➤ Key Highlights

EQT sold a 25 property, 8.7M SF logistics platform across 13 U.S. markets described as 2025’s largest industrial trade.

Assets were modern, post-2000 logistics facilities in supply constrained metros (Atlanta, Chicago, NY/NJ, Phoenix, Texas).

Transaction confirms deep liquidity for stabilized logistics portfolios even in a high rate environment.

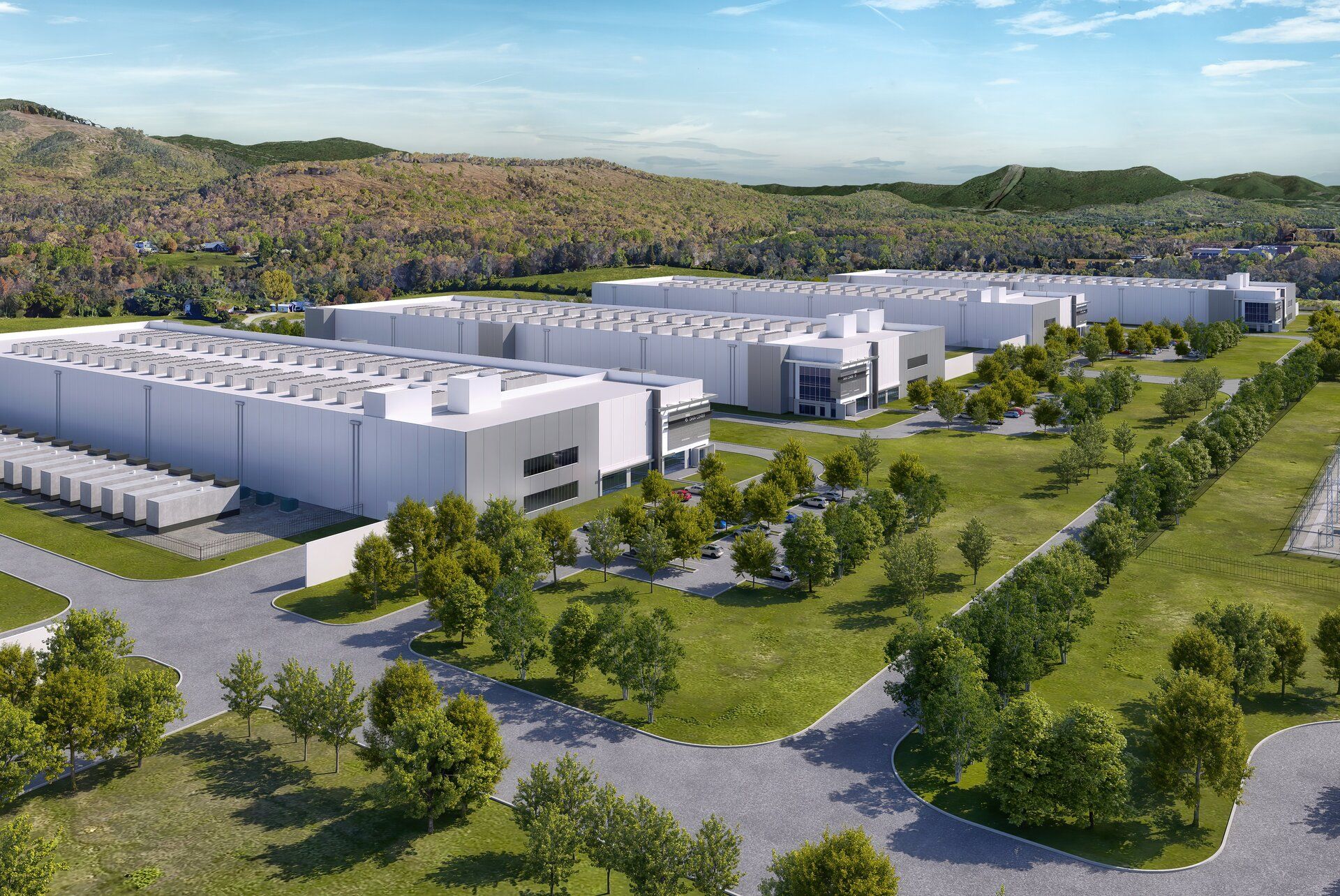

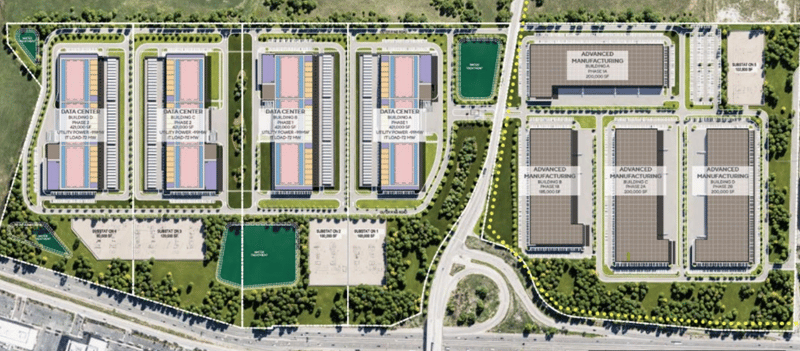

Meanwhile, Prologis’ Project Sail (600MW, 4.9M SF hyperscale campus in Georgia) faces organized community pushback.

Concerns center on water use (up to 6M gallons/day), power grid load, and changing rural character.

County officials have delayed zoning decisions, signaling rising regulatory friction for hyperscale development.

EQT’s logistics platform sale shows institutional capital still clears quickly when an asset class is standardized, de-risked, and distribution oriented. In contrast, Prologis’ Project Sail demonstrates that hyperscale data-center development is colliding with infrastructure limitations and community resistance. The divergence reflects a structural split: logistics trades like infrastructure, while data centers increasingly behave like contested utilities.

Capital allocators may continue to favor logistics for predictable absorption and clean underwriting, but data center development is no longer a simple “growth story.” Power availability, water rights, and local sentiment now sit at the center of feasibility meaning underwriting hyperscale assets requires regulatory and infrastructure analysis equal to financial analysis. The risk premium for compute scale developments is quietly rising.

⚠️ Why it matters now

Expect more logistics portfolio trades as institutional owners rebalance and unwind multi-market platforms. For data centers, expect slower approvals, heavier conditions, and escalating public hearings especially in rural counties that lack infrastructure tolerance. Power heavy sites will see NIMBY to political escalation over the next 12_24 months.

Stop Reading Headlines

Start Understanding the Market

➤ TAKEAWAY

Liquidity flows to clarity. Friction follows scale.

Logistics stays liquid because everyone understands demand, cost, and risk.

Hyperscale data centers are shifting from “growth darling” to “infrastructure liability.”

For investors and developers, the edge now comes from reading infrastructure constraints before reading the pro forma.