🚨Key Highlights

$76 M land assembly at East 79th & Lexington Ave (100 K SF buildable).

Five of six parcels closed ($62.5 M); final $13.5 M due 2026.

All-cash purchase—no acquisition debt in 7%-rate environment.

Planned 15-story, ~30–40 unit boutique condo targeting $4,000+/SF.

Closer Properties controls ≈$5 B portfolio—first active U.S. project.

Signal

When Zhang Xin—the developer once known as “the woman who built Beijing”—quietly spent $76 million assembling parcels at East 79th and Lexington, she wasn’t just buying land. She was buying a narrative: that global ultra-wealth still trusts New York’s permanence. Her family office, Closer Properties, financed the deal entirely with equity, side-stepping the financing paralysis freezing most developers. In a market dominated by refinancing stress, Zhang’s move is both symbolic and instructive—a liquidity statement disguised as architecture.

Capital Without Credit

At roughly $760 per buildable SF, Closer Properties locked in a prime Upper East Side corner at near-cycle-low pricing. The all-cash strategy neutralizes rate volatility and signals a preference for certainty over leverage. While peers face debt maturities at 7%–8%, Zhang’s family office deploys patient capital at 0% cost of funds. The implication: private global wealth is selectively replacing institutional capital now constrained by regulation. In practice, her purchase shows how equity-heavy actors can restart urban development when banks retreat.

Boutique Over Bravado

With 100,000 buildable SF, the planned tower will likely yield 30–40 expansive condos priced near $3,000–$3,500/SF—mirroring peers like 150 E 78 and 200 E 83. Instead of chasing super-tall spectacle, Zhang is matching context: limestone façade, restrained luxury, ground-floor retail. This shift toward “quiet high-end” aligns with a maturing buyer pool—local families trading co-ops for new product rather than offshore investors chasing skyline trophies. On balance, the UES’s conservatism becomes a feature, not a constraint.

Timing the Trough

Land values softened ~15% from 2022 highs; construction costs, though +20% since 2021, have stabilized. Zhang’s plan to deliver by 2027 bets on a moderate recovery—luxury condo absorption of 20–30 units/year could clear inventory within 18 months post-completion. Meanwhile, equity-funded construction avoids loan-draw timing risk. For now, she benefits from the lag between sentiment and fundamentals: while capital markets remain risk-off, end-user demand for prime addresses has barely declined.

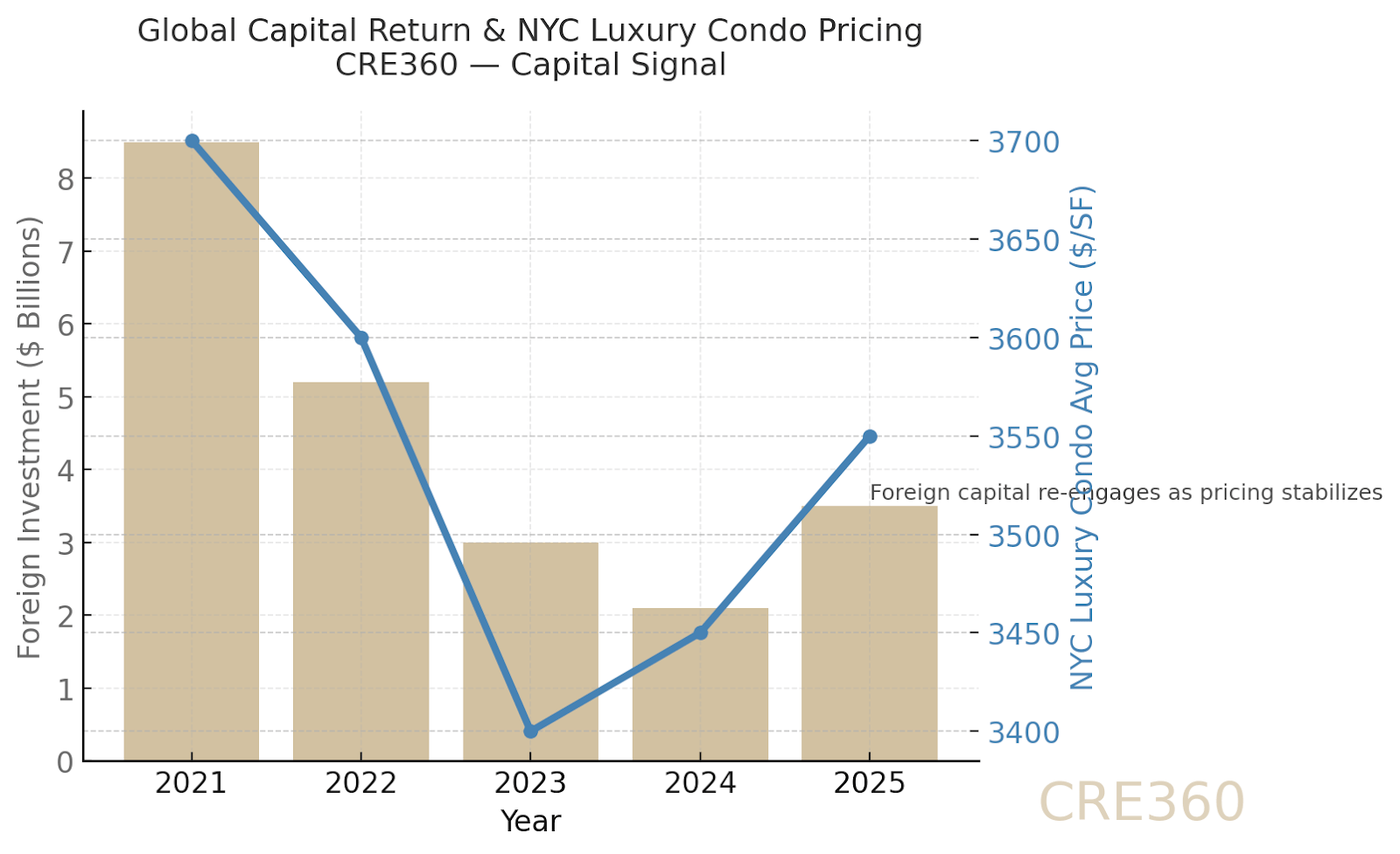

Foreign Capital’s Return Pattern

Chinese investment in U.S. real estate fell >80% from 2016 peaks, yet Closer Properties’ entry may mark a micro-reversal. By operating through an offshore family platform, Zhang bypasses mainland capital-control friction. Her move hints at a new wave: smaller, privately controlled, reputationally driven deployments rather than state-linked megaprojects. In turn, Manhattan’s high-end pipeline gains diversification of capital sources—foreign, but conservative.

Execution & Governance

Demolition of five pre-war buildings will require meticulous staging under strict UES rules. Expect higher soft costs for legal, logistics, and community coordination—perhaps +10% to budget. Still, Closer’s balance sheet removes lender oversight friction. The greater risk is cultural: adapting Beijing-scale processes to New York’s slower, permit-dense system. Zhang’s track record suggests she’ll counter by hiring elite local partners (A.M. Stern, SLCE, or RAMSA type). The payoff is reputational—precision over speed.

By 2025–26 sales launch, the boutique-luxury segment should benefit from scarcity: less than 200 unsold UES new-development units remain, according to Corcoran Sunshine. If Closer achieves >40% presales by completion, financing optionality widens for future U.S. projects. For capital markets, Zhang’s arrival reinforces a broader inflection—global family offices re-deploying into tangible, prime-location assets as currency hedges. In a cycle dominated by deleveraging, equity depth becomes competitive advantage.

Discipline is the new glamour—luxury now trades in certainty, not spectacle.

Bisnow ; NYC Department of Buildings filings; Corcoran Sunshine Q3 Luxury Market Data; CBRE Land Advisory 2025