🚨Rite Aid’s full operational shutdown — including the closure of its final 89 stores in October — marks the end of a 2-year wind-down that has now left over 7 million square feet of retail vacancy across the U.S. . Most of this footprint was concentrated in secondary and tertiary markets, where backfilling is proving capital intensive and slow. Landlords face 20–40% value markdowns on Rite Aid-exposed assets, and REITs like Realty Income are under pressure as rent rolls shrink. Meanwhile, CMBS servicers report DSCR on some Rite Aid–anchored centers dipping below 1.0x, triggering escalations

Total Vacated Space: 7.1M SF (cumulative closures 2023–2025) — [Source: WSJ; Bisnow].

Typical Lease Size: 9,500–14,000 SF per box — [Source: Bisnow].

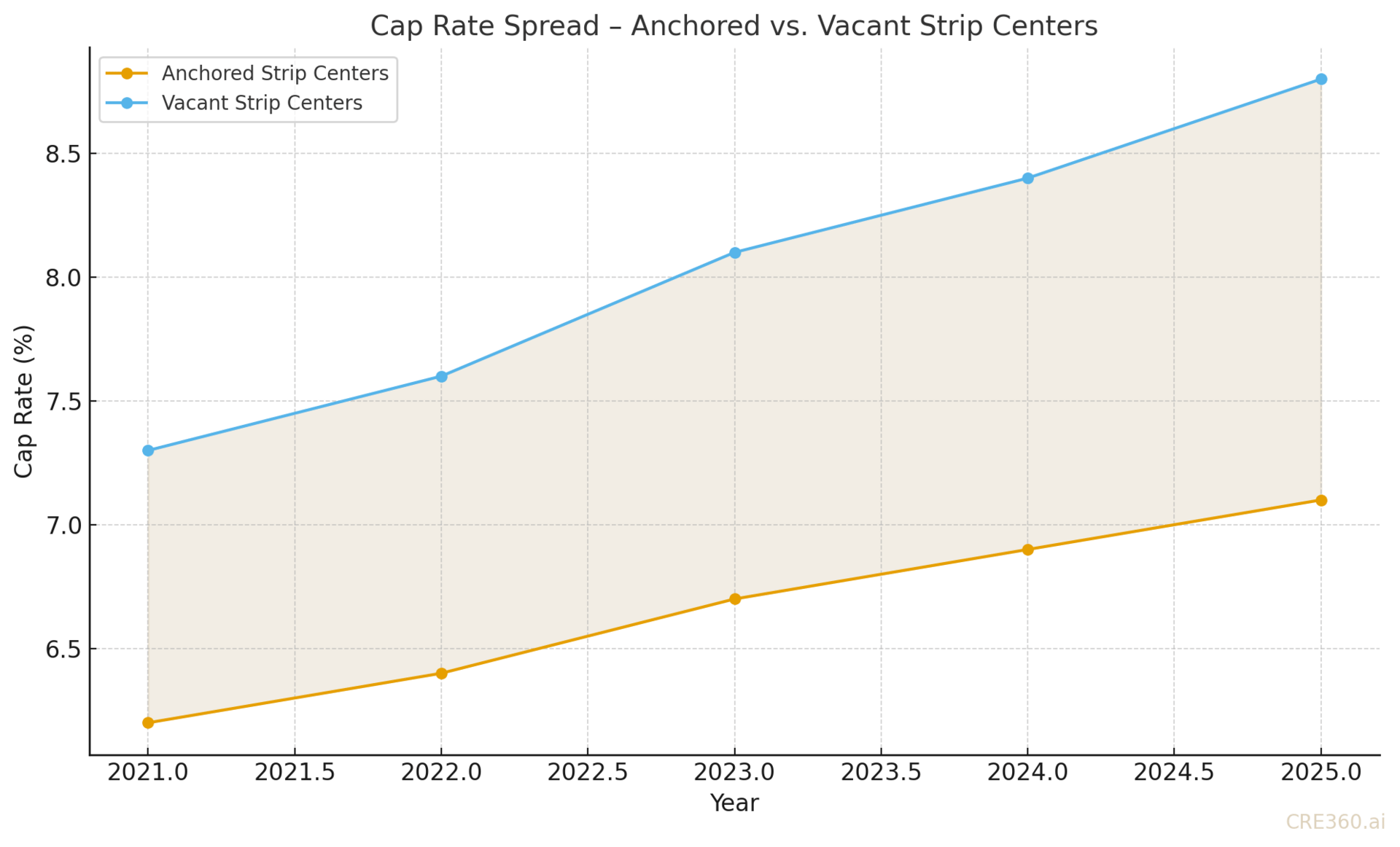

Cap Rate Spread: Anchored strips at 7.1% vs. 8.8% for vacant strips in 2025 — [Source: CBRE; Green Street].

Re-tenanting TI/LC: $35–$60/SF range depending on use — [Source: Operator Interviews].

Loan Performance. Rite Aid–anchored CMBS loans are slipping into distress as anchor exit pushes DSCR sub-1.0x. Lenders are initiating workout conversations or pursuing servicer transfers.

Demand Dynamics. Tenant interest is bifurcated: high in urban-adjacent corridors, muted in tertiary trade areas. Medical, fitness, and discount uses show the most backfill demand.

Asset Strategies. Subdivide fast; two 5K SF tenants are more viable than one 10K SF anchor. Consider urgent care + QSR hybrids. Roll concessions into 3-year TI schedules to soften NOI impact.

Capital Markets. Buyers are demanding 30–40% discounts vs. pre-COVID retail pricing. CMBS delinquency expected to rise in Q4. Equity buyers want TI escrows or seller-carried retenanting credits.

Drugstore collapse = retail distress accelerant.

High retenanting costs slash IRR for owners lacking TI reserves.

Secondary market pricing now includes Rite Aid exposure discount.

Opportunistic retail capital is mobilizing — but only in strong zip codes.

🛠 Operator’s Lens

Refi. Rite Aid exits are pushing coverage ratios below covenants — consider repositioning debt or requesting waivers.

Value-Add. Prepare $40–$60/SF TI plans; subdivide quickly to offset carry costs.

Development. New development must underwrite deep leasing risk in drugstore-anchored corridors.

Lender POV. DSCR drops and lack of credit anchors = higher spreads or refinance scrutiny. Servicers are flagging Rite Aid loans early.

Watch Q4 REIT earnings for impairment disclosures on Rite Aid–heavy portfolios.

CMBS delinquencies likely to rise in affected strip centers.

Expect distressed retail note sales in tertiary geographies.

New leasing comps will redefine market rent expectations for secondary strips.

Bisnow — “Rite Aid Closes Final Stores” (Oct 3, 2025). https://www.bisnow.com/national/news/retail/rite-aid-closes-remaining-stores-2025 WSJ — “Rite Aid Bankruptcy Coverage” (2023–2025). CBRE — U.S. Retail Strip Center Trends (2025). https://www.cbre.com/research-and-reports Trepp — CMBS Delinquency Report (Oct 2025). https://www.trepp.com/