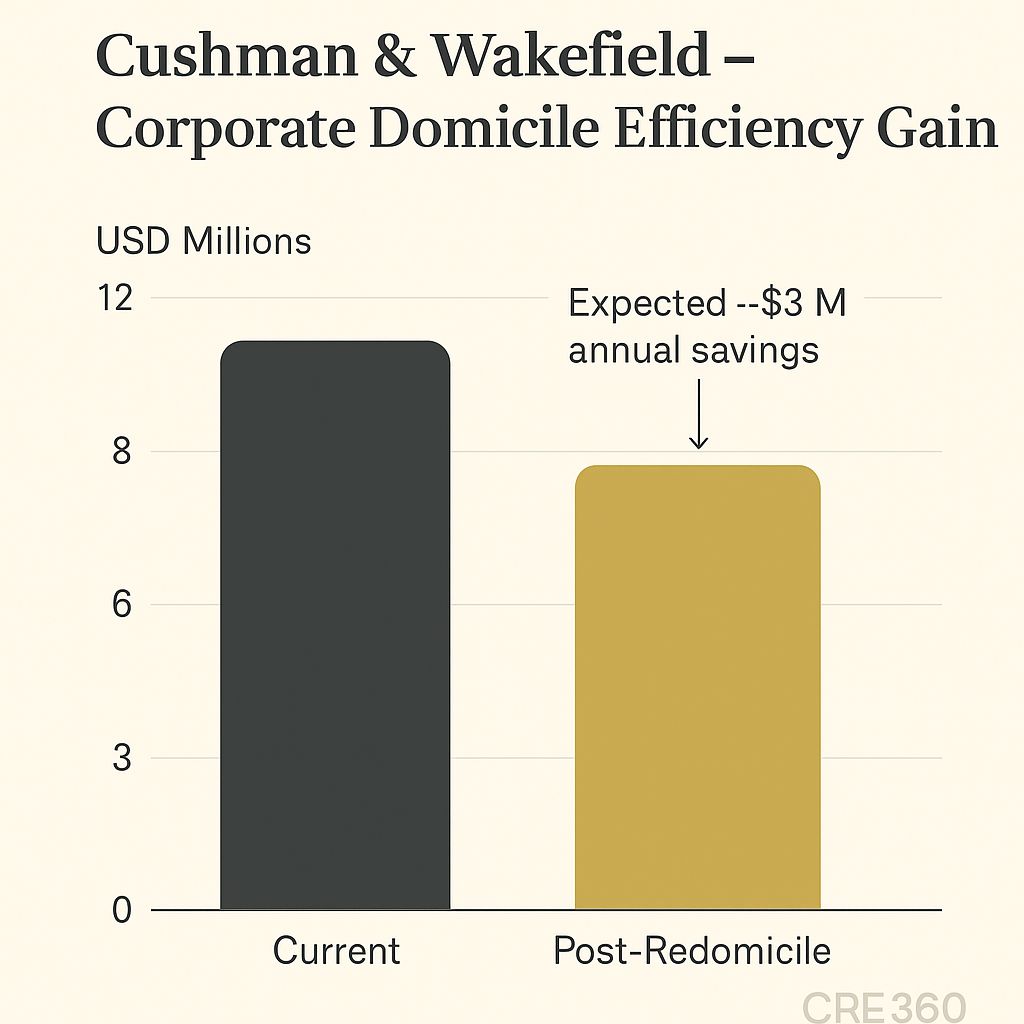

🚨Cushman & Wakefield is set to re-incorporate from the U.K. to Bermuda following endorsements from proxy giants ISS and Glass Lewis. The move—framed as a corporate efficiency measure—reflects broader CRE industry shifts toward governance flexibility and cost optimization amid slower transaction markets. Projected annual savings of $3 million are modest against $9 billion in revenue, yet management argues the simplification will improve agility and shareholder alignment, especially with its U.S. investor base.

Estimated annual savings: $3 million (corporate structure efficiencies)

Revenue base: $9.0 billion (FY 2024) Shareholder vote scheduled: October 16, 2025

Major proxy advisers endorsing: ISS & Glass Lewis (Oct 2025)

Loan Performance. No direct credit impact, but stronger governance transparency could marginally support counterparty confidence in C&W’s debt issuance and CMBS servicing arms.

Demand Dynamics. Clients and occupiers unaffected; focus remains on transactional efficiency and advisory continuity.

Asset Strategies. For investors in CRE services firms, cost-cutting via structural moves signals margin protection in a fee-compression environment.

Capital Markets. Governance realignment to Bermuda positions C&W alongside peers optimizing domicile for legal simplicity; potential future trend among global CRE advisors and REIT service entities.

Governance agility over tax advantage.

Nominal savings but symbolic modernization.

Alignment with U.S. shareholders.

Corporate domicile shifts may normalize in CRE services.🛠 Operator’s Lens

Refi. No operational lending change; credibility in corporate paper stable.

Value-Add. Demonstrates cost discipline—signal to investors of margin awareness.

Development. Neutral operationally; improves parent-level flexibility.

Lender POV. View as credit-neutral; transparency benefits governance perception.

Shareholder vote on October 16 expected to pass given ISS/Glass Lewis backing.

Other CRE service firms may evaluate domicile optimization.

Execution risk lies in realizing promised administrative savings without distraction.

Cushman & Wakefield plc — Shareholder Circular on Redomiciliation (Oct 2025). https://ir.cushmanwakefield.com Glass Lewis — Proxy Report Recommendation (Oct 2025). https://www.glasslewis.com ISS — Advisory Report on C&W Proposals (Oct 2025). https://www.issgovernance.com