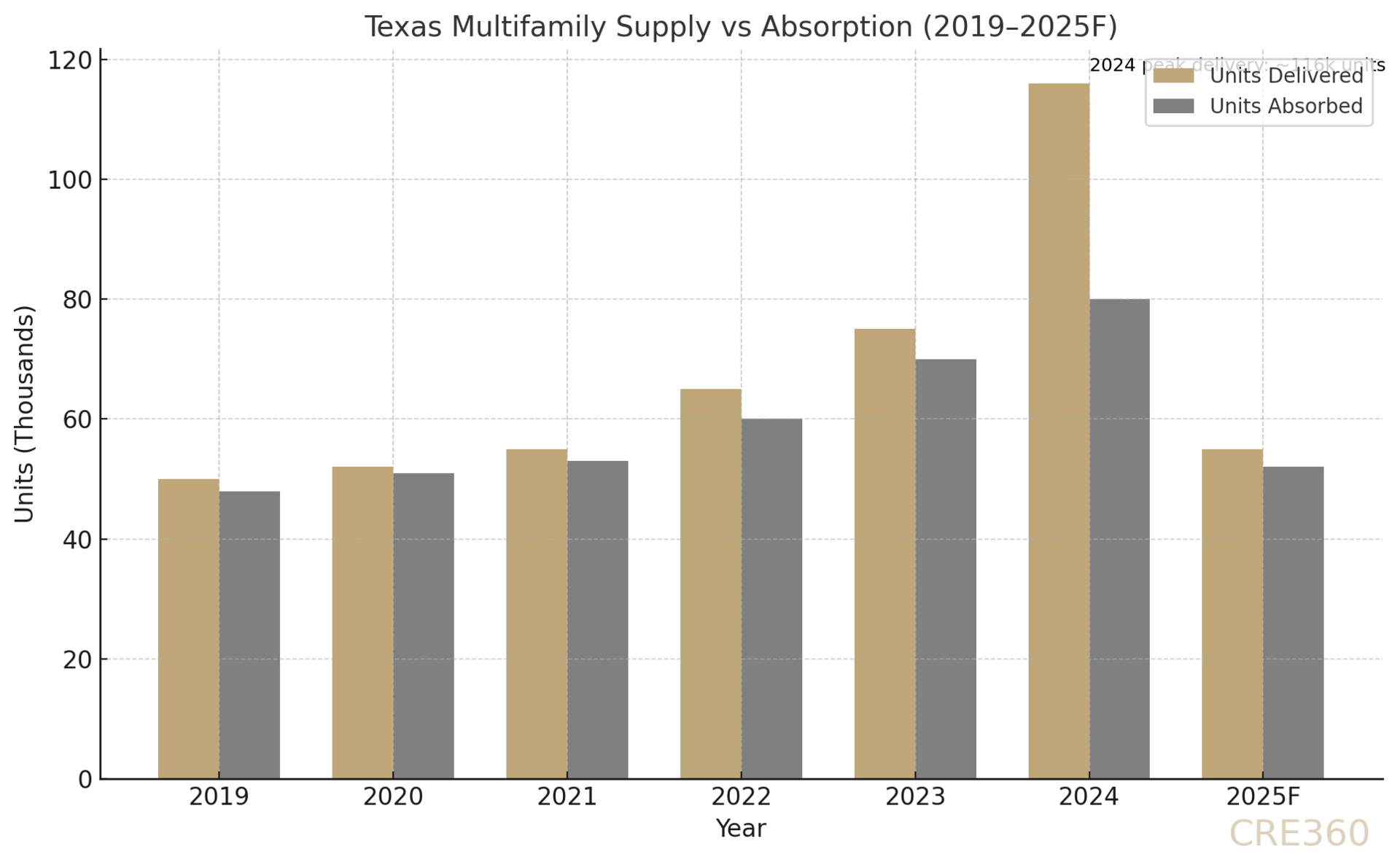

🚨Texas’ historic apartment construction surge is finally abating. After delivering over 97,000 units in 2024 — nearly double the norm — developers have pulled back hard, with 2025 deliveries projected to drop by over 50%. Meanwhile, absorption is accelerating, buoyed by robust population and job growth. Vacancies remain elevated (~10–12% in major metros), but net leasing has turned a corner, especially in Houston and Dallas, where surplus inventory could normalize within two years. With cap rates ~100 bps higher than 2022 and construction costs still elevated, well-leased assets are drawing investor attention.

2024 Apartment Deliveries: 97,000+ units statewide — [Source: Cushman & Wakefield].

Statewide Vacancy Rate: ~10–12% as of mid-2025 — [Source: Cushman & Wakefield].

2025 Rent Growth Forecast: Flat to +0.5% YoY — [Source: Texas Real Estate Research Center].

Absorption Forecast: Houston ~1.6 yrs, Austin ~2.1 yrs, Dallas ~2.3 yrs — [Source: Cushman & Wakefield].

oan Performance. Flat rents and high vacancy have stressed DSCRs on recent deliveries. Most Class-A lease-ups are absorbing slowly under 2–3 months of concessions. Refinancing near-term maturities requires NOI stabilization or cash-in resets. Insurance and tax spikes continue to weigh on coverage ratios.

Demand Dynamics. Migration and job growth remain key tailwinds. Young renters and in-migrants are filling units at discounted rates, favoring well-amenitized mid-2010s properties over new builds with premium pricing. Effective rents are still soft in Austin CBD, but suburban strength is emerging.

Asset Strategies. Operators are prioritizing retention with renewal freezes and perks. Value-add timelines are delayed: Class-B owners are focused on interior upgrades but deferring rent pushes. In-place NOI preservation is outperforming pro forma rent growth.

Capital Markets. Cap rates for Texas multifamily have expanded ~100 bps since 2022. Exit cap guidance now sits around 6.0%+. Buyers are underwriting conservatively, building in lease-up friction and higher OpEx. Equity is circling stalled lease-ups and stabilized core assets.

Rates/growth short line: Rent growth has flatlined, but absorption is healthy.

Favored assets vs rent-beta: Stabilized 2010s Class-A > new lease-ups with high concessions.

Financing stance: Refi windows narrow. Scrutiny on NOI durability, not pro forma rents.

Spreads/structure caveat: Exit cap spreads >200 bps over 10Y UST now standard.

🛠 Operator’s Lens

Refi. Expect cash-in or delayed refinances on recent deliveries. Lenders stress test flat-to-negative rent rolls.

Value-Add. Defer major pushes. Interior upgrades OK, but rent lifts wait until Class-A supply clears.

Development. Pipeline pause gives breathing room. New starts likely in late 2025 for Houston, 2026 for Austin.

Lender POV. Heavily discounting unrealized NOI. Focus is on occupancy trends and cost containment.

Next policy/data inflection: Watch Q4 vacancy prints — declining rates signal real absorption.

Market confirmation: Bulk sales of troubled assets or debt indicate capital repositioning.

Risk to thesis: If leasing velocity stalls or insurance/tax costs spike further, recovery timeline could stretch.

Cushman & Wakefield — Bigger in Texas: Multifamily Supply Trends (Oct 3, 2025). https://www.cushmanwakefield.com/en/united-states/insights/bigger-in-texas-unpacking-multifamily-supply Texas Real Estate Research Center — 2025 Texas Real Estate Forecast (Dec 2024). https://trerc.tamu.edu/article/2025-texas-real-estate-forecast/