➤ Key Highlights

Municipal resistance is accelerating as large-scale data center approvals collide with zoning codes not designed for hyperscale infrastructure.

Utilities—not land—are becoming the binding constraint, with water, power, and grid resiliency now central to entitlement risk.

Political risk is shifting local, with city councils and planning commissions becoming de facto gatekeepers of AI-era infrastructure.

Regulatory ambiguity is widening underwriting spreads, extending timelines and injecting approval risk into previously “by-right” markets.

Community opposition is no longer symbolic; it is materially delaying projects and forcing policy reversals.

What’s Happening

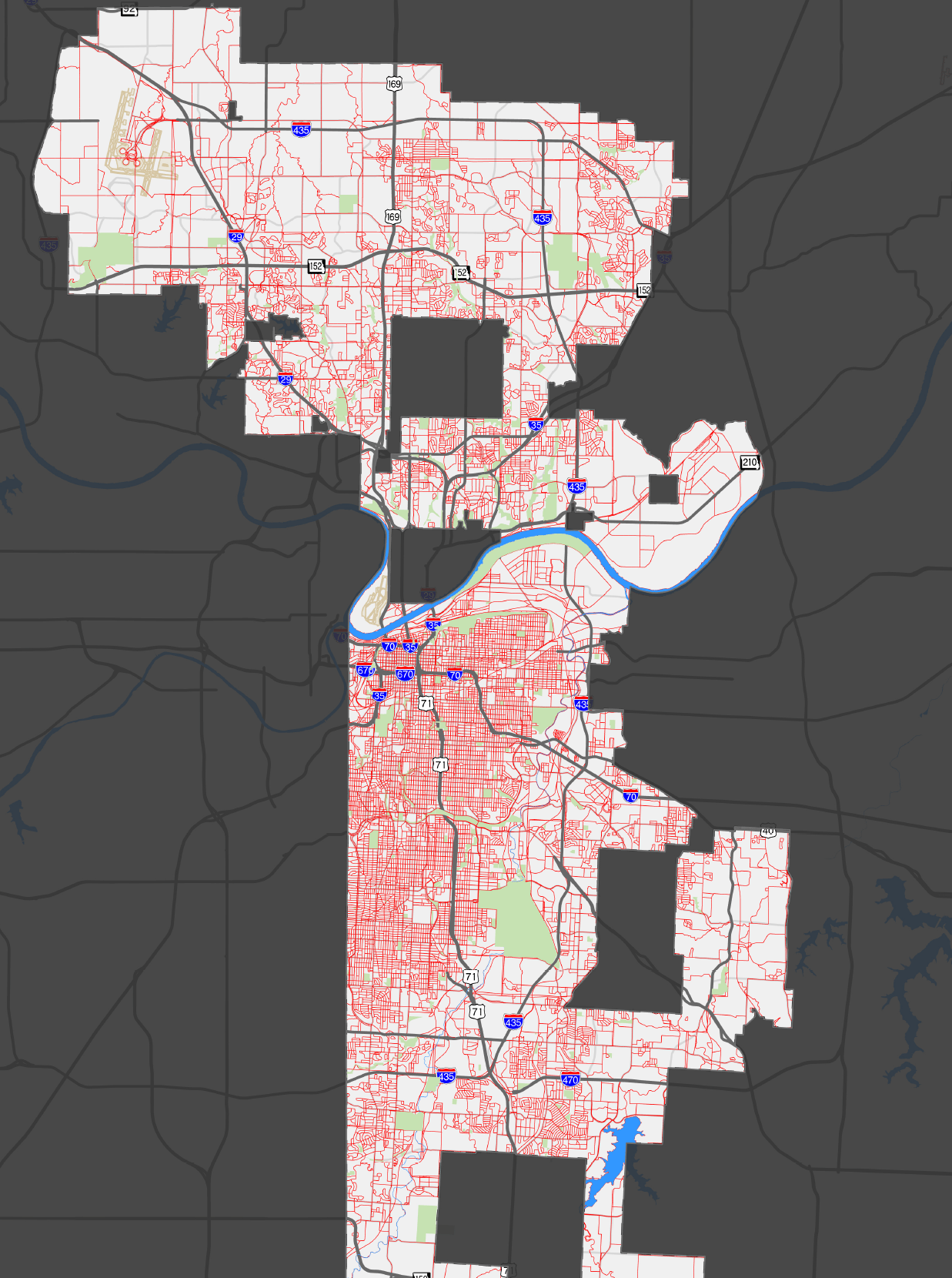

Kansas City, MO and Palm Beach County, FL are early signals of a broader national recalibration in how data centers are regulated, approved, and perceived.

In Kansas City, proposed zoning code amendments sought to classify data centers as “Large Format Uses,” effectively streamlining approvals and reducing case-by-case scrutiny. The pushback was immediate and intense. Residents flooded city officials with objections centered on water usage, grid strain, noise, and lack of transparency. The ordinance was ultimately paused, signaling political sensitivity around fast-tracking digital infrastructure in urban settings.

In Palm Beach County, a 200-acre AI data center project (“Project Tango”) faced a similar fate. After hours of public opposition citing environmental, noise, and proximity concerns, county commissioners unanimously delayed the vote until 2026, pending further studies and public engagement.

These are not isolated NIMBY events. They reflect a structural mismatch between legacy land-use frameworks and next-generation infrastructure.

For institutional capital, data centers have been underwritten as quasi-infrastructure assets with predictable entitlement paths. That assumption is breaking down.

Entitlement timelines are extending: What was once a 6–9 month approval process is now subject to multi-year political review cycles.

Risk premiums must expand: Zoning and community opposition now deserve line-item treatment in development risk models.

Capital stack fragility increases: Delays directly pressure construction loans, interest carry, and power reservation agreements.

Geographic arbitrage is re-emerging: Secondary and tertiary markets with surplus utilities may outperform urban infill sites despite weaker fiber adjacency.

This is a repricing moment—not of demand, but of friction.

Utilities Are the Real Battleground

The debate is no longer about buildings; it’s about resource allocation.

Municipal leaders are increasingly forced to answer uncomfortable questions:

Who absorbs long-term water draw during drought cycles?

How resilient is the local grid under peak AI loads?

What happens when residential growth competes with server demand?

Cities claiming “adequate infrastructure” are being challenged to prove it—not in aggregate, but at the marginal, project-specific level. This shifts leverage away from developers and toward utilities, regulators, and voters.

Stop Reading Headlines

Start Understanding the Market

➤ TAKEAWAY

Data centers remain structurally essential. But their friction profile has changed.

This is not a demand risk story. It’s a governance and infrastructure story. Markets that fail to adapt zoning, utilities, and political processes will lose investment—not because capital disappears, but because it reroutes.

For operators and investors, the signal is clear: entitlement risk is back on the balance sheet.

DODGE Construction