🚨Marcus & Millichap closed the sale of a 13,579 sq. ft. Childcare Network facility in Locust Grove, GA, just 42 days after listing. The tenant, among the top five U.S. childcare operators, extended its corporately guaranteed lease for 10 more years, creating a bond-like income stream. Investors are favoring early education centers for their resilience and yield premium, often 50–100 bps above pharmacies or QSRs, making them one of few net lease sectors with positive leverage spreads.

Closing timeline: ~42 days from listing to closing — [Source: Marcus & Millichap].

New lease term: 10 years corporately guaranteed by Child Development Schools

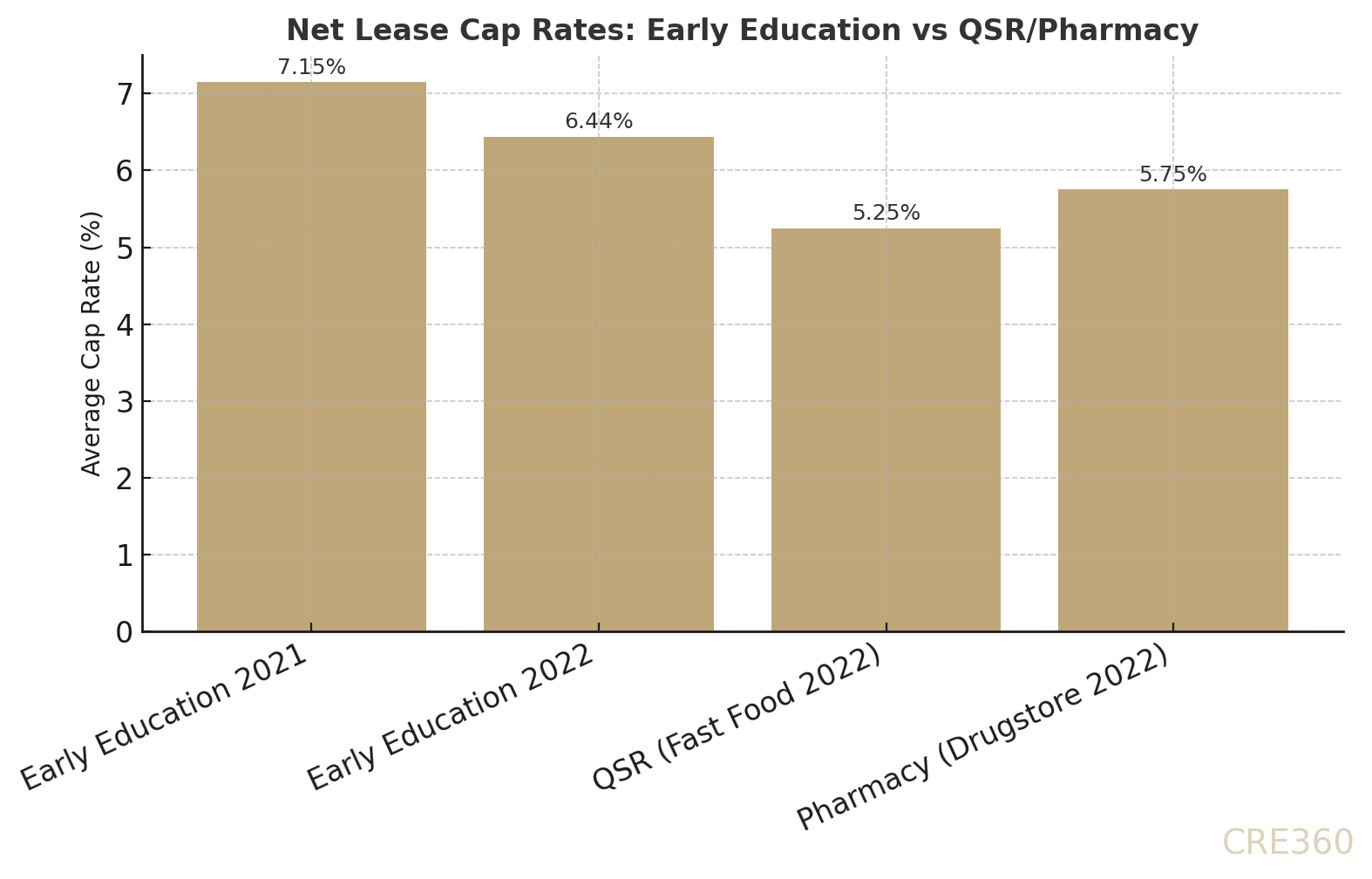

Early education cap rates: ~6.44% (2022 low), ~71 bps tighter than 2021

Net lease sector cap rates: +1 bp QoQ in Q2 2025, stability despite high rates

Loan Performance. Long-term NNN lease stabilizes DSCR and offsets rate volatility. Escalations (if 1–2% annually) protect against inflation, giving lenders confidence.

Demand Dynamics. Daycare is mission-critical and e-commerce-proof. Enrollment resilience and dual-income demand anchor NOI. Renewal risk depends on demographics and local competition.

Asset Strategies. Owners must plan for tenant-driven upkeep under NNN but reserve for long-term retrofit. Property’s childcare buildout makes reuse specialized but viable for schools or clinics.

Capital Markets. Early education cap rates offer rare yield spread; lenders underwrite moderate credit risk. Repeat buyers dominate flows, suggesting liquidity for exits at mid-term.

Net lease pricing resilient despite rate pressure.

Early education yields provide spread over QSR/pharmacy.

Financing favors long leases with guarantors.

Exit premiums possible with 5–6 years term left.

🛠 Operator’s Lens

Refi. Monitor cap rate trends; consider shorter-term debt for later refi at lower rates.

Value-Add. Reserve for long-term capex (roof, playground, code updates).

Development. Specialized use; pro formas should underwrite renewal probability conservatively.

Lender POV. Viewed as higher-yield NNN niche; lenders favor corporate guarantees and tenant tenure.

Rate cuts in late 2025 could compress net lease cap rates, boosting values.

Policy shifts in childcare funding may strengthen operator credit.

Renewal prospects hinge on Atlanta exurban growth and demographics.

Marcus & Millichap — Net-Leased Georgia Daycare Center Sold (Sep 29, 2025). WealthManagement — Net Lease Childcare Centers in Demand (2022). GlobeSt. — Childcare Net Lease Cap Rates Hit Record Lows (2022). Net Lease Advisor — Net Lease Cap Rate Report (2021). Boulder Group — Net Lease Research Report (Q2 2025).