🚨FPI Management, one of the nation’s largest apartment operators (165,000 units), has agreed to pay $2.8 million and curb algorithmic rent tools under a class-action settlement. The move prohibits mandatory use of software like Yardi or RealPage that auto-enforce higher rents across portfolios. For CRE, the shift forces underwriting back to fundamentals—occupancy, comps, and retention—rather than algorithm-driven rent escalations. Institutional capital is expected to recalibrate rent growth assumptions toward 2–3% annually, with more weight on tenant retention.

FPI portfolio size: ~165,000 units across 23 states — [Source: Reuters].

Settlement payment: $2.8 million to renters, plus cooperation with plaintiffs — [Source: Reuters].

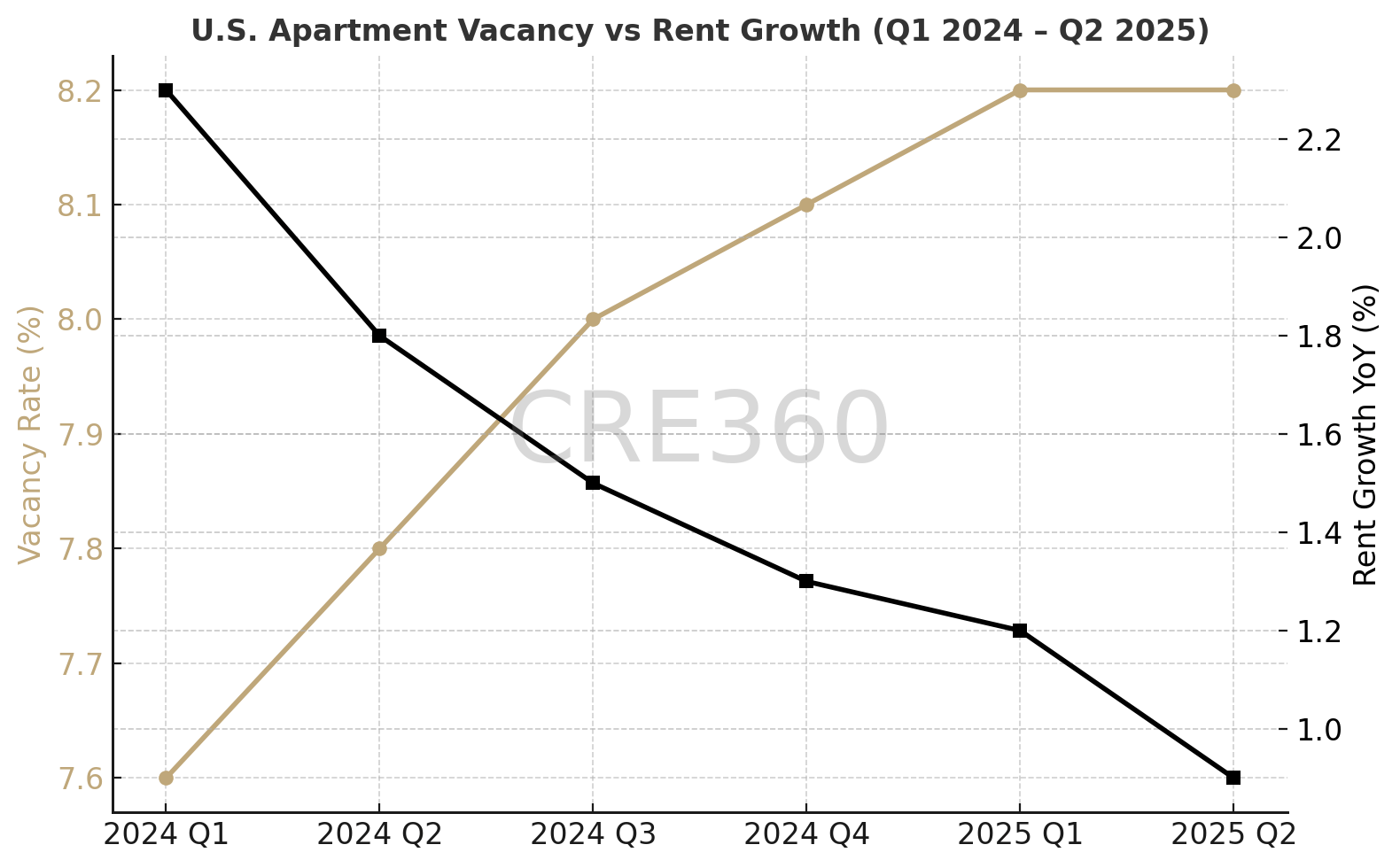

U.S. multifamily rent growth: +0.9% YoY, Q2 2025 — [Source: CoStar].

U.S. apartment vacancy: ~8.2% as of Q2 2025 — [Source: CoStar].

Loan Performance. Reduced algorithmic rent lifts mean underwriting DSCR off stabilized occupancy, not speculative rent CAGR. Higher occupancy targets (95% vs 92%) can offset thinner rent margins.

Demand Dynamics. Leasing strategies will tilt toward maximizing occupancy, with more concessions in competitive markets. Renewals may carry smaller increases but higher tenant retention.

Asset Strategies. Owners must invest in on-site leasing skill, market surveys, and tenant retention programs. Underwriting should budget modestly higher leasing payroll.

Capital Markets. Investors and lenders will discount prior algorithm-driven growth. Cap rates could widen slightly on portfolios with high exposure, but reduced legal risk may offset.

Algorithms under scrutiny = tempered rent growth.

Occupancy stability valued over rate peaks.

Tenant retention reduces turnover drag.

Lenders reward predictable DSCR over aggressive pricing.

🛠 Operator’s Lens

Refi. Assume 2–3% annual rent growth, not algorithmic escalations.

Value-Add. NOI growth must come via renovations and expense control.

Development. Conservative pro formas: higher occupancy, lower rent CAGR.

Lender POV. Expect more questions on rent-setting compliance; DSCR tested on occupancy, not rent spikes.

Expect further settlements in the class action within 6–12 months, pushing most large operators away from RealPage/Yardi yield management. Regulators may codify restrictions, but proactive compliance reduces risk. Capital will pivot toward operators demonstrating organic rent growth and tenant loyalty.

Reuters — “FPI settles renters’ lawsuit over rent algorithm” (Sept 30, 2025). CoStar — “U.S. Apartment Rent Growth, Vacancy Trends Q2 2025” (Aug 2025). https://www.costargroup.com DOJ — “United States v. RealPage, Inc. Antitrust Case” (2025). https://www.justice.gov