🚨Key Highlights

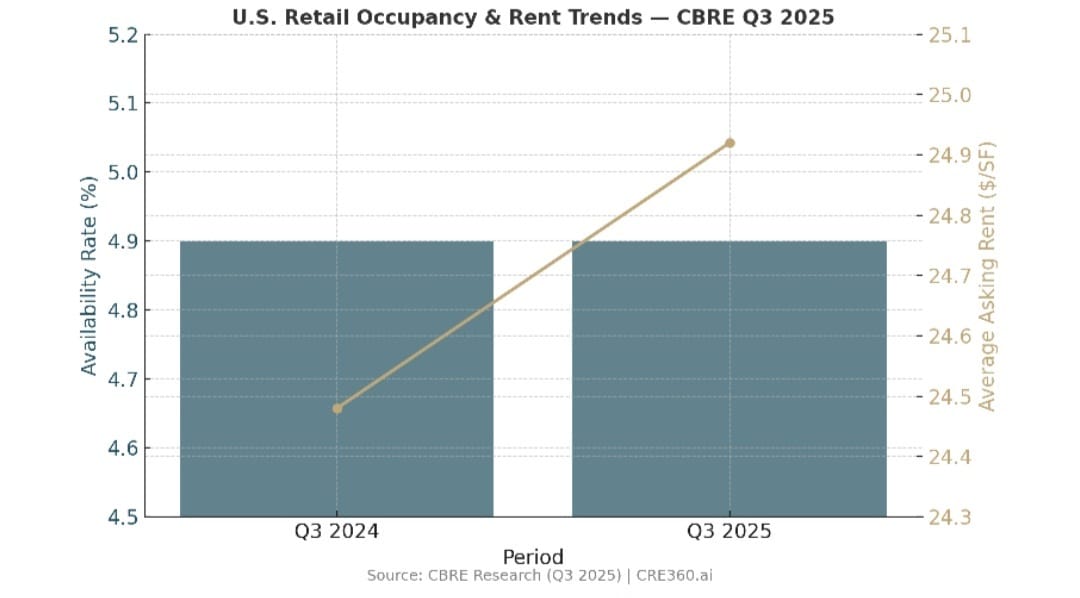

Availability steady at 4.9%, near the lowest in two decades (CBRE).

+1.8 M SF net absorption in Q3 – first positive quarter of 2025.

Asking rents up 0.4% QoQ / 1.8% YoY to $24.92 per SF.

Grocery-anchored centers ≈ full; mall vacancy split: Class A 5.8% vs Class C 10%+.

Cap rates for essential retail compress ~25 bps YTD, signaling renewed investor confidence.

Signal

After a decade of churn, retail real estate has settled into rare balance. Availability held at 4.9% in Q3 (CBRE), while +1.8 million SF of space was newly absorbed—the first positive quarter all year. This quiet equilibrium reflects disciplined leasing rather than exuberance: landlords prioritized credit strength and retention over rent spikes.Retail’s post-pandemic stabilization marks a structural shift—occupancy and income durability, not expansion, now define success.

Demand Balances Outflows

Grocery, dollar, and discount chains led expansions that offset lingering apparel and bank closures. Houston alone accounted for the largest share of new completions and absorption, underscoring the South’s population-driven demand.

Meanwhile, older northern strips still lag but are no longer hemorrhaging tenants. In practice, regional vacancy differentials are narrowing—a sign of true sectoral maturity.

For leasing teams, stability is now strategy: defensive renewals keep occupancy near full, even at the cost of slower rent growth.

Rents Creep Up with Selectivity

Average asking rent rose to $24.92 per SF (+0.4% QoQ, +1.8% YoY).

That gain trails inflation yet signals regained pricing power after years of stagnation.

Sunbelt metros and prime coasts set the tone; secondary markets stayed flat as owners favored durable tenants over peak rent.

Still, this modest ascent hints at scarcity: with supply growth negligible, even restrained demand lifts effective rents.

For now, rent discipline anchors value more than expansion does.

Format Matters

Neighborhood and strip centers, often grocery-anchored, remain nearly full (~6% vacancy).

Regional power centers hover near 5.5%, while Class A malls tightened to 5.8% (-30 bps QoQ).

Class B/C malls still exceed 10% vacancy—proof of bifurcation persisting beneath aggregate stability.

Off-price and food tenants continue to fill inline spaces, while experiential uses backfill former anchors.

Ultimately, adaptive reuse now defines mall recovery more than traditional leasing cycles.

Capital Re-engages

Investors, drawn by income visibility, are rotating back into retail.

Cap rates for grocery-anchored and necessity-based centers compressed roughly 25 bps this year to the mid-6% range.

Debt capital is accessible—banks and life companies quote around 6% coupons at 60% LTV, often preferring retail over office or multifamily.

Private buyers view yields (6–7%+) as a spread play against bonds.

As a result, retail’s perception has flipped: the former laggard is now the steady-yield anchor of mixed portfolios.

Operational Discipline

Operators are leveraging high occupancy to secure long-term renewals rather than chase rent jumps.

Energy-efficiency retrofits and CAM control are central to NOI protection, while experiential and service tenants (fitness, medical, food) fortify traffic.

Centers that facilitate omnichannel retail—curbside pickup, smaller formats, integrated logistics—retain tenants longest.

Still, underwriting prudence remains key: low single-digit rent growth, adequate TI allowances, and realistic re-tenanting assumptions separate durable cash flow from optimism.

Retail fundamentals should maintain a moderate-growth glide path through 2026.

Availability could tighten toward 4.5% as limited new supply meets steady retailer expansion in discount, grocery, and service categories.

Rent growth of 2–3% annually is plausible if inflation cools and rates ease.

Selective development—especially in growth corridors—may re-emerge by 2027, but only where population and income justify it.

Capital-market sentiment remains constructive: if yields hold and debt stabilizes, prime centers could reprice 25–50 bps tighter within 18 months.

Stability isn’t stagnation—it’s credibility rebuilt, rent by rent.

CBRE Research — U.S. Retail Figures Q3.Cushman & Wakefield — Shopping Center Data Q3.

Colliers — U.S. Retail Vacancy Insights Q3