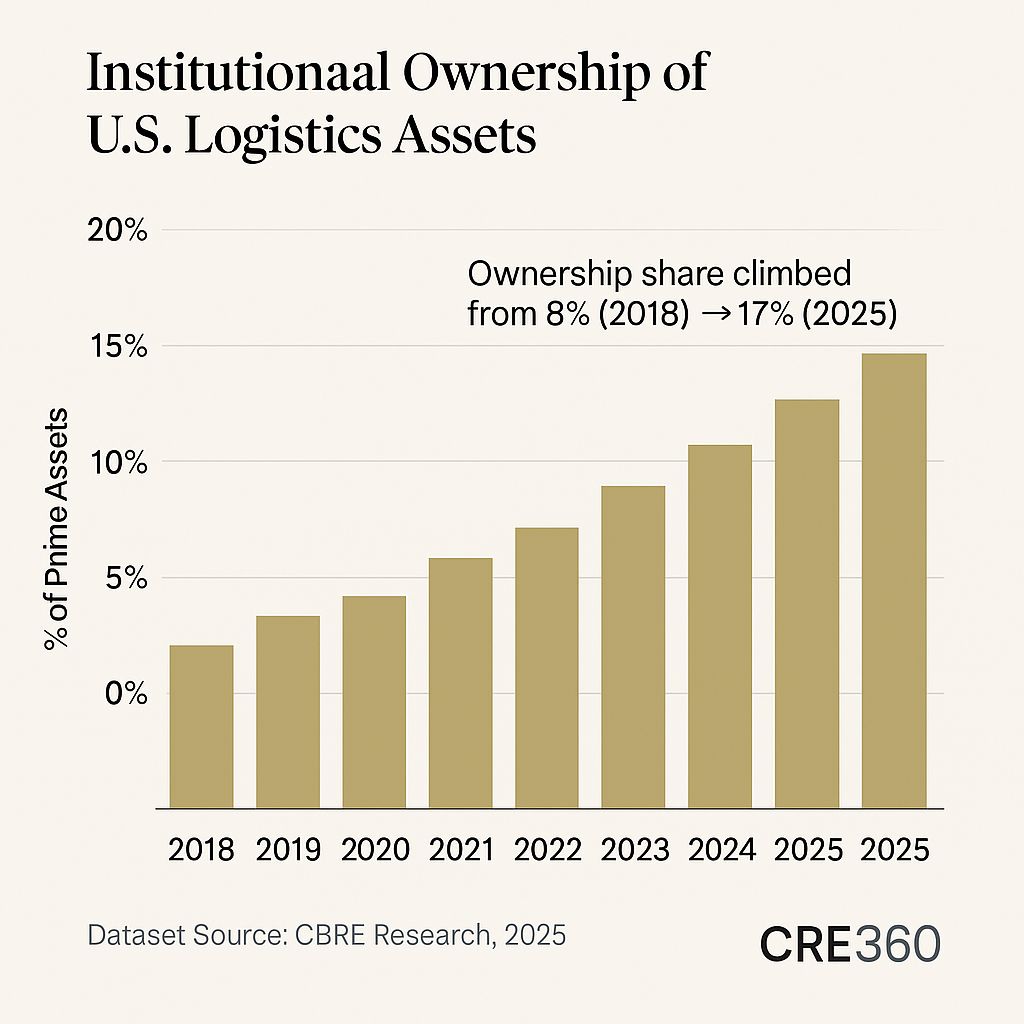

🚨Financial firms have emerged as dominant players in U.S. industrial real estate, now owning roughly 17% of prime logistics assets — a sharp rise fueled by ~$88 billion in Q1 2025 acquisitions. Using hybrid debt-equity models and joint ventures with 3PLs, institutions have effectively industrialized ownership itself. With cap rates compressing to ~5.2%, the sector is behaving more like fixed income than traditional real estate. For CRE operators, this means valuations are increasingly driven by institutional balance sheets and capital markets dynamics, not just rent growth or construction cycles.

Institutional control: 17% of prime logistics assets (2025)

Industrial acquisitions: ~$88 B in Q1 2025

Average cap rate: ~5.2%

100 bps rise in 10Y → ~41 bps industrial cap rate move

Loan Performance. Tight yields and stable NOI mean lenders treat logistics as quasi-core credit. DSCRs remain >1.6× even under 6–7% debt costs; mezz-to-equity hybrids cushion leverage risk.

Demand Dynamics. E-commerce absorption keeps vacancy <5%. “Smart” facilities with AI-driven automation secure rent premiums and longer lease terms, reinforcing yield stability.

Asset Strategies. Operators must retrofit older inventory with automation and ESG features or risk value erosion. TI/LC budgets should prioritize robotics integration.

Capital Markets. Institutional dominance raises entry barriers for private buyers. CMBS allocations tilt toward logistics, while cap-rate spreads to Treasuries narrow below 100 bps — a clear signal of bond-like pricing.

Industrial is now a yield-compression play, not a value-add spread.

Tech-enabled assets outperform manual facilities.

Financing remains favorable but selective.

Spreads tight; competition institutionalized.

🛠 Operator’s Lens

Refi. Strong DSCR supports cash-out refinances; consider swap caps through 2026.

Value-Add. Focus on automation upgrades; budget 8–10% for tech retrofits.

Development. High construction costs (+35% since 2020) require equity-heavy stacks.

Lender POV. Banks and debt funds treat institutional-backed industrial as low-risk paper; spreads tightening to ~+150 bps over SOFR.

Expect continued capital inflows into logistics and data-center hybrids. Cap-rate floors near 5% could persist until Fed cuts reprice debt costs. Watch for mid-2026 compression reversal if supply resumes or institutions rebalance toward data centers.

CBRE — U.S. Industrial Outlook 2025 (Sept 2025). https://www.cbre.com/ Savills — Global Logistics Investment Report (Oct 2025). https://www.savills.com/ MSCI — Real Assets Market Trends Q1 2025. https://www.msci.com/ JLL — Industrial Insights 2025 Q2. https://www.jll.com/