🚨Key Highlights

Retail vacancy in Tampa remains 3.4 %, among the lowest nationally.

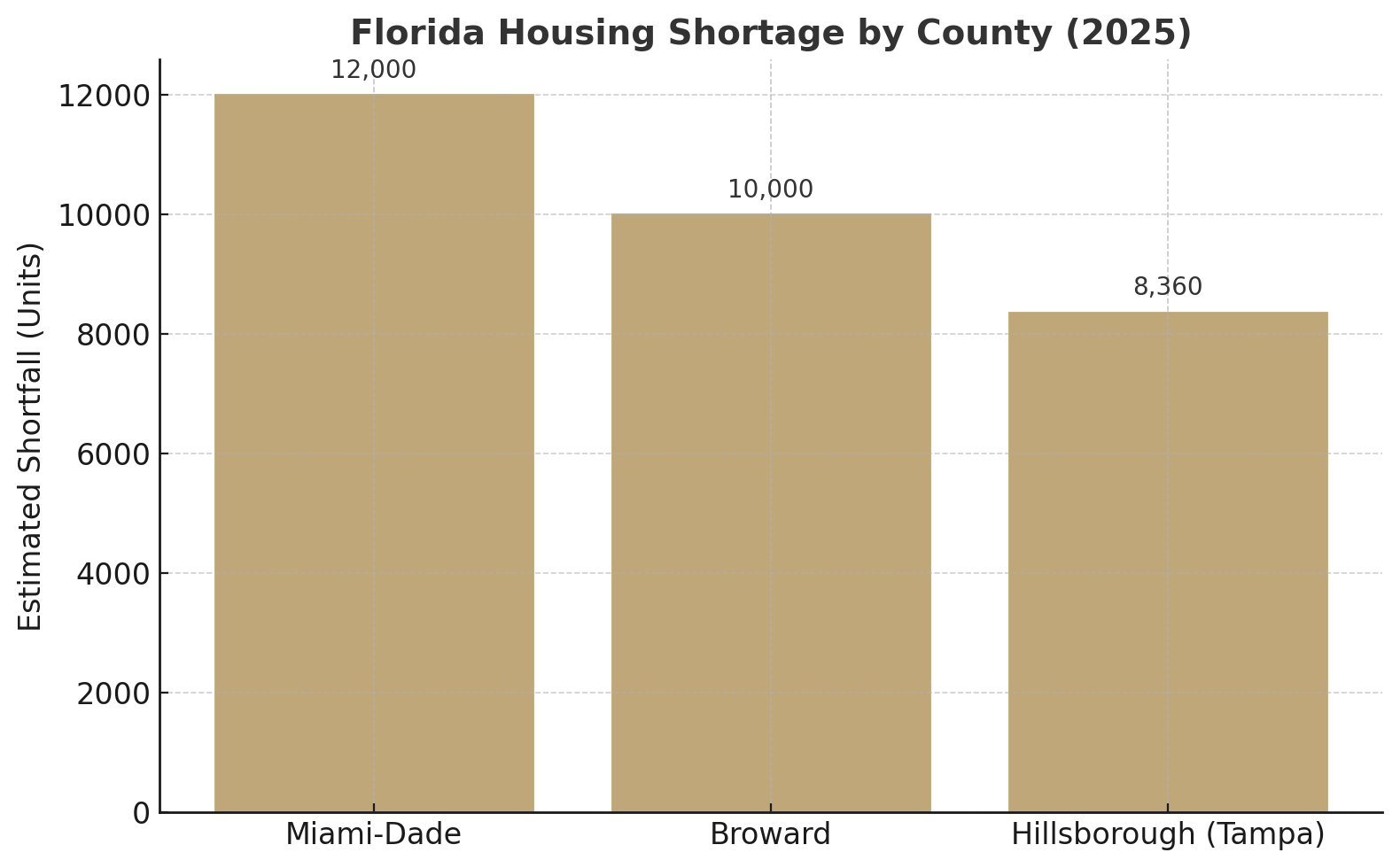

Florida faces a ~120 000-unit housing shortfall, led by Miami-Dade (12 k) and Broward (10 k +).

Q2 2025 tourism hit 34.4 million visitors, a record +9 % YoY.

Retail investment reached $332 M (Q3) in Tampa, with 6.5 % cap rates.

Overseas visitor spending rose 11 % YoY, reinforcing foreign capital inflows.

Signal

Florida’s CRE engine is running hot across all sectors. Retail, multifamily, and hospitality remain undersupplied even as capital pours in. Tampa’s 3.4 % retail vacancy and multifamily occupancies near 96 % anchor a cycle defined by scarcity, not softness. The state’s demographic pull — about 900 new residents per day — has turned limited inventory into competitive advantage. The paradox: investors and operators enjoy near-perfect demand while underwriting for volatility in insurance, climate, and rate risk.

Housing Shortfall, Lasting Demand

A statewide housing deficit near 120 000 units (multifamilydive.com) has become Florida’s structural floor for occupancy. Miami-Dade (≈ 12 000 units short), Broward (10 000 +), and Hillsborough (Tampa, 8 360) cannot build fast enough. Developers facing 7 % construction debt still pursue projects because undersupply guarantees absorption. In practice, landlords now prioritize retention over rent escalation: renewal increases are moderate, yet units re-lease within weeks. As a result, multifamily cap rates remain compressed near 5 %, even with higher risk-free yields.

Meanwhile, affordability is the constraint. Wage growth (≈ 3 % YoY) lags rent levels, pushing some demand into single-family rentals — a segment expanding ~2 % quarter-over-quarter in starts statewide.

Retail Stability, Consumer Expansion

Florida’s retail market defies the national plateau. Tampa’s open-air centers average 3.4 % vacancy, nearly 250 bps below the U.S. average. Persistent population and tourism gains keep tenants expanding: discounters, fitness, and fast-casual brands dominate absorption. Average retail rent in prime corridors exceeds $40 / sf, up 2 % YoY despite muted national growth. Landlords favor occupancy over rent spikes; stability, not speculation, defines value.

By contrast, obsolete enclosed malls still trade 20–25 % below 2019 pricing, underscoring a bifurcated retail reality. In practice, Florida’s retail is both tight and selective — high-traffic, high-visibility assets command global bids while tertiary stock stagnates.

Tourism Reaches Record Altitude

Tourism now functions as Florida’s macro-stimulus. The state drew 34.4 million visitors in Q2 2025, its highest second-quarter total ever (flgov.com). Room demand rose 1.2 % YoY, and occupancy in Orlando and Miami exceeded 90 % during summer peaks. Hotels, resorts, and cruise ports are operating near capacity, prompting renovations and new pipeline activity. International arrivals climbed 11 %, reversing post-pandemic softness.

For operators, the boom brings pressure: labor and insurance costs both rose ~8 % YoY. Still, RevPAR and ADR gains more than offset these inputs. Hospitality REITs and private buyers are underwriting sustained demand through 2026, assuming stable airfare and global mobility.

Capital and Underwriting Discipline

Capital markets mirror this operating strength. Tampa’s $332 M in Q3 retail sales at a 6.5 % cap rate signals institutional confidence. Banks and insurance lenders are active but cautious, funding multifamily and retail at 60–65 % LTV with 200–250 bps credit spreads. Foreign capital adds momentum as a weaker dollar and strong tourism spending (+11 % YoY) renew Latin American and European investor interest in Miami and Orlando assets. Underwriters, however, price risk in insurance and storm exposure through higher expense reserves and slightly wider discount rates (+25–50 bps). Discipline, not optimism, keeps deals pencilable.

Florida’s growth model appears durable but not friction-free. Supply will remain behind demand through 2026 given construction cost inflation (~6 % YoY) and tight labor. Housing shortages sustain multifamily stability while insurance premiums shape investment geography — interior markets gain advantage as coastal costs rise. Retail and hospitality benefit from tourism’s record base and the state’s population inflows, but both depend on energy prices and discretionary income. For capital, Florida remains a yield and growth magnet — yet the mature cycle demands underwriting for climate volatility and insurance drag. Liquidity is ample; discipline is currency.

Sunshine covers risk, not randomness — Florida’s strength endures because discipline is priced in.

Matthews Real Estate (Q3 2025) — Tampa Retail Market Update.

Multifamily Dive (Sept 2025) — Florida Housing Shortage Report. Florida Governor’s Office (Aug 2025) — Tourism and Visitor Statistics. NAR (2025) — Foreign Buyer Report.