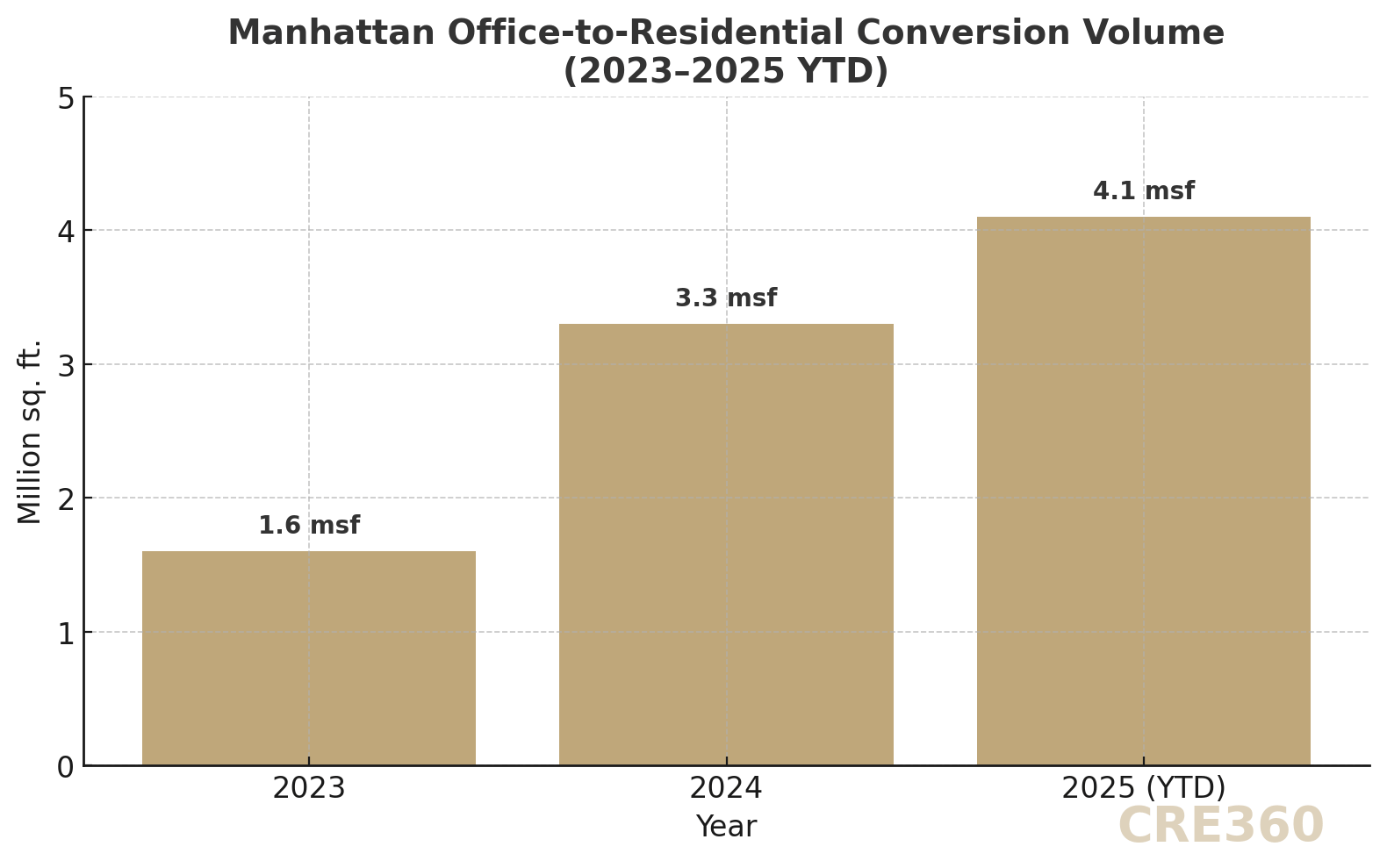

🚨Manhattan developers are converting 4.1 million sq. ft. of offices into housing in 2025, the fastest pace since 2008. More than 25 additional projects totaling 8.8 msf are in the pipeline, potentially delivering thousands of new apartments. Policy incentives (notably the 467-m abatement) and persistent office vacancies (~22.6%) are accelerating conversions. For CRE capital, this trend reshapes underwriting: obsolete offices are increasingly valued on residential reuse potential, shifting lender and equity focus toward adaptive reuse strategies.

4.1 msf Manhattan offices under conversion in 2025 — record since 2008.

8.8 msf of office-to-housing projects proposed across Manhattan

Vacancy impact: Manhattan 22.6% → 21.8% if all projects complete. Downtown 22.8%

Loan Performance. Conversions reposition underperforming office loans into multifamily development risk. DSCR resets on new NOI, but lenders view residential cash flows as more resilient than weak office leases.

Demand Dynamics. Manhattan housing demand provides a natural absorber. Midtown South and Downtown units remain competitive, though lease-up may stretch 2–3 years. Early concessions likely.

Asset Strategies. Owners must triage: hold Class A core, convert obsolete B/C, or exit. Costs of $200–$300+/sf require disciplined contingency planning.

Capital Markets. Construction and debt funds are active, underwriting conversion plays at discounted office bases. Tax incentives materially improve IRR. CMBS less relevant; bespoke construction loans dominate.

Office vacancies force adaptive reuse as a pressure release.

Apartments offer a safer cash-flow horizon than offices.

Financing exists, but execution costs are steep.

Incentives swing feasibility; without them, only top sites pencil.

🛠 Operator’s Lens

Refi. Refinance obsolete offices only if tied to conversion plans; pure office refis remain strained.

Value-Add. Conversion is the new value-add; capex should assume 15–20% contingency.

Development. Treat conversions as ground-up: entitlement, zoning, lease-up. Adjust pro formas for 24–36 month stabilization.

Lender POV. Debt funds lean in; banks selective. Pricing reflects residential end-value, not office NOI.

2026 will likely see an even larger pipeline if Albany expands conversion incentives.

Execution risk (financing, costs, permitting) will filter winners from overstretched entrants.

Market watchers will benchmark values of “brown” office assets increasingly on conversion feasibility, widening the gap to true Class A.

Cushman & Wakefield — Office-to-Residential Conversion Report (2025). Multi-Housing News — 25 Water Street Conversion Completion (2025). 6sqft — NYC Conversion Incentives History (2025). Financial Times — NYC Office Conversions Surge to 17-Year High Amid Housing