📢 Good morning,

Nomura Holdings has relaunched its U.S. commercial real estate lending arm, recruiting a top CMBS team from Barclays. After nearly three decades away, the Japanese bank is stepping into a market defined by distress and refinancing shortfalls, betting on disciplined lending around high-quality assets.

$58.8B CMBS issuance in H1 2025, busiest first half since GFC (Bisnow)

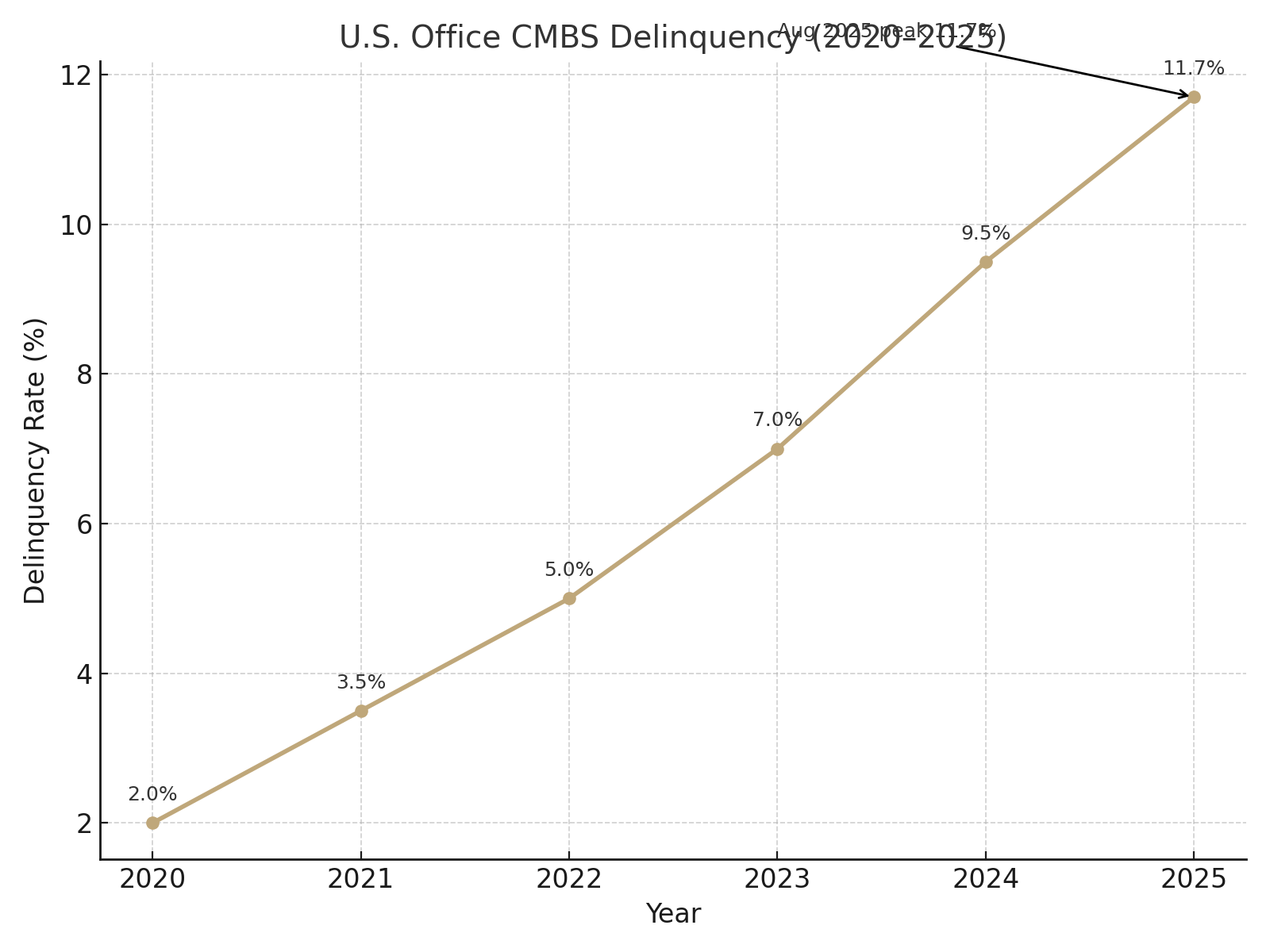

Office CMBS delinquency hit 11.7% in Aug 2025, record high (Trepp)

$23B+ of CRE loans matured in 2025 without payoff (Bisnow)

Barclays team Nomura hired originated ~$8B CMBS in 2024 (~7.6% market share) (Commercial Observer)

Loan Performance

Defaults in office loans have peaked at unprecedented levels, forcing lenders to tighten underwriting. Nomura’s strategy reflects this: leverage caps at 50–60% of today’s values and DSCR floors above 1.5x mean loans can withstand NOI shocks. Cash sweep and recourse triggers will add downside protection, insulating Nomura from the failures currently driving delinquency rates.

Demand Dynamics

Borrowers face a refinancing cliff, with over $23B of loans already past maturity without repayment in 2025. While regional banks have stepped back, demand for refinancing on high-quality assets remains intense. Nomura’s arrival supplies fresh capital for stabilized trophy assets, but owners of transitional or secondary properties will remain starved of options, accelerating bifurcation across CRE.

Asset Strategies

Nomura will prioritize SASB securitizations on core assets: high-occupancy, prime-location offices, multifamily, and retail centers. These loans are structured conservatively, with strict requirements for hedging floating-rate debt and explicit exit strategies. That discipline narrows eligible deal flow but ensures the bank avoids the pitfalls of value-inflated lending seen earlier in the cycle.

Capital Markets

The move underscores how global players are stepping in as U.S. lenders retreat. With BoJ policy keeping rates near zero, Japanese banks can achieve higher yields abroad. Nomura’s timing aligns with surging CMBS issuance in prime SASB deals even as conduits remain thin. If executed well, the re-entry could shift pricing benchmarks, forcing domestic lenders and debt funds to sharpen terms for top assets.

Global capital is filling the void as U.S. banks pull back.

Nomura’s discipline: low leverage, high DSCR, and hedging mandates.

Focus on Class A, SASB deals; weaker assets remain stranded.

First transactions by Q4 will set market perception of Nomura’s platform.

🛠 Operator’s Lens

Landlords with stabilized Class A properties should prepare full data rooms and expect granular diligence. Nomura’s underwriting team will test NOI and capex assumptions rigorously.

Borrowers can use Nomura’s presence to create competition in refinancing bids, but only if their collateral is trophy-quality and fully hedged against interest rate volatility.

Nomura is expected to announce its first SASB CMBS or warehouse deal by Q4, likely on a marquee office or multifamily property. Pricing and structure of that transaction will signal how aggressively the bank intends to compete.

If Nomura executes successfully, other global lenders could follow, injecting selective liquidity back into CRE debt markets. However, this inflow will benefit only the best collateral. Class B/C owners may see conditions worsen as capital bypasses their assets, potentially triggering higher defaults and distressed sales in 2026.

Macro risks remain: renewed Fed tightening or a U.S. downturn could test Nomura’s conservative underwriting. Yet their re-entry demonstrates a contrarian bet that CRE credit has reached a turning point, with disciplined capital poised to capture outsized spreads.

Bloomberg, Commercial Observer, Bisnow, AInvest, Reuters, Trepp

Chart 1: U.S. CMBS Issuance H1 Totals (2019–2025)

Chart 2: U.S. Office CMBS Delinquency (%)