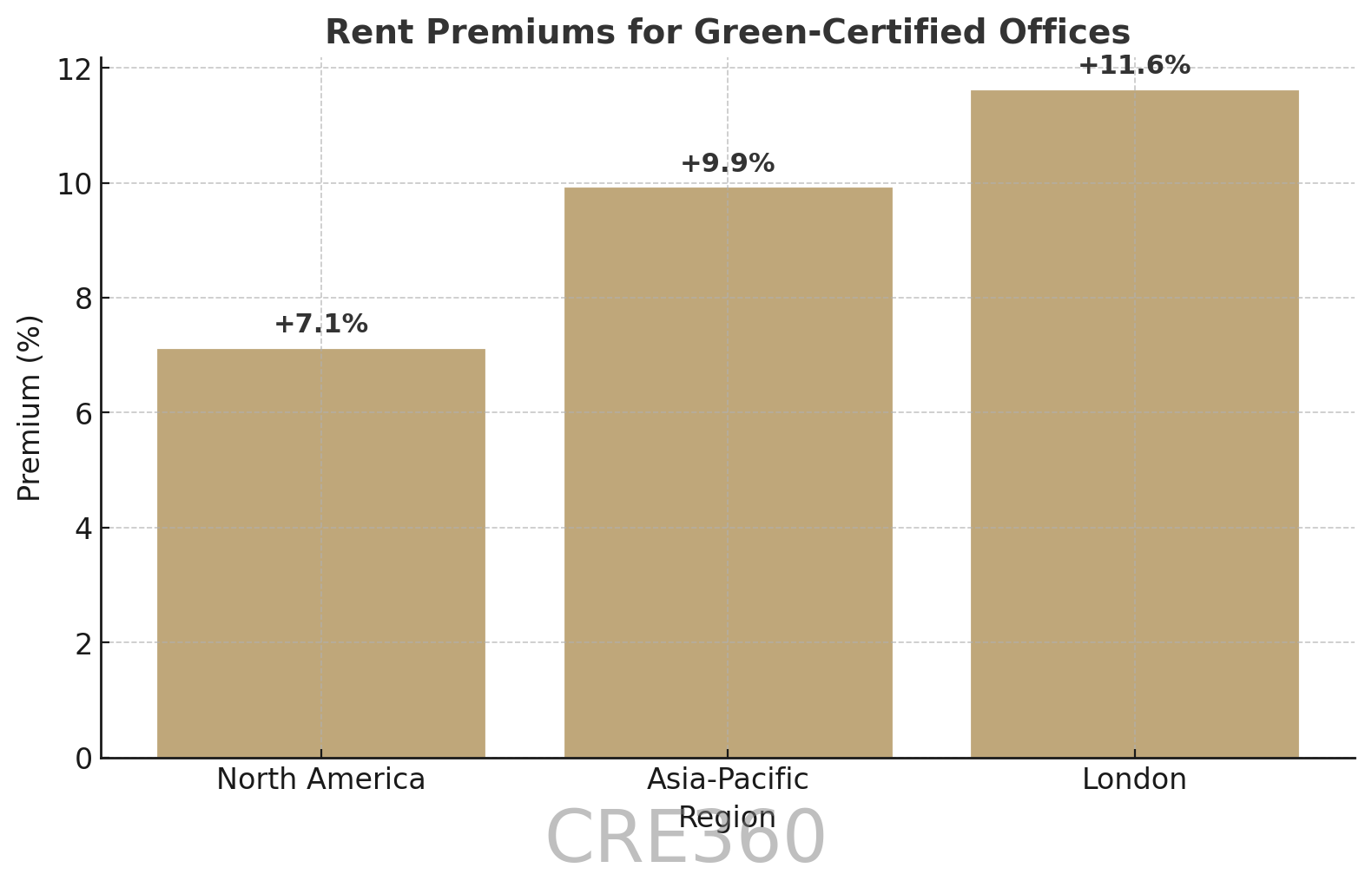

🚨Sustainability has become an income driver in commercial real estate. Green-certified office buildings are achieving 7–12% rent premiums globally, with London surpassing 11% [Source: WEF/JLL]. Yet supply lags demand — current pipelines will cover only 34% of projected tenant needs for low-carbon workspace. Retrofitting offers strong ROI, with energy savings boosting NOI and asset resilience. Regulatory pressure and capital flows are reinforcing this divide: green assets are favored with tighter cap rates, while inefficient “brown” assets face discounts and compliance costs.

Green office rent premiums: +7.1% (North America), +9.9% (Asia-Pacific), +11.6% (London), 2023

Global retrofit market: $500B (2024) → $3.9T (2050 projection, 8% CAGR)

Global building energy demand cut: ~12% potential via retrofits

Loan Performance. Green-certified assets may underwrite 5–10% higher rents and occupancies; lenders often offer 10–25 bps rate reductions. Non-compliant assets risk carbon fines and value erosion.

Demand Dynamics. Tenant ESG goals are driving preference for green leases, boosting occupancy and retention; brown buildings risk obsolescence by 2030.

Asset Strategies. Retrofit sequencing (HVAC, lighting, solar) can deliver 5–7 year paybacks; certification (LEED, Energy Star) boosts liquidity and exit cap compression.

Capital Markets. Green bonds and sustainability-linked loans expand access to cheaper debt; institutional buyers increasingly require ESG-forward assets, supporting tighter exit cap rates.

Green premiums are real and widening.

Brown discounts are accelerating.

Financing is rewarding ESG credentials.

Retrofits offer NOI uplift and resilience.

🛠 Operator’s Lens

Refi. Seek green loan programs; model 10–25 bps rate reduction for certified retrofits.

Value-Add. Allocate $3–5/sf capex annually for efficiency upgrades; target <7 year paybacks.

Development. Bake ESG into pro formas; model exit cap rate compression (25–50 bps) for certified assets.

Lender POV. Banks and CMBS desks favor sustainable buildings, while pricing risk into brown portfolios

By 2027–2030, stricter emissions codes will mandate upgrades; non-compliant assets risk fines and liquidity loss.

Rent and value premiums likely persist as supply lags tenant demand.

Green debt and insurance incentives will deepen, making ESG-forward CRE more competitive.

World Economic Forum — Sustainability as a Value Driver in Real Estate (Jan 2025). JLL — Green Premium Research (2023). World Economic Forum — Energy Efficiency and Retrofit Report (2024).