🚨Key Highlights

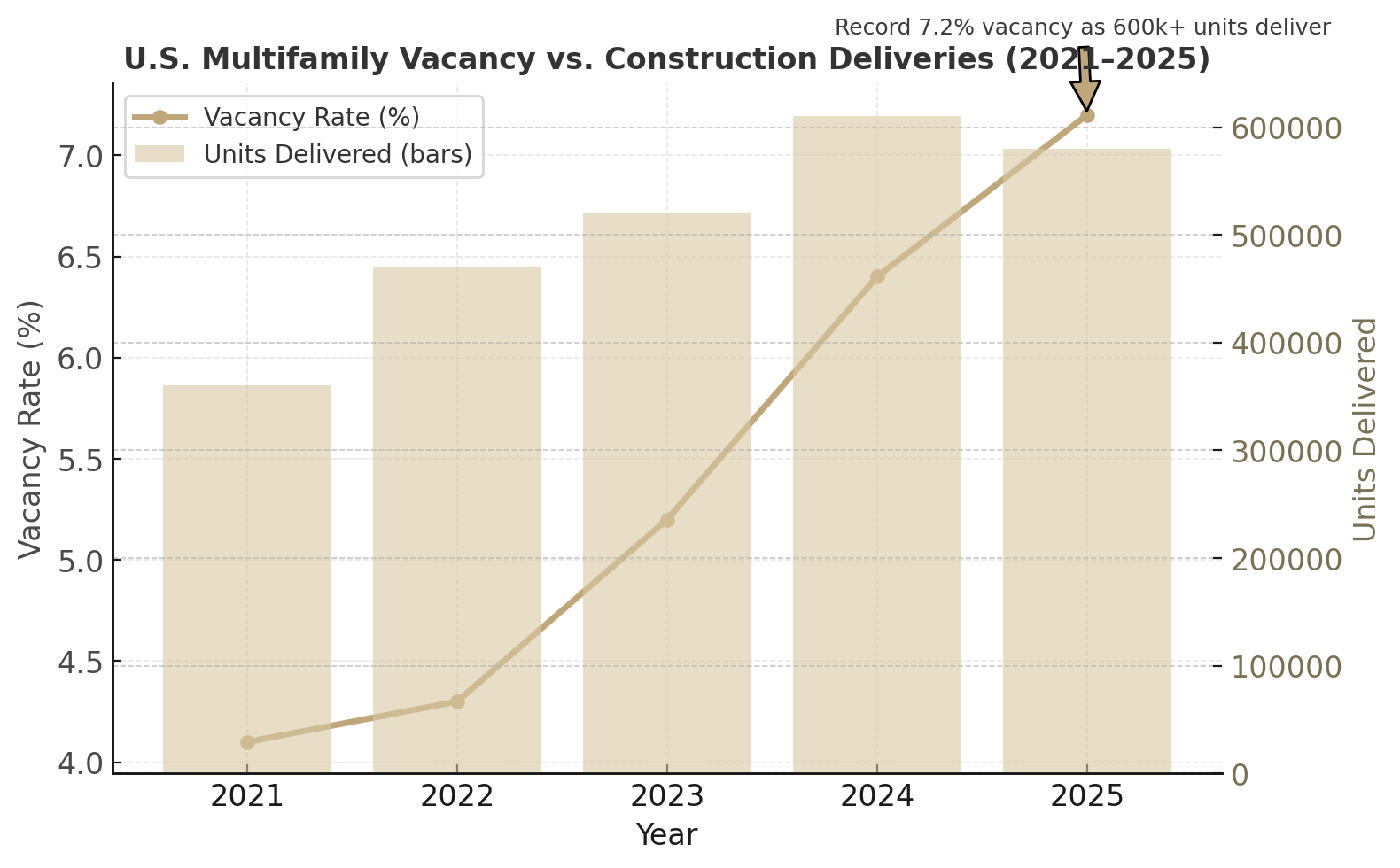

U.S. vacancy hit 7.2%, highest since tracking began in 2017.

National median rent fell 0.8% MoM and 0.9% YoY to $1,381.

Austin rents down –6.5% YoY amid record deliveries.

Midwest and Northeast metros hold vacancy below 5%, with +5% rent growth.

Cap rates have widened 50–75 bps since 2021 lows.

Signal

An unprecedented flood of new apartments is testing the limits of U.S. multifamily demand.

Vacancy climbed to 7.2% in October, the highest in Apartment List’s records, while rents slipped another 0.8%. Developers who raced to deliver 600 k units last year now face lease-up fatigue and rising concessions. “Traffic’s back, but velocity isn’t,” said one Texas operator managing mid-rise lease-ups in Austin and San Antonio. The signal: the multifamily cycle has pivoted from expansion to absorption—where operational skill, not rent growth, determines returns.

Sunbelt Strains

Across the Sunbelt, supply is overwhelming absorption. Austin’s –6.5% YoY rent drop leads the nation, joined by Phoenix, Orlando, and Dallas, each flush with new completions. Vacancy that was 4% in 2023 now exceeds 9% in some submarkets. Meanwhile, construction lenders are tightening: bank loan-to-cost ratios have compressed ~5 points, and equity cushions are rising. As a result, even stabilized assets must compete through price. In practice, Sunbelt strength has become its stress—population growth remains robust, but demand is outpaced by cranes.

Resilient Regions

By contrast, the Northeast and Midwest are stabilizers. Providence, RI posted +5.3% YoY rent growth, while markets like Cleveland and Milwaukee hold vacancies near 4.5%. Limited new construction keeps supply disciplined, preserving cash flow even as national averages slip. Investors are rotating toward these “steady-yield” metros: transaction data show deal volume up ~18% YoY in tier-two Midwest cities, a mirror image of Sunbelt retrenchment. Still, yields are thinner; the trade-off is reliability over scale.

Capital Adjusts

Capital is selective but available. Fannie and Freddie remain the backbone of liquidity—though they’ve lifted required debt-service coverage to 1.35× for high-vacancy markets. CMBS lenders price risk wider, with multifamily BBB- tranches now ~95 bps over Treasuries. Equity prefers a value-add angle: buying half-leased Class A assets at 10–15% discounts to replacement cost. On balance, cap rates have moved up 50–75 bps from 2021 lows, yet the October Fed cut is softening financing costs, reopening refinancing windows for performing assets.

Operational Reality

Owners are reverting to fundamentals. Average time-on-market has reached 33 days; free-rent offers are ubiquitous. Operators now underwrite stabilized vacancy at 7–8% nationally, 10%+ in oversupplied metros. Expense lines are under strain—insurance premiums in Florida up 12% YoY, property taxes rising 6–8% across Texas. Technology helps at the margin, but retention tactics matter more: renewal incentives, upgraded amenities, and localized marketing. As one operator put it, “Right now it’s not about rent growth—it’s about keeping heads in beds.”

Cycle Compression

The construction surge that began in 2023 is nearing its limit. Starts have fallen ~22% YoY as financing costs and lender scrutiny rise. Deliveries will peak through mid-2026 before vacancy plateaus and gradually improves. Forecasts call for national rent growth to return to 2–3% by late 2026 once absorption catches up. In turn, investors expect a wave of consolidation in 2025–26 as smaller owners capitulate and institutional buyers step in for discounted lease-ups. The rebalancing is painful but productive—a cleansing phase after years of surplus capital and perpetual growth assumptions.

Multifamily’s next 18 months will be defined by discipline. Vacancy will stay elevated through 2025 as pipeline deliveries crest, and rent growth remains flat. Markets with affordability and limited new supply (Midwest, Mid-Atlantic) will anchor portfolios. Capital markets should remain orderly—agency liquidity, moderating Treasury yields, and patient equity will prevent systemic distress. By 2026, supply tapers and demand recovers, restoring pricing power to well-located assets. The lesson for operators and investors alike: growth will return, but it will reward discipline, not momentum.

If rent growth is gone, resilience becomes the new yield.

Apartment List — National Rent Report (Oct 2025)/Wolf Street — CMBS Delinquency Data (Oct 2025)/Green Street — All-Property Price Index (Sep 2025)