📢Good morning,

Douglas Emmett refinanced a nine-asset portfolio in SoCal and Honolulu for >$1B, confirming lender appetite for large, stabilized coastal multifamily with strong sponsors. Execution follows a drop in the MBA 30-yr mortgage rate to 6.49%, while private-label CMBS issuance has firmed into late summer.

📊 Quick Dive

Size: >$1B across CA/HI multifamily; executed via agency channels.

Rates: 6.49% 30-yr fixed, an 11-month low as of week ending Sep 5.

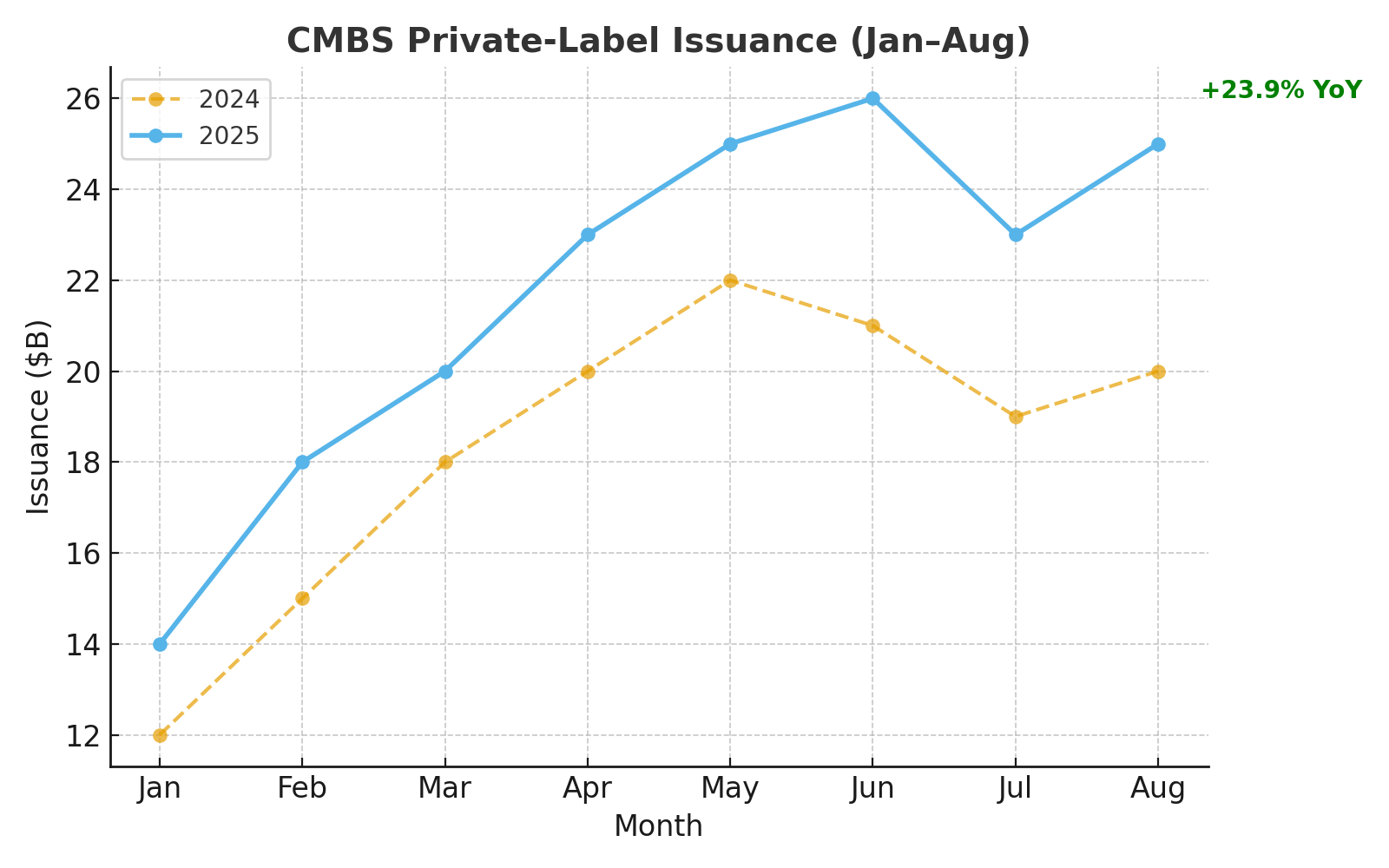

CMBS: Private-label issuance +23.9% YoY YTD through Aug 2025.

Distress Investor Closes $1B War Chest as Loan Maturities Loom, Cottonwood Group raised $1.0B for distressed CRE as the $2T maturity wall builds through 2027. The firm has deployed ~$300M and targets debt with equity-conversion rights to control outcomes in stressed situations. Research pegs $591B of loans as potentially troubled at today’s rates, supporting a loan-to-own playbook. Expect rescue capital at high teens cost where banks/CMBS remain selective.

AJ Capital refinances Graduate Hotels portfolio with $304M loan, AJ Capital secured $303.5M from Barings to refinance seven Graduate Hotels, leveraging brand resilience in college markets despite soft summer RevPAR prints. STR’s weekly reads showed negative YoY through late August, so lenders emphasize cash traps and FF&E discipline. Rate backdrop improves sentiment as the MBA 30-yr slid to 6.49%.

Trophy NJ Apartments land $340M refi ahead of 2026 maturities, Ironstate and Panepinto locked $340M for 50 & 70 Columbus ( 938 units ), replacing ~$288M of 2016-era debt and creating runway well before April 2026 maturities. Occupancy sits near 99%, supporting DSCR and modest cash-out with bank balance-sheet appetite shifting toward prime multifamily

Focus on scale, seasoning, and simplicity. Portfolio executions and trophy transit-oriented assets are clearing first with banks and agencies. Use Q4 to term out 2026 maturities and accept proceeds discipline to protect DSCR.

Operators should pull renewals forward and bid insurance early across markets. Coverage first, proceeds second. Build 50–75 bps stress buffers into every refi model; today’s prints reward readiness, not perfection.

FOMC Sep 16–17: Base case –25 bps; watch front-end for coupon drift.

CMBS window: Expect selective reopenings for clean multifamily; weaker sponsors remain spread-capped.

Hospitality: Event-driven demand helps flagged portfolios, but underwriting should retain 5–10% RevPAR stress.

2026 maturity wall: Early movers reduce competition for capital and lock carry before the bulge.

Chart of the Day: CMBS Private-Label Issuance (Jan–Aug)

Issuance is up +23.9% YoY through August 2025. Why it matters: A thaw in securitization markets is reopening selective refinancing windows for clean multifamily portfolios.