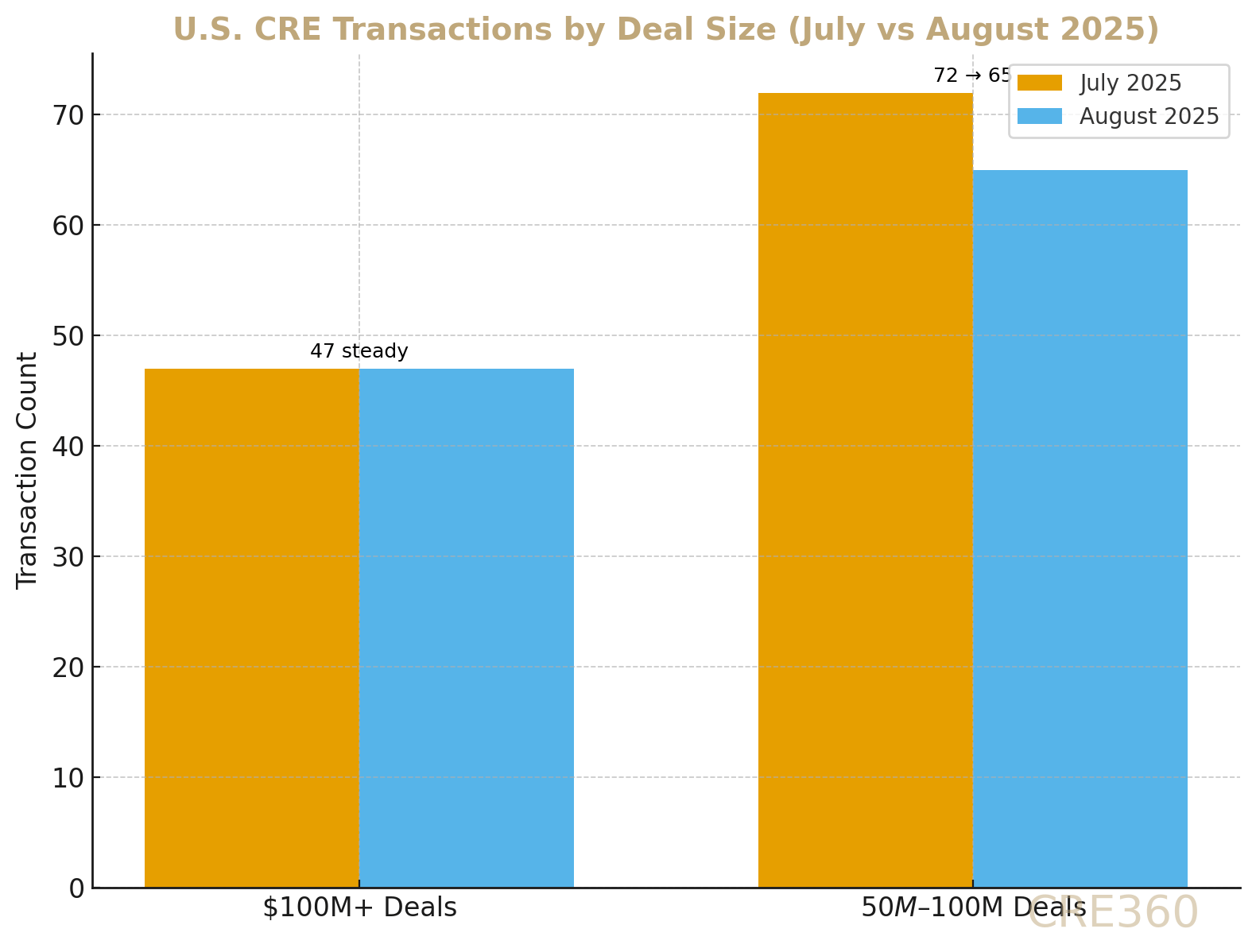

🚨U.S. CRE deal activity in August showed resilience. $100M+ trophy transactions held steady at 47, matching July, while mid-market trades ($50–100M) dipped only slightly to 65 but remained 12% above year-to-date averages. LightBox’s CRE Activity Index registered 104.8, marking its seventh straight month above the 100 expansion line. The divergence in outcomes—74% of repeat sales trading at gains, 26% at losses—underscores selective strength: prime assets continue to transact near peak pricing, while troubled offices and older assets face sharp write-downs.

$100M+ transactions: 47 deals in August, unchanged from July

Mid-market ($50–100M): 65 deals in August vs. 72 in July, still ~12% above 2025 average

LightBox CRE Activity Index: 104.8 in August (vs. 111.8 in July), 7th month >100

Repeat-sale outcomes: 74% at gains, 26% at losses

Loan Performance. Stabilized assets in multifamily/industrial remain refinanceable with DSCR >1.3 and debt yields >8%. Distressed office loans will need higher cap rates and extended hold assumptions.

Demand Dynamics. Multifamily/industrial absorbing capital inflows; retail and hospitality selective. Offices remain bifurcated—distressed vs. trophy.

Asset Strategies. For weaker assets, layer in higher TI/LC and longer lease-up; prime assets justify shorter downtime assumptions. Consider blend-and-extend for retention.

Capital Markets. Mid-market deals clearing via banks/life cos with straightforward structures; nine-figure trades require creative financing. CMBS tone cautious but open.

Market paused seasonally, not structurally.

Prime assets command gains; obsolete offices discounted.

Financing available for transparent, mid-cap deals.

Spreads remain stable but underwriting discipline key.

🛠 Operator’s Lens

Refi. Lock caps on floating debt; test fixed-rate execution where DSCR >1.3.

Value-Add. Focus capex on repositioning retail/office; contingency 10–15%.

Development. Model pro formas with 50 bps higher exit cap on non-core sectors.

Lender POV. Banks and insurers favor clean $50–100M deals; distressed office only with deep discounts.

Expect Q4 pickup as seasonal lull fades; Activity Index likely to rebound if rates stabilize. Watch Fed trajectory—steady or easing rates would catalyze refinancings. Distress likely remains sector-specific (office-heavy maturities 2026), offering selective acquisition opportunities.

Connect CRE — “U.S. CRE Deal Flow Remains Steady Through Late Summer Lull” (Sep 29, 2025). LightBox — CRE Activity Index (Aug 2025).