🚨Key Highlights

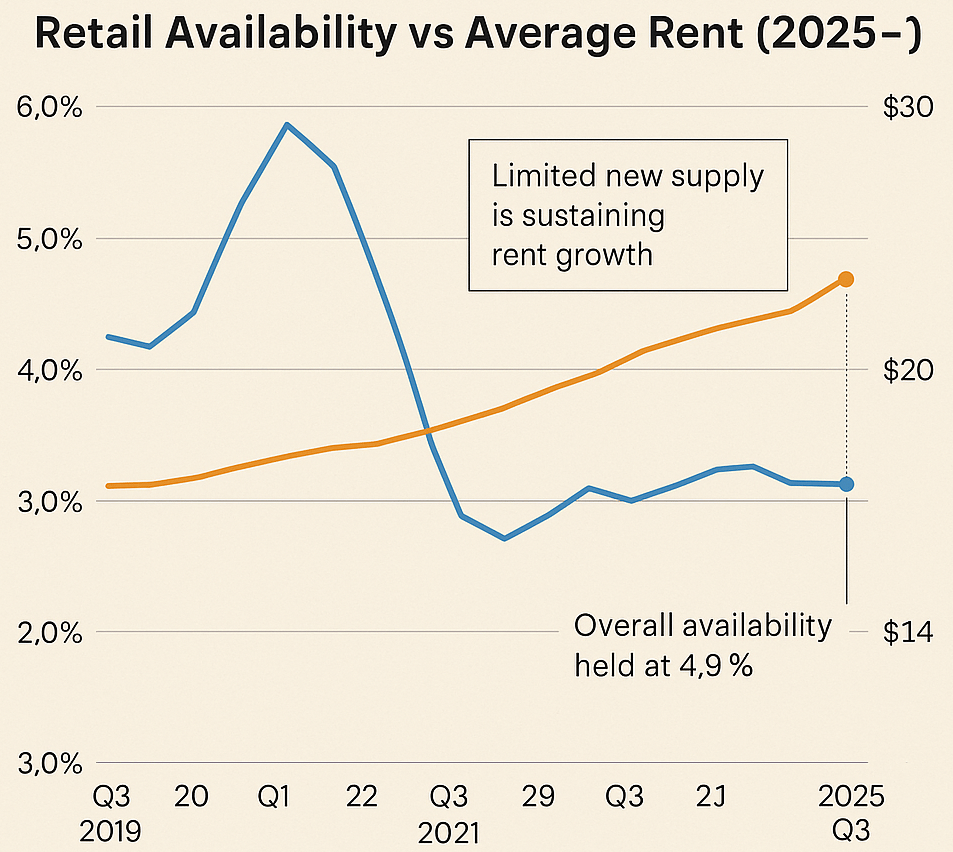

U.S. retail availability steady at 4.9 % in Q3 2025; Houston at 5.6 %.

Net absorption turned positive: +1.8 MSF nationwide, +0.65 MSF YTD in Houston.

Average Houston asking rent $25.01/SF, up ~2 % YoY.

New retail deliveries total just 13.8 MSF U.S.-wide, 1.2 MSF in Houston.

Grocery-anchored and discount chains drive leasing; discretionary retail soft.

Signal

After a shaky first half, Houston retail proved the quiet outperformer of Q3. Availability remained near record lows at 5.6 %, while national vacancy froze at 4.9 %. A rebound in absorption—+0.32 MSF locally—showed that expanding grocers and discount formats are replacing 2025’s chain closures. This balance of modest demand and constrained supply signals a stabilized retail base for the metro’s landlords and lenders alike.

Disciplined Pipeline, Disciplined Pricing

Only 13.8 MSF of new space delivered across the U.S. year-to-date, a fraction of pre-pandemic cycles. Houston’s 1.2 MSF under construction underscores a capital discipline born of cost inflation and format caution. Limited new product keeps rents buoyant: Class A centers posted mid-single-digit gains, offsetting flatness in legacy strips. In practice, scarcity, not exuberance, is driving pricing.

Essential Anchors Lead the Cycle

Grocers, fitness operators, and discount retailers account for most recent leases. Their expansion has backfilled boxes left dark earlier in 2025. The tenant mix is tilting service-heavy—urgent care, gyms, family entertainment—creating internet-resilient occupancy but higher TI outlays. For landlords, this rotation stabilizes cash flow even as it reshapes center operations. Retail’s survival strategy is diversity, not density.

Capital Confidence Returns—Selectively

Cap rates for Houston’s best grocery-anchored centers hover near 6.0–6.5 %, about 200 bps above multifamily but now compressing. Local banks and CMBS desks are quoting 6.25–6.75 % loans at ~60 % LTV, signaling renewed credit confidence. Investors remain bifurcated: necessity retail attracts bids; mall assets languish. Still, a 7 % cap sale of a grocery-anchored portfolio in Q3 suggests value-add capital is re-entering Texas retail.

Consumers Slow, Operators Adapt

Inflation and tariff effects—furnishings and electronics CPI +5 % since March—are eroding discretionary sales. Yet Houston’s energy-anchored economy cushions the blow. Operators are trimming lease terms to five years, granting limited concessions, and emphasizing tenant curation. As one center manager noted, “It’s less about filling space, more about creating rhythm—morning gyms, lunch traffic, evening dining.” Human adaptability is the new leasing metric.

Macro Lens: Underbuilding as a Safety Net

Unlike earlier cycles, the sector enters this slowdown underbuilt. With supply throttled and omnichannel models maturing, brick-and-mortar retail functions as infrastructure for logistics and community engagement alike. This structural undersupply blunts recession risk: even if consumption dips, vacancy shouldn’t surge. Investors who once avoided retail now see yield with insulation.

Retail fundamentals appear set for “steady-state” performance—vacancy around 5–6 %, rent growth near 2 % annually. Discount and fast-casual chains will anchor modest expansion, while digitally native brands pilot physical stores. Redevelopment of obsolete malls into mixed-use assets will accelerate, particularly across Houston’s suburban belts. If policy easing continues and rates drift lower, expect transaction volumes to rise and top-tier retail cap rates to compress another 25–50 bps. The market’s risk now lies less in space oversupply than in consumer endurance.

Stability isn’t stagnation—it’s scarcity, priced with discipline.

CBRE — U.S. Retail Figures (Q3 2025)/ Cushman & Wakefield — Retail Market Data (Oct 2025)