➤ Key Highlights

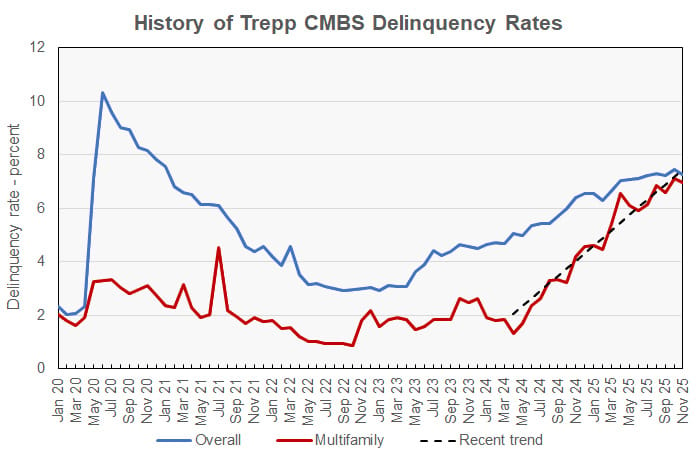

KBRA: U.S. private-label CMBS delinquency rate holds at 7.8% in November (7.9% in October).

KBRA Distress Rate (delinquent + specially serviced loans) dips from 10.9% → 10.5%.

Office drives the newest wave of distress, accounting for ~25% of newly troubled loans.

Trepp: Overall CMBS delinquency rate edges down 20 bps to 7.26%.

S&P: Aggregate CMBS delinquency at 6.0%, but office is “nearing 10%.”

Headline delinquency numbers look stable — even mildly improving — but the composition of distress is worsening.

The stress is no longer broad.

It is concentrated and accelerating inside specific property types: office, lodging, and certain industrial pockets.

Lenders and servicers are now staring at long-duration impairment, not short-term noise.

⚠️ Why it matters now

This is not a liquidity story anymore — it’s a fundamental performance story.

Office distress continues to compound, with no clear demand recovery mechanism.

Lodging and industrial delinquency upticks signal that post-pandemic “safe sectors” are no longer insulated.

Borrowers approaching maturity walls in 2026–2027 face refinancing math that hasn’t improved despite headline-rate optimism.

“Overall averages” are masking sector-level deterioration — the kind that affects underwriting discipline and lender posture.

For operators, the capital environment is shifting from rate anxiety to asset-level scrutiny.

Stop Reading Headlines

Start Understanding the Market

What’s Next

Expect the divergence to widen:

Office: More transfers to special servicing; valuation resets will accelerate.

Lodging: Margin compression from operating costs may continue to push weaker assets into delinquency.

Industrial: A low base, but rising — signaling the end of the “bulletproof” industrial narrative.

Lenders will tighten DSCR expectations and demand stronger sponsor guarantees or fresh equity.

CMBS special servicers will likely expand workout activity through 2026.

➤ TAKEAWAY

The headline numbers will fool anyone who watches the top line instead of the structure.

CRE distress is now sector-specific, not system-wide — and that’s more dangerous for operators because it compresses exit options:

Fewer buyers

Harsher underwriting

More punitive refinance terms

Lower tolerance for business-plan misses

The smart operators are already shifting to asset-by-asset risk scoring, not market-level generalizations.