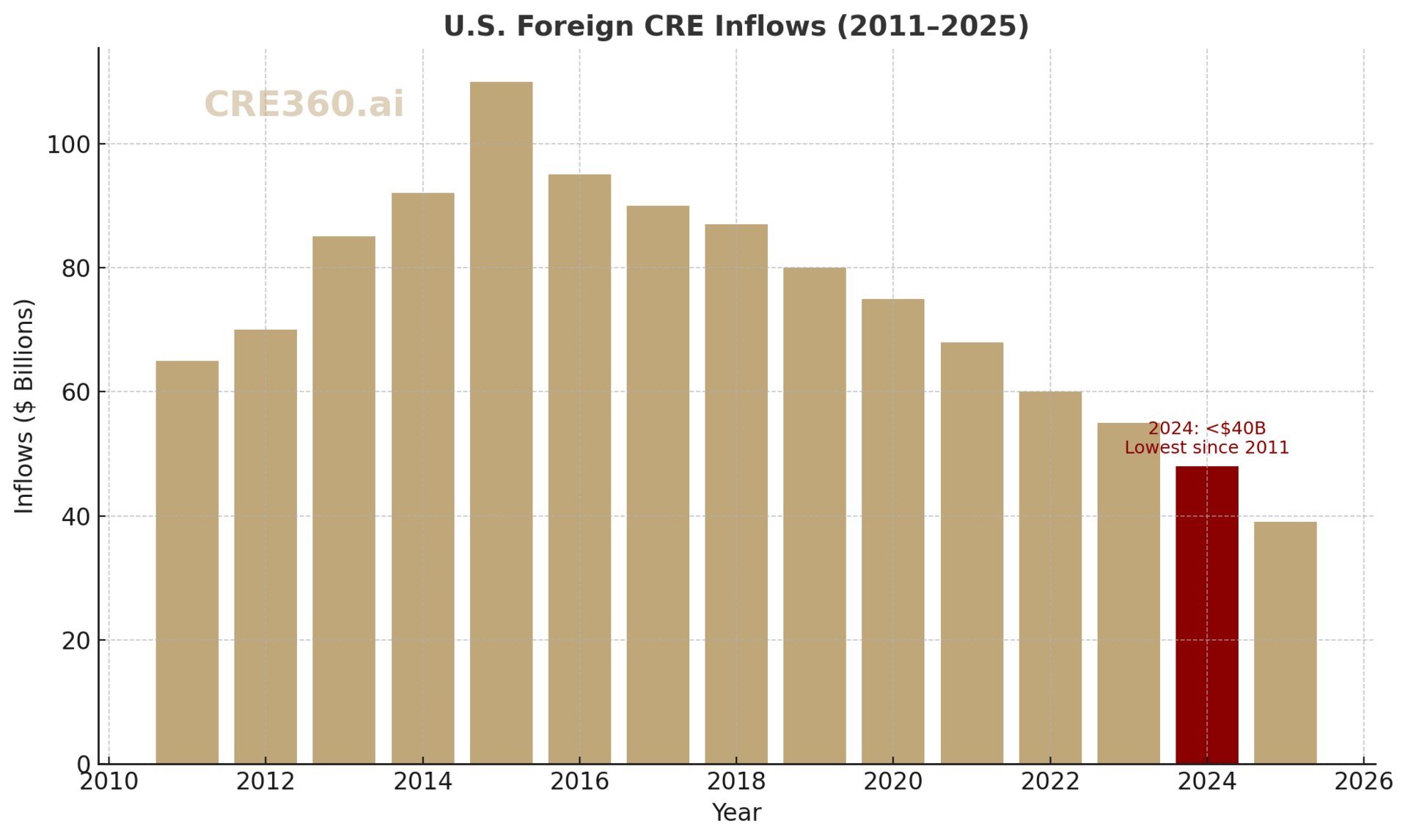

🚨Foreign investment in U.S. CRE fell below $40B in 2024, the lowest since 2011 [Source: MSCI]. Despite a 10% decline in the U.S. dollar in H1 2025, high FX hedging costs deterred many global investors [Source: Invesco]. While 44% of foreign investors plan to increase allocations, 63% remain cautious, leaving selective capital—particularly from Gulf sovereign wealth funds—active in data centers and multifamily [Source: AFIRE; Invesco]. For CRE financing, this means domestic syndicates and private credit are increasingly critical to bridge funding gaps once filled by offshore buyers.

Foreign CRE inflows: <$40B, 2024 (lowest since 2011) — [Source: MSCI].

U.S. dollar decline: –10% in H1 2025 — [Source: Invesco].

Foreign investor sentiment: 44% increase allocations, 63% cautious (2025 survey) — [Source: AFIRE].

Middle East SWF pledge: $20B to U.S. data centers — [Source: Invesco].

Loan Performance. Sellers relying on foreign bids face thinner debt sizing; hedging costs reduce appetite for long-tenor leverage.

Demand Dynamics. Multifamily and student housing remain favored for cross-border buyers; industrial stable. Office and retail see minimal foreign depth.

Asset Strategies. Structure JVs with local operators to accommodate selective foreign capital. Increase reliance on private credit or domestic syndicates in auctions.

Capital Markets. Wider spreads persist; preferred equity and structured credit gaining traction as alternatives to absent offshore senior bids.

Foreign inflows at decade lows.

Multifamily, student housing still attract offshore capital.

Domestic credit is bridging gaps.

FX volatility dictates flows.

🛠 Operator’s Lens

Refi. Assume no foreign takeout; size DSCR to domestic bank/private credit standards.

Value-Add. Foreign capital may back student housing upgrades, but demand co-GP alignment.

Development. FX sensitivity modeling critical if sourcing from euro/yen pools.

Lender POV. Domestic lenders cautious; SWF-backed projects get premium underwriting.

2026 Fed cuts could re-open foreign inflows.

Gulf/Singapore JVs remain anchor pools.

ESG compliance will continue screening function.

Invesco — Global Real Estate Outlook (Oct 2025). Savills — Global CRE Report H1 2025 (Oct 2025). MSCI — Global Real Estate Transactions Dataset (2024). AFIRE — 2025 Investor Survey (2025).