🚨Key Highlights

Average institutional target CRE allocation slipped 10 bps YoY to 10.7%, the first dip since 2013.

Actual allocations lag targets by 9.8 percentage points, the widest gap in a decade.

64% of investors now rate CRE ≥ 6 / 10 for risk-adjusted opportunity.

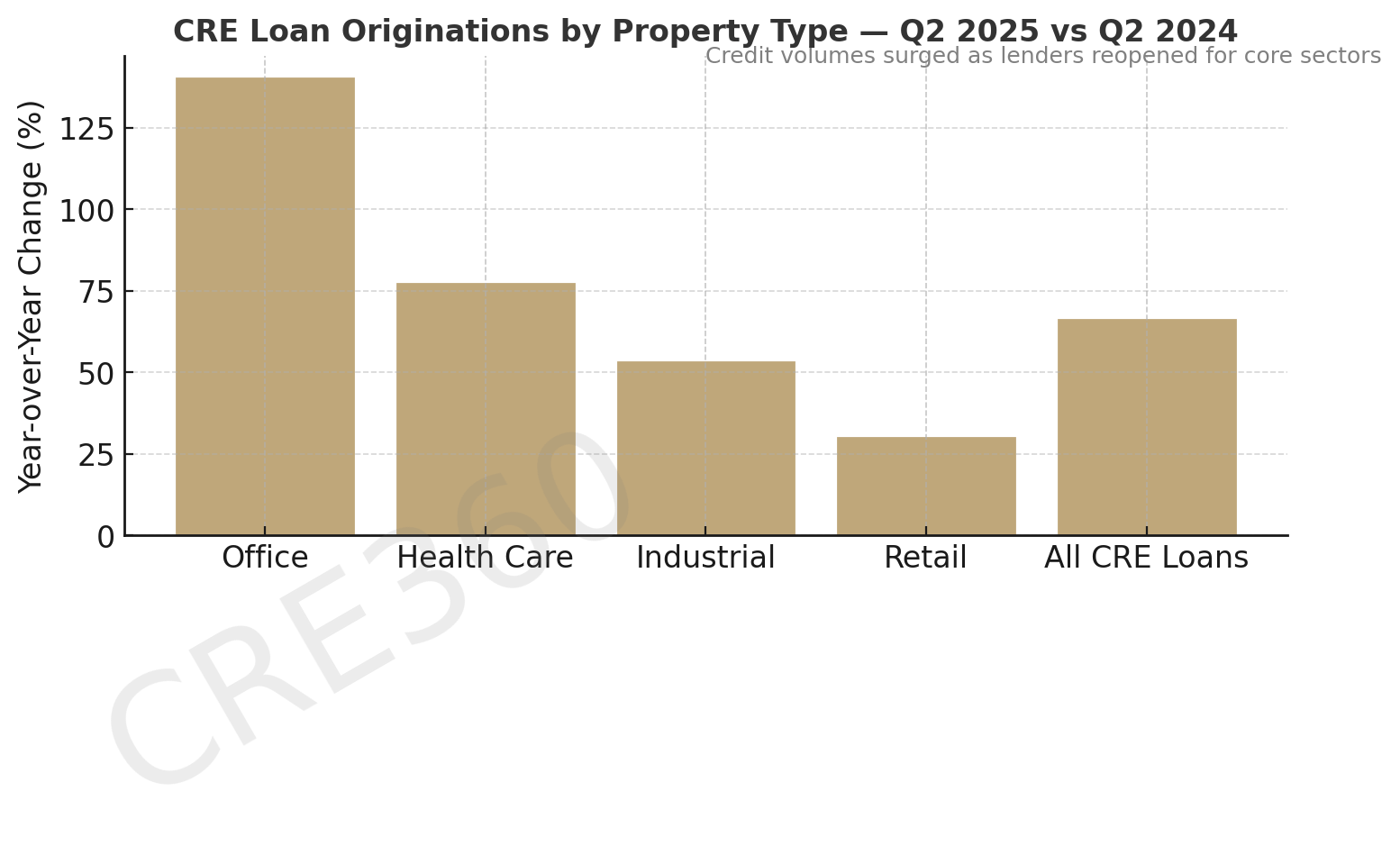

CRE loan originations +66% YoY in Q2 2025 show credit reopening.

Only ~9% of banks were tightening CRE credit by mid-2025, down from 67% in 2023.

Signal

After nearly two years on the sidelines, global institutions are preparing to return to commercial real estate. The latest Hodes Weill Investor Intentions Monitor shows allocations falling short of targets by 9.8 percentage points—the largest under-exposure since the global financial crisis. With the Federal Reserve beginning to ease and pricing stability emerging, pensions and insurers are re-activating teams to close their gaps. Capital is not rushing in; it’s lining up for disciplined entry.

Dry Powder Meets Discipline

Institutional portfolios under-allocated by nearly 1 percentage point of AUM represent hundreds of billions in deployable equity. At the same time, short-term returns have lagged—only 0.3% in 2024 for Americas accounts versus ~9% targets—prompting trustees to rebalance. For now, most are sticking to core and core-plus strategies in prime markets, but survey responses show a renewed appetite for value-add and select development. In practice, allocators want “bond-like” real estate that anchors portfolio volatility.

Credit Thaw and Rate Relief

Lending conditions confirm the shift. According to Deloitte and Federal Reserve data, only ~9% of banks were still tightening CRE credit by mid-2025—down from 67% in early 2023. MBA data show CRE loan originations up 66% year-over-year in Q2 2025, led by office (+140%) and industrial (+53%). Meanwhile, the 10-year Treasury hovering near 3.9% and spreads 20–30 bps tighter than 2023 signal capital costs are finally normalizing. This has restored deal flow confidence—life companies and debt funds are actively quoting again.

Underwriting Under a New Order

Institutions are returning with guardrails. Leverage caps of 50–60% LTV and target debt yields above 9% are becoming standard. Managers must now prove durability through sensitivity scenarios—showing how returns hold if rates stay higher for longer. ESG criteria have moved from optional to mandatory, with allocators budgeting $1–2/SF for energy and resilience capex. Core buyers want conservative exit assumptions—at least +50 bps over entry for five-year holds—to guard against illiquidity. The discipline is institutional, not defensive.

Contrarian Capital Awakens

Even within a core-centric mood, contrarian capital is emerging. Distress-focused vehicles like Milestone’s $1.1 billion apartment fund are raising dry powder to buy notes or recapitalize projects facing maturity walls. A few sovereign and pension allocators are testing the water through programmatic JVs with operators who proved asset-management discipline through the downturn. Nonetheless, the capital curve favors stability over speed—deals that clear today’s tighter hurdles can secure funding.

Institutional Execution

Owners with stabilized core assets are preparing sale processes for early 2026, anticipating more bidders and better pricing. Buyers are running forensic-level diligence—tenant credit, climate risk, and refinance path matter as much as yield. For operators raising equity, the message is clear: capital is coming back to quality, not to optimism. That means conservative business plans, fixed-rate hedging, and co-investment to signal alignment.

CRE capital markets are entering a re-engagement phase. Transaction volumes could rise 15–20% in 2026 as rates ease and liquidity returns. Industrial and multifamily are poised to lead, while prime office assets trade from distress. If the Fed cuts toward 3% by mid-2026, banks may resume construction lending and CMBS spreads tighten further. Should returns normalize, institutions may lift target allocations above 11% by 2027—re-pricing core cap rates 25–50 bps lower. The window to buy before that compression is narrowing.

Stability isn’t hesitation—it’s capital learning to trust discipline again.

ConnectCRE (Oct 27 2025); Hodes Weill Investor Intentions Monitor (2025); Urban Land Institute / MBA Loan Data (Q2 2025); Deloitte / FRB Senior Loan Officer Survey (2025).