📢 Good morning,

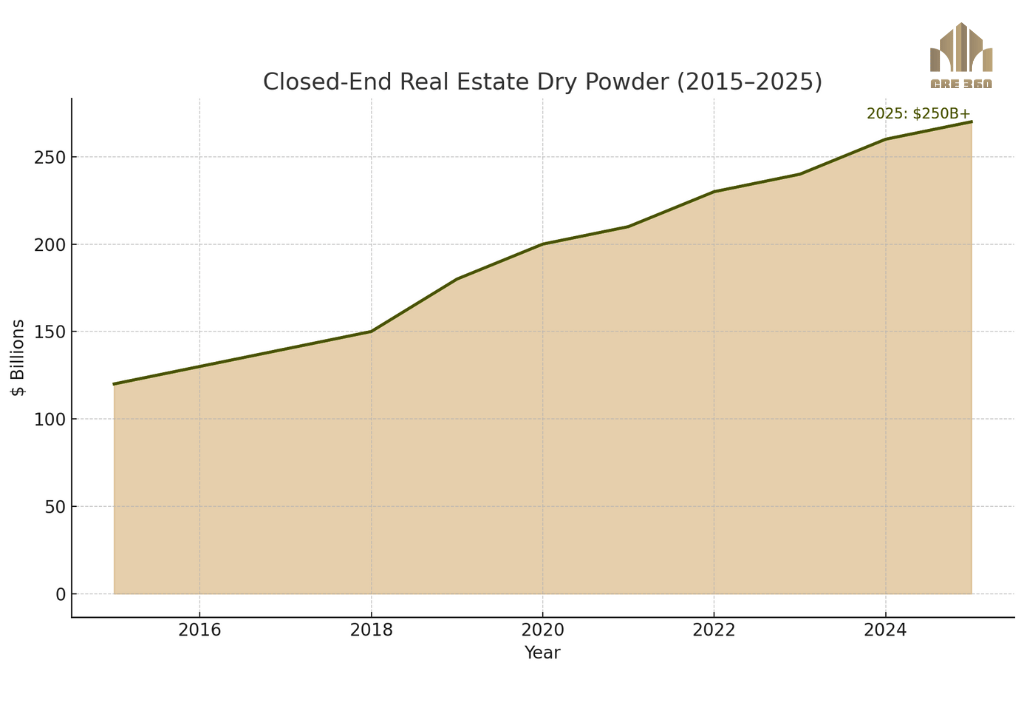

Private equity managers sit on more than $250B of dry powder for CRE, the highest since 2021, as valuations reset and lending conditions ease. After a muted 2024 fundraising year, capital has built for opportunistic, debt, and core-plus strategies. Deployment is expected to accelerate in late 2025 as price discovery improves, creating a wall of equity ready to meet the $957B 2025 loan maturity wave and selective transaction rebound.

Dry powder: ~$250–270B (Preqin Q2 2025) in closed-end real estate funds.

Fundraising: 2024 volume ~30% below 2022 peak; H1 2025 modest rebound (+9% YoY).

Target returns: Opportunistic funds underwriting IRR 15–18%; core-plus ~8–10%.

Deployment pace: 2024 vintage funds only ~22% drawn after 18 months (vs. ~35% norm).

Maturity overlap: $957B CRE debt maturing in 2025, a major target for rescue/recap capital.

Returns / Performance Trends

Investors expect distressed and value-add vintages to outperform, echoing post-GFC playbooks. With values down 15–20% from 2022 peaks, funds are penciling higher going-in yields. Opportunistic vehicles are skewing to office repositionings, residential conversions, and development recapitalizations.

Lending / Capital Conditions

Dry powder aligns with constrained bank lending: private equity is stepping into bridge gaps, rescue capital, and mezzanine tranches. Debt funds are absorbing demand banks avoid, often with coupons 10%+ all-in. Core-plus equity has edge where life co and agency lending provide senior stability.

Transaction Activity & Investor Flows

Deployment lags commitments, creating pent-up deal flow. Managers are beginning to greenlight trades in multifamily, industrial, and necessity retail, while offices remain highly selective. Expect joint ventures with lenders on extensions (cash-in recapitalizations), portfolio recaps, and platform deals.

Broader Implications

Capital concentration suggests coming velocity: if bid-ask spreads narrow further, 2026 could see a deployment surge. Funds with 2022–23 capital that waited are positioned to buy at reset values. Risk is concentration: too much money chasing finite high-quality distress could compress returns.

$250B+ dry powder = largest since 2021; waiting for clearer pricing.

Fundraising modest in 2024 (–30% vs. 2022) but rebounding in 2025.

Target IRRs 15–18% opportunistic, 8–10% core-plus → higher than prior cycle.

Deployment only ~22% drawn → pent-up capital flow likely in 2025–26.

Maturity wall $957B → rescue and recap equity directly aligned with needs.

Institutional Lens: Align with capital managers now; co-GP or JV slots scarce once deployment accelerates. Position assets as recap-ready with fresh valuations and credible NOI stories. Opportunistic funds favor clean execution, clear paths to stabilization, and governance rights.

Operator’s Lens: If refinancing is tough, approach PE funds proactively; many seek structured equity injections. Bring updated appraisals and credible lease-up plans to make a quick “yes.” On acquisitions, expect more competition by 2026—act now on mispriced deals before dry powder floods in.

Late 2025–26: Wave of deployments as pricing stabilizes and Fed cuts lower debt costs.

Office conversions: Top opportunity set, especially under state incentives (TX, CA).

Fundraising trend: Expect 2025 full-year to surpass 2024 by 15–20%.

Competition risk: Capital abundance could compress yields faster than fundamentals if deployment surges.