📢Good morning,

CRE debt markets reopened in Q2: new originations rose 66% YoY and 48% QoQ, with banks more than doubling activity and debt funds close behind. Lending breadth and stabilizing rates are pulling buyers back in after 2024’s freeze. The 10-year UST ~4.2% and futures markets pricing a ~90% September Fed cut have improved underwriting confidence even as spreads remain wider than pre-2022.

Forward pipelines are building, aided by price discovery and signs that values have stabilized off the 2022 peak.

+66% YoY originations (Q2 2025); +48% vs. Q1. Broad rebound across lender types.

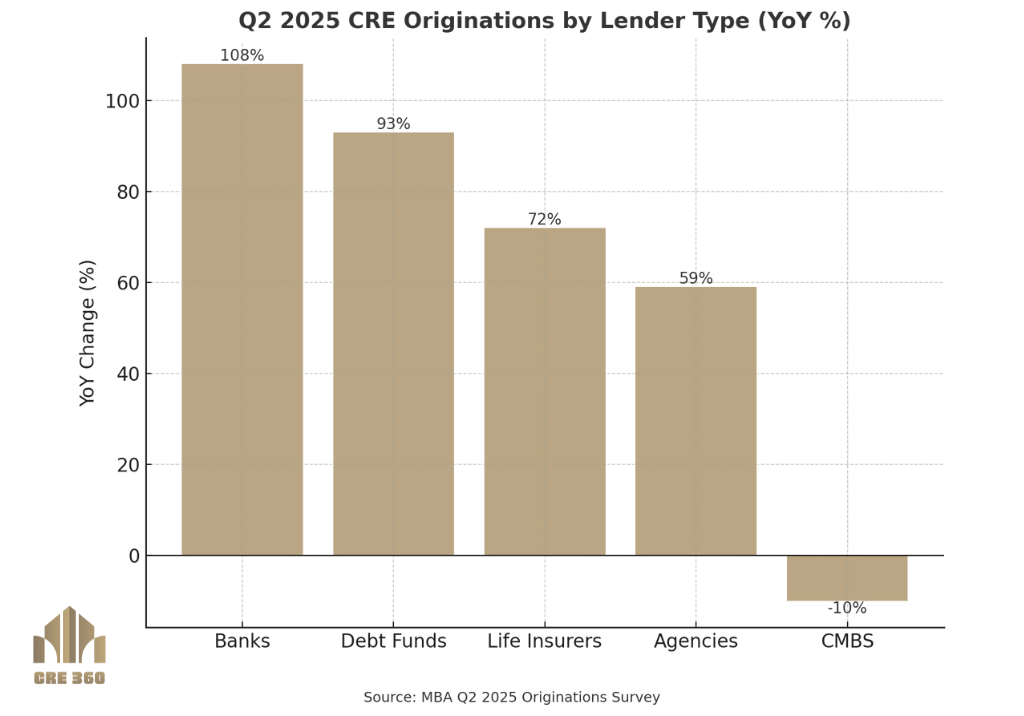

Lenders: Banks +108%, investor-driven debt funds +93%, life insurers +72%, agencies +59% YoY; CMBS –10%.

By property: Office +140%, industrial +53%, retail +30%, healthcare +77% YoY; multifamily –35%, hotel –30%.

Rates backdrop: 10-year UST ~4.24%; average permanent loan spreads ~190 bps in Q2. Implies coupons near 6–6.5% for core assets.

Maturities: ~$957B of CRE loans face 2025 maturities, keeping refi demand elevated.

Metric | Latest | Source |

|---|---|---|

Q2 originations YoY | +66% | MBA |

Bank originations YoY | +108% | MBA |

10-yr UST (Aug 27) | 4.24% | FRED |

Loan spreads (Q2 avg) | ~193 bps | CBRE |

2025 maturities | ~$957B | Multi-Housing News |

Returns / Performance Trends

Price discovery is advancing. Green Street’s all-property index shows +3.2% YoY but –17.7% vs. 2022 peak, consistent with a bottoming narrative at lower levels. That reset is restoring debt coverage and enabling new loans at more conservative bases.

Lending / Capital Conditions

Re-engagement is broad: depositories re-opened books, debt funds scaled, and life companies and agencies lifted volumes. CMBS remains selective. Spreads are tighter than 2024 but still above 2019, keeping all-in rates elevated yet financeable. With the 10-year near 4.2% and high odds of a September Fed cut, lenders are underwriting with more rate certainty while still stressing scenarios.

Transaction Activity & Investor Flows

Refi and payoff inquiries are rising ahead of maturities. The ~$957B 2025 wall ensures steady loan demand; quality assets will clear first, while transitional deals lean on debt funds or structured stacks.

Broader Implications

Market stress is contained but not gone. Overall CMBS delinquency hovered a little above 7% this summer, signaling pain in older pools even as new credit flows to better collateral—supporting a cautious but improving liquidity regime.

66% YoY jump in Q2 originations → liquidity is back, especially from banks and debt funds.

Rates stabilize: 10-yr ~4.2% and cuts priced → underwriting clarity improves.

Sector split: Office +140% origination growth from a low base; multifamily –35% as agencies stayed selective.

Values reset: Green Street –17.7% from peak, +3.2% YoY → better loan metrics on recalibrated bases.

Maturity pressure: ~$957B 2025 maturities → refi wave sustains capital flows into 2026.

Institutional Lens: Expect modest spread compression if the Fed cuts, but count on conservative proceeds. Banks and lifecos favor stabilized, cash-flowing assets at 55–65% LTV, while debt funds fill gaps for transitional stories at higher coupons. Use today’s pricing to term out risk and protect downside; CMBS remains selective and skewed to higher-quality collateral.

Operator’s Lens: Underwrite with debt yields ≥10% and DSCR ~1.30–1.40x at actual coupons. For quality assets, all-in rates ~6–7% pencil if in-place NOI is durable and exit caps are underwritten 100 bps above 2021 levels. Re-engage lenders now; pull term sheets to benchmark leverage and rate options.

If the Fed cuts, expect marginally lower coupons and slightly higher proceeds in 2026.

Refi volumes stay high through 2026 as 2024–2025 maturities roll. Bifurcation persists: prime assets clear first; transitional deals rely on structured capital.

Watch CMBS delinquency trend and spreads for early signals of broader credit easing.

📊Resources

Mortgage Bankers Association — Q2 2025 Originations Survey (release + PDF). MBA +1. CBRE — Q2 2025 lending spreads and capital markets figures. CBRE +1. FRED — 10-Year Treasury (DGS10). FRED. Reuters — Fed cut probabilities; Bessent housing measures and rents commentary. Reuters +1. Green Street — CPPI (All-Property): +3.2% YoY, –17.7% from 2022 peak. Multi-Housing News — 2025 CRE maturities ~$957B. Multi-Housing New. Trepp — CMBS delinquency ~7.1% (June/July 2025). Trepp +1