🚨Key Highlights

Wells Fargo’s CRE portfolio –8% YoY; U.S. Bank –5% — banks retreat.

Debt-fund share of new loans rose to 14% (+400 bps YoY).

10-year Treasury ≈ 4.1%, down 30 bps month-on-month.

Blackstone sold $30 B in Q3, holding $188 B dry powder.

CRE CLO issuance +234% YoY to $22.7 B.

CMBS BBB- spreads steady near +475 bps.

Signal

The Federal Reserve’s October 25 bp cut to 3.75–4.00% was supposed to ease borrowing costs; instead it unleashed private credit. As banks trimmed CRE exposure — Wells Fargo down 8% YoY — debt funds and insurers filled the void with 7–9% loans. The result is a structural re-wiring of real-estate finance: capital is flowing not from banks, but from funds engineered to price risk faster. In this new credit hierarchy, liquidity is abundant but discipline decides its price.

Banks Pull Back, Funds Step Up

Big banks spent Q3 shrinking their loan books. Wells Fargo’s CRE outstandings fell 8%, U.S. Bank’s 5%. Even those still active demand shorter terms and recourse. Meanwhile, debt funds now capture 14% of new CRE loans — their highest share on record. “Too many lenders chasing too few deals,” said Bank OZK’s CEO, whose own payoffs outpaced originations 3:1. In turn, borrowers enjoy tighter spreads and higher leverage for institutional-grade projects, though unregulated lenders mean wider underwriting dispersion. The shift is systemic: CRE credit now flows through fund structures, not deposit takers.

Fed Stance: Stability Over Stimulus

The policy rate’s midpoint (3.9%) sits near neutral. Chair Powell signaled “data dependence,” and markets tempered bets — only 60–70% odds of one more cut by January. Core inflation ≈ 3%, unemployment ≈ 4.3%, and balance-sheet runoff is ending. That combination anchors the 10-year yield around 4.0–4.3%. For CRE finance, a flat curve is a feature, not a bug: pricing certainty outweighs the dream of cheaper debt. On balance, stable rates may spark more transactions than further cuts would.

Institutional Capital Repositions

Liquidity is not idle. Blackstone sold $30 B of assets in Q3 and holds $188 B in deployable cash. Ares and partners are taking Plymouth Industrial REIT private for $2.1 B ( +50% premium ), a vote of confidence in warehouse values. Sovereign funds are tilting back to U.S. real estate after a pause. In practice, these moves mirror a 2006-style REIT privatization wave as public valuations trail NAV by 15–20%. Capital is rotating — out of bonds as yields ease, into hard assets and private credit. Discipline is the new beta.

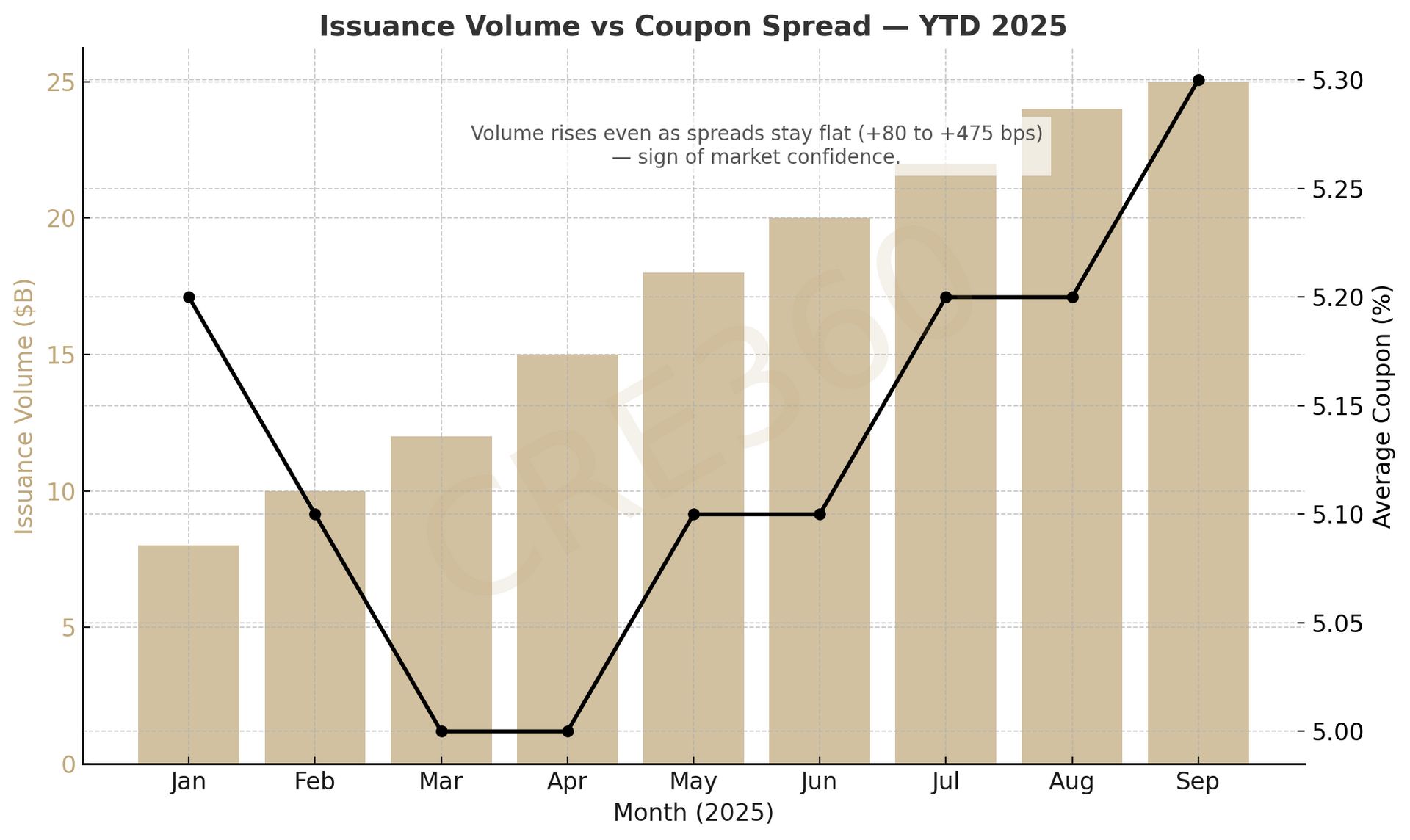

Structured Debt Finds Its Range

CMBS issuance reached $91.4 B YTD (+26% YoY); Agency CMBS $105.7 B (+39%). CRE CLO volume soared 234% to $22.7 B. Conduit AAA spreads (~+80 bps) and BBB- (~+475 bps) are steady, signaling risk is priced, not feared. Delinquencies eased to 8.59%; office stress persists but retail and lodging improve. Ultimately, bond investors accept 6% coupons for stability — a trade-off CRE borrowers can live with. Liquidity is back, but selective.

Borrowers face a two-track market: tight bank credit alongside agile private money. Those who blend sources — life co senior loans, mezz from funds, agency debt for multifamily — will outpace those relying on legacy bank lines. Underwrite for flat rates and modest rent growth; assume refis near today’s levels. Fixed-rate 6% loans now outshine floating SOFR + 300 bps. In practice, credit discipline and sponsor liquidity are the new collateral. Rate volatility may have peaked — risk management has not.

Capital is plentiful again — but prudence, not policy, now prices the cycle.

CREFC (Oct 2025); Credaily Q3 Capital Markets Report; Reuters Fed Survey (Oct 2025)