🚨Key Highlights

$123 million in creditor claims; Chapter 11 converted to Chapter 7 within weeks.

~400 NYC hotel rooms offline temporarily after operator defaults on leases.

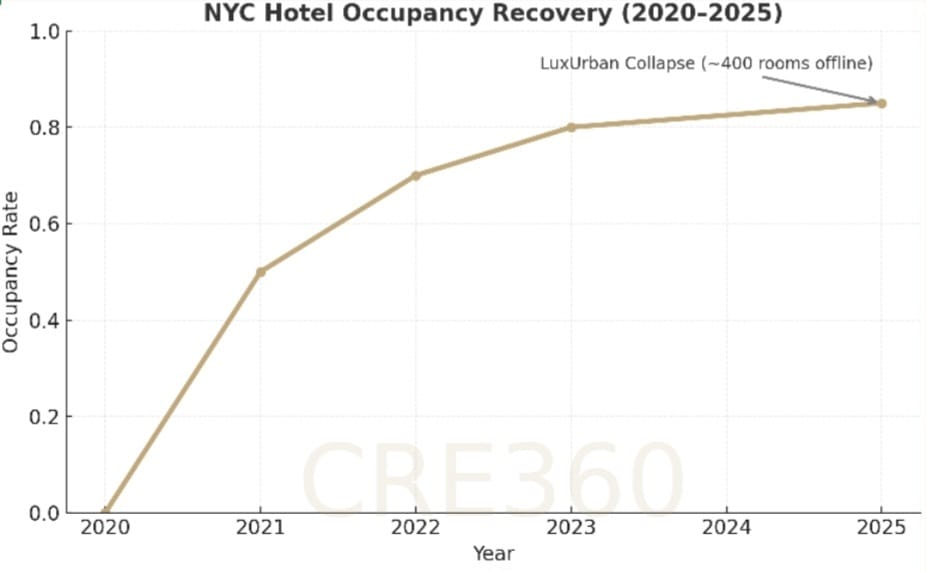

Occupancy citywide remains strong at ~85% — a post-pandemic high.

Landlords move swiftly to re-tenant assets; minimal systemic impact.

Case underscores counterparty risk of “asset-light” master-lease structures.

Signal

A New York bankruptcy court has forced LuxUrban Hotels into Chapter 7 liquidation, ending its brief experiment as a tech-driven “asset-light” hotel operator.

The company’s model — leasing hotels wholesale, rebranding them, and marketing stays online — collapsed under unpaid rents, stranded guests, and $123 million in claims.

For owners, lenders, and credit desks, the implosion is a vivid warning: a fixed-rent master lease is only as strong as the lessee’s balance sheet.

Collapse of a Model

LuxUrban promised predictable income to landlords and “frictionless” urban stays to guests. Instead, the platform became a liability pipeline. Within 18 months, more than a dozen leased hotels stopped paying rent. Court records cite “gross negligence,” and bookings continued even as properties shuttered.

Meanwhile, lenders and landlords lost months of income — proof that lease-arbitrage hospitality can unravel faster than rent cycles adjust.

By contrast, NYC hotel occupancy sits near 85%, the highest since 2019, showing sector strength even as one operator implodes.

Counterparty Risk Re-Rated

For capital allocators, LuxUrban’s demise recalibrates underwriting. Master leases once viewed as credit substitutes now look like contingent risk.

Underwriting guidance is shifting: treat lease income from unrated operators at 75–80% credit value, require 6–12 months of rent reserves, and stress-test yields on direct-operation basis.

In practice, landlords who insisted on strong guarantees or recapture clauses are already re-tenanting. Those who didn’t are navigating legal purgatory — a costly reminder that rent certainty can mask covenant fragility.

Operational Fallout

Roughly 300–400 rooms across Herald Square and NoMad went dark as LuxUrban folded. Yet the damage is localized, not systemic.

New operators are negotiating takeovers, and one hotel has reopened under interim management. The trustee’s fast liquidation freed landlords to re-lease without protracted Chapter 11 delays — rare speed that may define future hospitality workouts.

Nonetheless, reputational scars linger: guests arriving to locked doors became a public-safety headline, prompting regulators to tighten oversight of hybrid hotel-rental models.

Capital and Credibility

The episode highlights a paradox in the post-COVID hospitality rebound.

Capital is abundant and performance metrics robust — RevPAR near 2019 levels, financing selectively available — yet credibility, not cash, is the scarcest commodity.

LuxUrban’s SPAC-era exuberance, thin reserves, and disregard for guest welfare converted innovation into contagion risk.

Investors now prize balance-sheet strength over branding novelty; “asset-light” has become a red flag unless paired with institutional sponsorship.

Policy and Precedent

Regulators’ swift conversion of Chapter 11 to Chapter 7 sets precedent. When consumer harm is imminent, the window for reorganization closes.

Expect closer scrutiny of Airbnb-adjacent hotel operators, stricter licensing, and possible financial-fitness tests for lease-based models.

That oversight, while burdensome for startups, protects landlords and guests alike — and effectively restores confidence in the mainstream hotel ecosystem.

By Q1 2026, most former LuxUrban assets should reopen under recognized flags. Occupancy momentum and tourism demand will absorb the disruption.

The real legacy will be contractual: fewer unconditional master leases, more owner oversight, and wider adoption of lockbox structures ensuring rent flows first to owners and staff.

Private lenders and REITs alike are likely to demand transparency clauses, treating operator solvency as integral to asset quality. In the next cycle, innovation will need capitalization to match ambition.

Discipline, not design, defines durability — in hospitality, trust is the truest asset.

Bisnow — “LuxUrban Extended-Stay Hotel Startup Collapses; Chapter 7 Liquidation on $123M Debt” STR — New York City Hotel Occupancy Data. U.S. Bankruptcy Court (S.D.N.Y.) filings, Case No. 25-23491 .