📢 U.S. apartment construction has retrenched to ~542,800 units as of Q2 2025, the smallest active pipeline since 2015. Completions now outpace starts, particularly in Sun Belt metros that led the last build-boom. The near-term effect is competitive lease-ups through 2025; the medium-term consequence is far fewer deliveries by 2026–27, tightening vacancy and restoring rent growth once today’s inventory is absorbed.

542.8k units under construction, Q2 2025 (lowest since 2015).

≈1.1M peak under construction in early 2023 → ~60% drop.

Pipeline fell ~320k units YoY (-37%) vs Q2 2024 (~863k).

≈354k units slated to deliver in next 12 months.

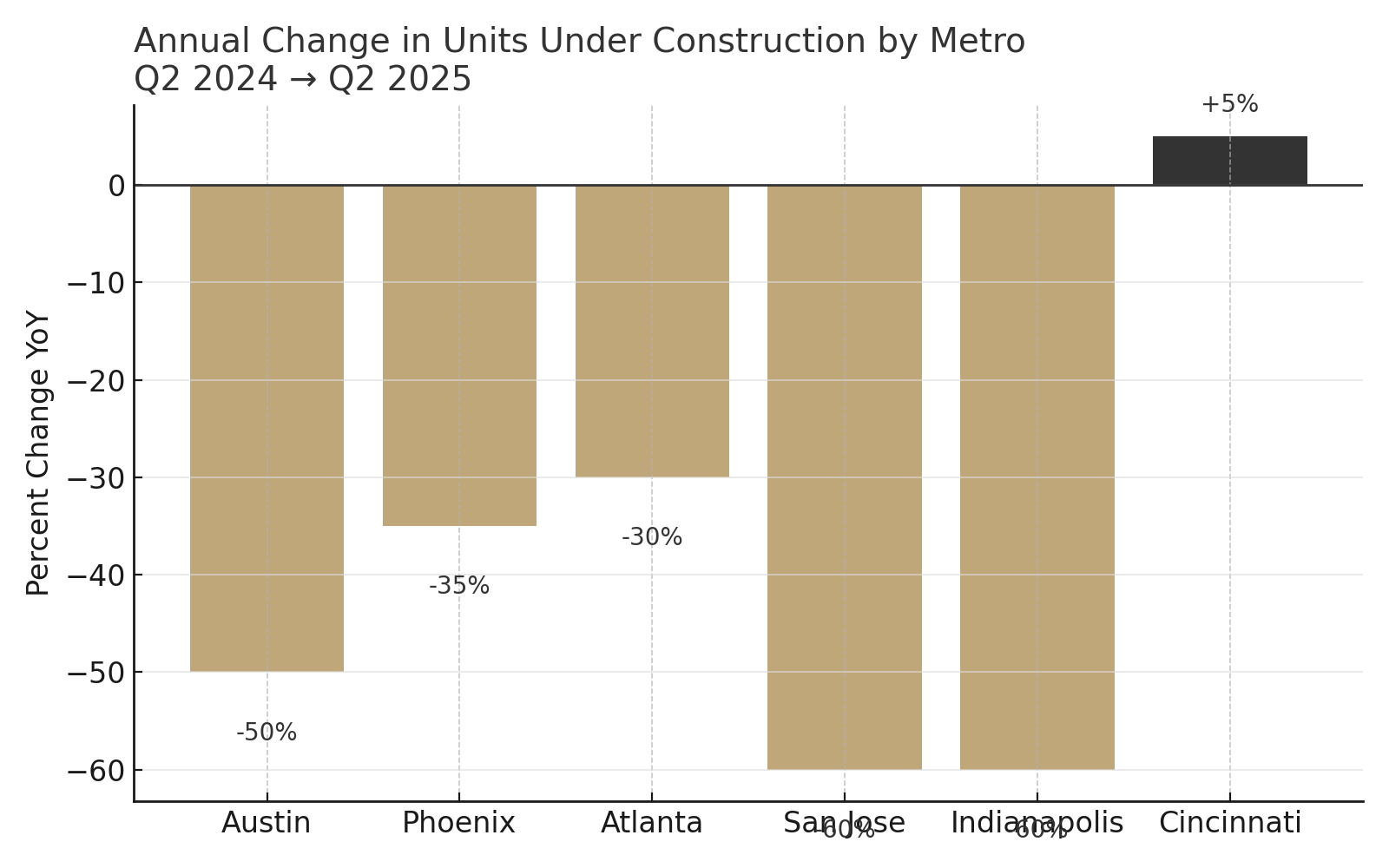

Metro pullbacks YoY: Austin ~-50%; Phoenix ~-35%; Atlanta ~-30%; San Jose ~-60%; Indianapolis ~-60%; Cincinnati ~+5%

Loan Performance. Construction loan appetite has tightened, with banks and debt funds prioritizing completion capital over new originations. Higher spreads, lower LTC, and stricter appraisals have shelved marginal projects, which mechanically accelerates the pipeline drawdown as completions burn off outstanding loans without replacement starts. Expect more extensions and re-allocations to finish in-flight deals; stalled land loans face repricing risk.

Demand Dynamics. Household formation and elevated mortgage rates keep renter demand resilient, but 2025 absorption must digest a heavy delivery cohort. Concessions remain the competitive lever in high-supply submarkets. As the pipeline collapses, the demand/supply balance should swing back by late 2026, especially in overbuilt Sun Belt nodes where new starts plunged 35–60%.

Asset Strategies. New deliveries should prioritize speed-to-stabilization over rent maximization in 2025. Legacy assets should defend occupancy with surgical pricing and targeted upgrades. Markets with the deepest start pullbacks (Austin, San Jose, Indianapolis) are candidates for 2026–27 rent re-acceleration; owners can stage capex to coincide with thinner competitive sets. Select secondary markets with slight pipeline growth (e.g., Cincinnati) warrant tighter underwriting near term.

Capital Markets. Equity is pivoting to existing product and value-add over ground-up. Developers with low basis and relationship lenders retain an edge; others face equity gaps or pause. The steep fall in future supply is a positive signal for apartment valuations into 2026–27 as investors price tighter vacancy and firmer rent trajectories into exit caps once the delivery bulge clears.

Construction bust now, supply drought next.

2025 = lease-up pressure; 2026–27 = tightening vacancy.

Sun Belt pullback is deepest, setting up sharper rebounds.

Capital prefers operate/renovate over new starts.

🛠 Operator’s Lens

Lock occupancy now; trade rate for speed on new assets through 2025. Time renovations for 2026 when new competition fades. In heavy-supply nodes, use shorter concessions and renewal incentives to bridge the next 12–18 months. In low-pipeline submarkets, prepare for measured rent pushes and reduced concessions starting late 2026.

Through 2025, national rent growth stays muted as deliveries crest. By 2026, completions drop materially, vacancy tightens, and effective rent growth re-accelerates—first in metros with the largest start collapses. If financing costs ease in 2026, starts return, but long lags mean relief arrives in 2028+, not before. Policy changes could modulate timing, but the base case is a classic cycle: oversupply → pullback → undersupply → price firming.

RealPage Market Analytics, Q2 2025 construction pipeline tables and metro breakouts.