📢 Good morning,

Two high-profile refinancings in New York confirm selective thaw in CRE lending. Bank Hapoalim refinanced a Harlem multifamily tower with $220M, while Starwood Property Trust extended $500M to an industrial portfolio in Westchester. These deals show that despite tight overall credit, well-leased multifamily and industrial assets continue to attract capital from both foreign and non-bank lenders.

$220M refinancing for 27-story, 490-unit Harlem multifamily (Bank Hapoalim).

Prior $210M construction loan retired; new debt upsized.

30% of units are affordable housing.

$500M Starwood Property Trust loan secured by 42-property, 2.4M SF industrial portfolio.

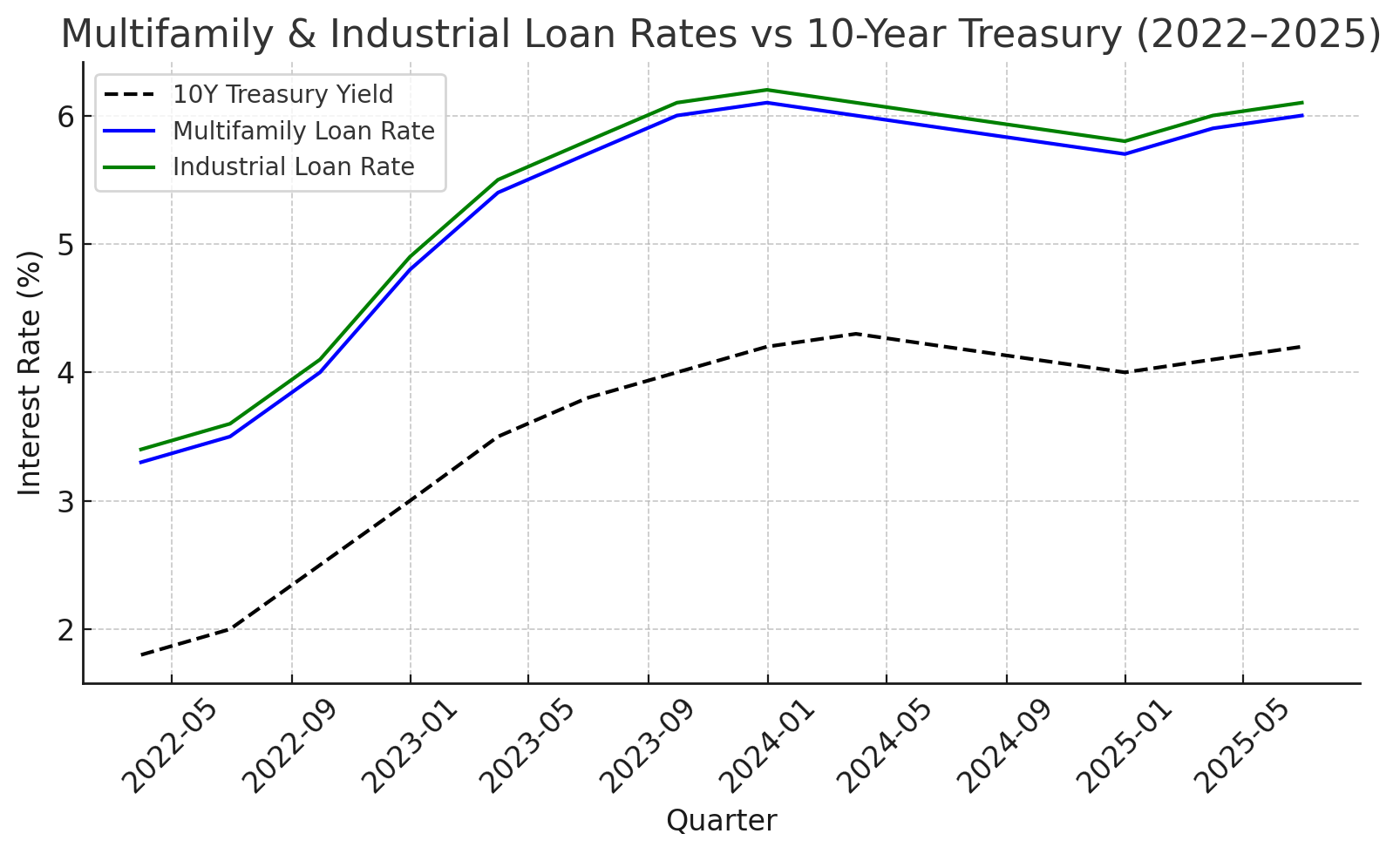

Treasury yield ~4.3%; Fed rate ~5.5%.

Typical LTV today: 55–65% (vs 70–75% pre-2022).

Lender minimum DSCR: ≥1.25x NOI at ~6% interest.

1. Asset Quality Defines Liquidity

The Harlem and Westchester deals underline that lenders are active only for prime assets. Newer multifamily with affordability features and fully leased logistics portfolios meet today’s higher standards, while office and secondary retail remain shut out.

2. Alternative & Foreign Lenders Step In

Regional U.S. banks remain constrained, creating space for Israeli banks, life insurers, REITs, and debt funds. Their presence adds competition but at higher spreads (150–200 bps over benchmarks for banks/life cos; 300–400 bps for debt funds).

3. Underwriting Guardrails

Leverage levels capped around 55–65% LTV. Interest reserves, covenants, and cash flow sweeps are common. Borrowers must demonstrate DSCR resilience even under interest rate shocks (+50 bps). Covenant-lite structures are gone.

4. Capital Market Context

Rates remain elevated, but spreads on multifamily and industrial loans are narrowing. As lenders adjust to “new normal” yields, execution confidence grows. This bifurcation in credit explains why investment sales in multifamily and industrial remain more liquid than office.

Debt capital is flowing to multifamily and industrial, not office.

International and private lenders are filling gaps left by U.S. banks.

Borrowers must prepare for lower leverage and stricter covenants.

Strong execution in refinancing is helping keep investment markets alive.

Institutional: Refinancing signals durability of favored asset classes. Institutional sponsors with track record and quality product can still refinance at scale.

Operator: Expect tighter reporting requirements, lender oversight, and reserve structures. Those who refinance successfully free bandwidth to shift from defensive (debt rollover) to offensive (growth, capex, expansion).

If base rates stabilize or fall, refinancing volumes in multifamily and industrial will increase. Life insurers and agencies are preparing to expand allocations in 2025. ESG and green loan programs could offer additional capital sources. Risks remain if delinquencies rise, but current fundamentals support cautious optimism.

Multifamily & Industrial Loan Rates vs 10-Year Treasury (2022–2025) – All-in rates stabilized near 6% even as Treasuries rose.

CRE Lending Volumes by Sector (2022 vs 2023) – Multifamily and industrial stayed resilient, office collapsed.