📢 Good morning,

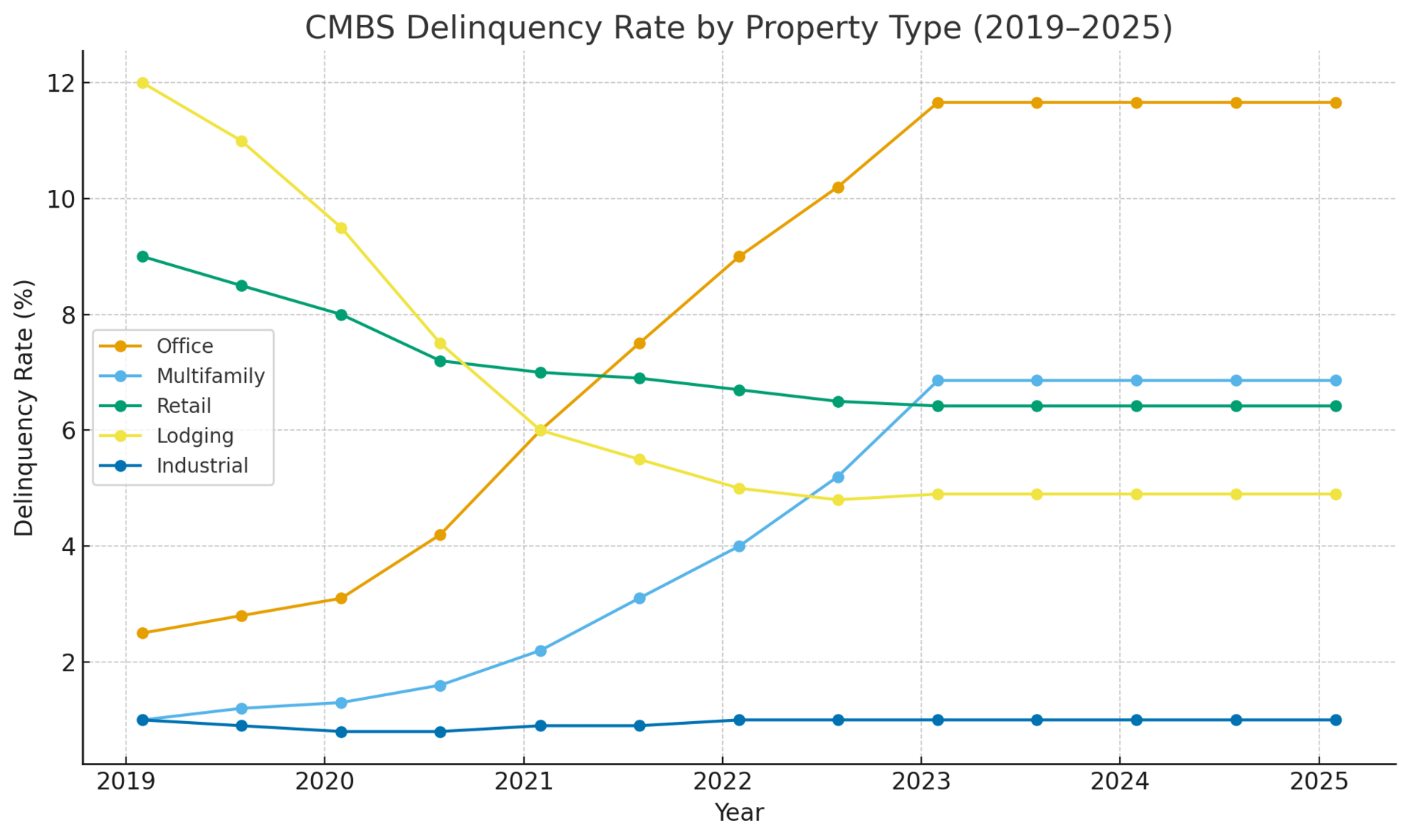

The U.S. CMBS delinquency rate climbed to 7.29% in August 2025, the sixth straight monthly increase and the highest since the pandemic. Office delinquencies hit an all-time high of 11.66%, while multifamily delinquencies surged to 6.86%, a nine-year high. Together, these sectors now drive the bulk of CMBS defaults, underscoring sector-specific distress amid a looming refinancing wall.

Overall CMBS delinquency: 7.29% (↑ from 7.16% MoM)

Delinquent balance: $44.1B of $605B outstanding CMBS (↑ from $43.3B)

Office delinquency: 11.66% (↑ 62 bps MoM, record high)

Multifamily delinquency: 6.86% (↑ 71 bps MoM, nine-year high)

Retail delinquency: 6.42% (↓ 48 bps MoM, lowest in a year)

Lodging delinquency: Flat, <5%

Industrial delinquency: ~1% (stable, lowest sector)

Special servicing rate: ~6.6%, up YoY

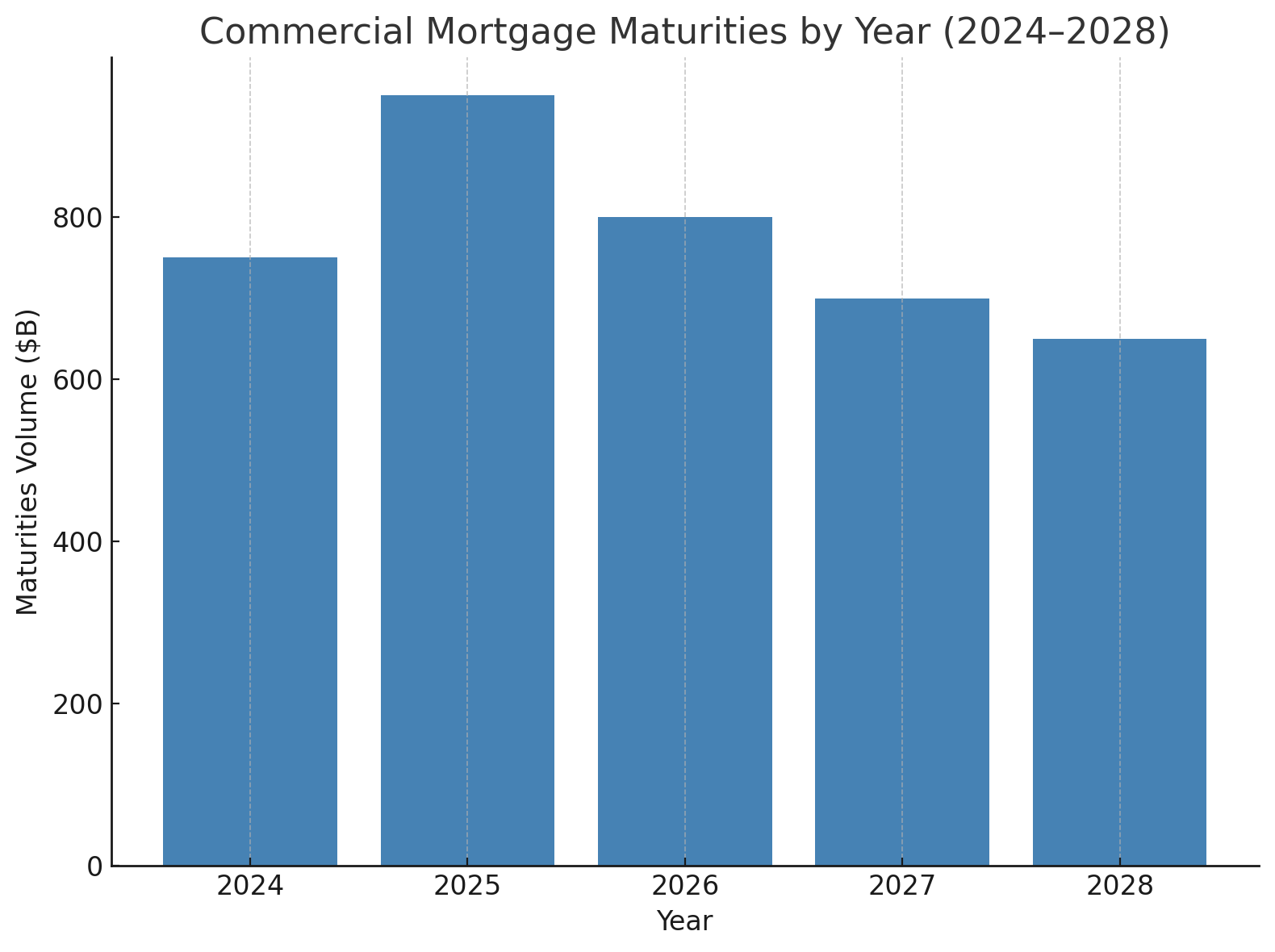

CMBS maturities due by 2027: $290B, with 2025–2026 front-loaded

Opportunistic capital raised for CRE credit: $50B+

1. Sector Divergence

Office and multifamily loans now lead CMBS distress, reversing pre-2024 dynamics when multifamily was considered safe. Retail and lodging show resilience: consumer spending and travel demand stabilize loan performance. Industrial remains an outperformer with delinquency near 1%.

2. Refinancing Crunch

With ~$290B of CMBS maturities by 2027, rising rates and lower valuations hinder take-out financing. Extension requests are rising, but servicers remain selective. Many high-profile office loans in NYC, SF, and Chicago have transferred to special servicing as balloon payments near.

3. Capital Market Strain

AAA conduit spreads widened modestly (+10 bps) but BBB tranches trade at yields in the teens. Investors brace for losses concentrated in office-heavy pools. Special servicers anticipate protracted workouts, often extending loans rather than foreclosing, which prolongs bondholder pain.

4. Distress & Opportunity

Private equity and debt funds with $50B+ in dry powder are preparing to buy loans at 70 cents on the dollar or less. Loan sale activity is picking up. Bid-ask gaps remain, but forced trades will set new benchmarks, particularly in gateway office towers expected to transact at 40–50% below 2019 values.

Sector bifurcation: Office and multifamily drive defaults; retail, lodging, and industrial remain stable.

Refinancing wall: Higher rates and lower valuations push more loans into special servicing.

Investor implications: BBB CMBS spreads signal distress pricing; opportunistic buyers eye discounts.

Asset management: Early workouts, updated valuations, and proactive sponsor engagement are critical.

Office operators: Cutting utilities, deferring CapEx, and negotiating tenant concessions to preserve occupancy.

Multifamily managers: Offering renewals with concessions as new supply pressures rents.

Lender relations: Weekly reporting and transparency with special servicers to secure extensions.

Tenant impact: Reduced amenities in offices and aggressive rent offers in apartments as operators prioritize cash flow survival.

Office delinquencies could climb to 13–14% by Q4 2025 as more towers default.

Multifamily stress will rise in oversupplied Sunbelt markets.

Retail and hotel may continue to improve, partially offsetting index pressure.

Expect distressed sales and note sales to accelerate into 2026, setting new price discovery benchmarks.

Policy interventions may emerge, from tax incentives for conversions to regulatory forbearance.

Opportunistic funds likely to deploy more capital by late 2025 as bid-ask spreads narrow.

CMBS Delinquency Rate by Property Type (2019–2025) — Office spiking to 11.66%, Multifamily to 6.86%, while Retail and Lodging improve and Industrial stays near 1%.

Commercial Mortgage Maturities by Year (2024–2028) — refinancing wall peaking in 2025 at ~$950B.