📢Good morning,

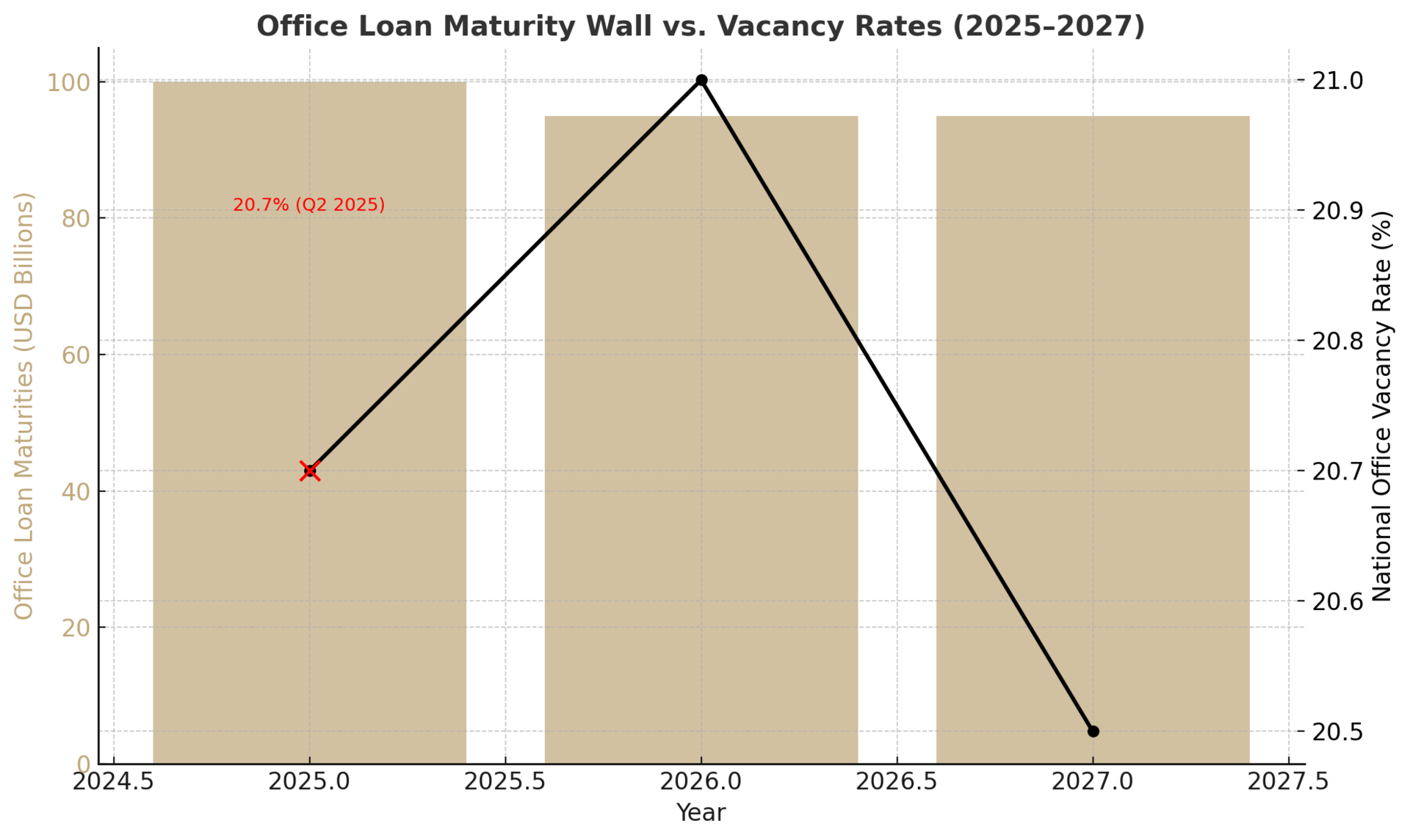

The U.S. office sector has entered uncharted territory: national vacancy reached 20.7% in Q2 2025, the highest level ever recorded. Tech-heavy metros are hardest hit — San Francisco’s availability soared to 27.7% (vs. 8.6% in 2019), while Downtown Manhattan and Charlotte hover near 23% empty. Landlords are grappling with falling rents, heavy concessions, and a looming $290 billion debt wall by 2027 that threatens widespread defaults.

📊 Quick Dive

20.7% national office vacancy in Q2 — surpassing early-1990s downturn records (Reuters/Moody’s).

San Francisco at 27.7%, Charlotte and Downtown NYC at ~23% vacant — nearly 1 in 4 offices dark (Reuters).

$290B in office debt maturities by 2027; CMBS delinquency jumped to 11.1% (Moody’s).

CRE Lending Rebounds Sharply in Q2 as Debt Funds and CMBS Fill the Void, Spreads Stabilize

Commercial real estate lending is showing signs of life after a long freeze. CBRE’s Lending Momentum Index jumped 45% YoY in Q2 2025, with alternative lenders (debt funds, mortgage REITs) now the largest group, accounting for 34% of non-agency loans. CMBS issuance also surged, doubling market share to 19%, while banks cautiously re-entered with 17% more originations. Loan spreads stabilized around 193 bps for commercial and 150 bps for multifamily. The result: borrowers now face more financing options at all-in rates near 5.5–6% — a sharp contrast to 2024’s credit drought.

San Francisco Puts Trophy Office Tower on the Block in Market Test as Downtown Sentiment Improves

San Francisco’s 101 California Street — a 48-story, 1.2M sq. ft. trophy tower — has been listed for just over $1 billion. The building is 88% leased, home to Goldman Sachs and Morgan Stanley, and recently underwent a $75M renovation. Owners Hines, GIC, and HKMA are seeking roughly $900 per sq. ft., about 10% below pre-COVID pricing. With citywide office vacancy near 34.6%, this listing is viewed as a critical test of whether global capital is ready to re-engage with prime urban offices. A sale near ask could re-rate values across San Francisco; a weak result could reinforce the “doom loop” narrative.

Early Signs of Life in Office Market: Occupancies Stabilize and Cap Rates Peak for Lower-Tier Buildings

Despite record vacancies, select office markets show hints of recovery. Net absorption turned positive in most major metros in early 2025, reversing years of givebacks. CBRE’s survey shows cap rates for Class B/C offices have plateaued, with the share of secondary offices trading at double-digit yields edging down from 74% in late 2024 to 71% in H1 2025. Investor sentiment is shifting: 68% of investors expect no further cap rate increases, and 16% foresee compression — the first signs of stabilization since the pandemic.

Northwest Arkansas CRE Bucks National Slump with Healthy Demand and Development

Northwest Arkansas continues to outperform broader U.S. markets. Overall CRE vacancy rose modestly to 7.2% in H1 2025 (vs. ~20% U.S. office average), supported by diverse tenant demand. Office vacancy sits at 6.8%, retail at 6.6%, and warehouse at 10.4%, with new construction quickly absorbed. Building permits surged 48% to $290M, the third-highest on record, signaling developer and lender confidence. Local lenders like Arvest remain active, and cap rates hold in the 6–7% range, far below national averages. NWA is increasingly viewed as a “safe haven” secondary market.

The office sector’s bifurcation is widening: commodity Class B/C space is spiraling into distress, while high-end towers and resilient secondary markets still draw capital. For practitioners, the playbook is clear:

Underwrite conservatively — assume elongated lease-up, higher TI/LCs, and elevated cap rates for office.

Follow the capital — liquidity is flowing into debt funds, CMBS, and select markets like NWA, while urban trophy towers are being tested in real time.

Position for conversions and capital rotation — obsolete stock will be repurposed, and lenders are rewarding proactive operators with access to refinancing.

This is no longer about cyclical patience — it’s about structural repositioning.

Vacancy Trajectory: U.S. office vacancy could exceed 21% by year-end 2025 (C&W forecasts).

Debt Pressure: $290B in maturities will drive workouts, defaults, and discounted note sales through 2027.

Selective Recovery: Trophy offices and Sun Belt metros may stabilize in 2026; secondary assets remain distressed.

Capital Rotation: Debt funds and CMBS will dominate new originations; regional banks stay cautious.

Regional Bright Spots: Markets like Northwest Arkansas highlight where fundamentals can still outperform.

Moody’s Analytics / CBRE / CoStar, Trepp / Yardi Research + Moody’s Analytics