🚨Key Highlights

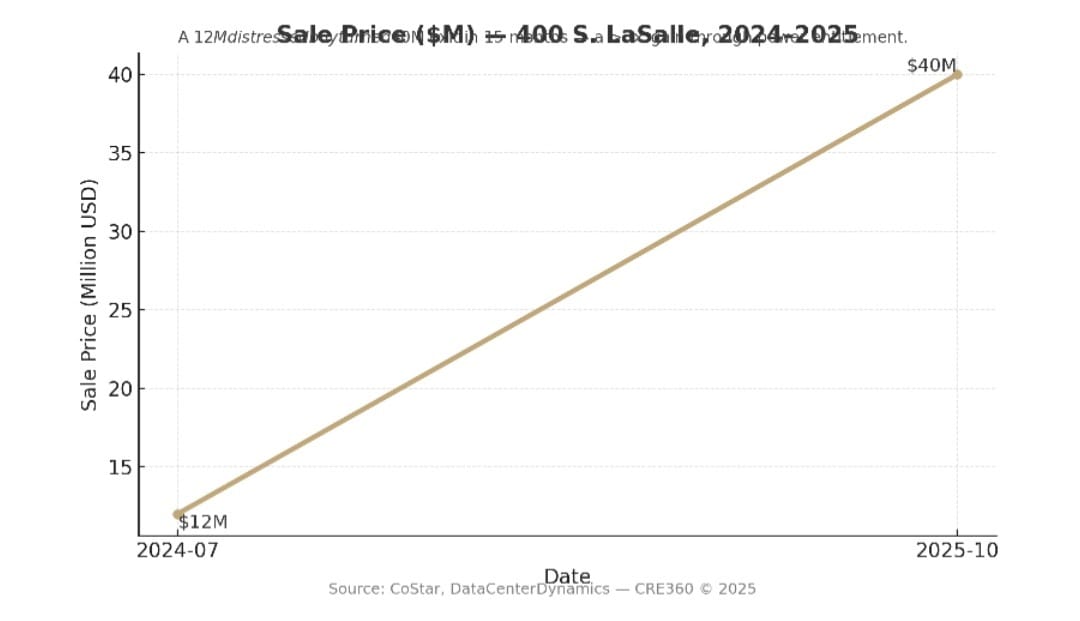

$12M acquisition → $40M sale in 15 months (+233%)

385K SF tower to be converted into 33 MW data center by late 2026

Chicago Loop office vacancy ~20% vs. U.S. data center vacancy ~3%

Value per SF jumped from $31 → $104 due to power-secured reuse.

Illustrates 500 bps cap-rate arbitrage between offices (10%) and data centers (5%)

Signal

In a downtown market still drowning in vacancy, one obsolete office tower became a case study in adaptive capital. Prime Group and Capri Investment turned a distressed $12 million buy into a $40 million sale within 15 months—by doing little more than securing the power capacity for a future data center. The buyer, Virginia-based Legacy Investing, will transform 400 S. LaSalle into a 33 MW facility, bringing digital infrastructure into the Loop’s vacancy belt. The message is stark: in 2025, grid access—not glass curtain walls—sets urban value.

Repricing Obsolescence

The transaction rewrote Chicago’s office math. The joint venture’s $12 million entry—about $31/SF—was a deep-distress trade reflecting zero tenant demand. By securing utility commitments, they repositioned the same real estate at $104/SF. This >230% gain isn’t an anomaly; it’s a repricing of risk. Distressed offices near substations or fiber routes now represent option value on power. Meanwhile, traditional office comps in the Loop continue to fall 10–15% YoY as absorption stays negative.

Power as Currency

Legacy’s managing director called the local team’s role “critical in assuring the building has enough power.” That single line captures the market shift. Nationwide, utility power scarcity is the new constraint: lead times for new grid connections exceed 18 months in many metros. Data center developers now pay premiums for sites with pre-secured megawatts—an inversion of prior eras when view corridors or floorplates drove value. In Chicago, where ComEd capacity is tightening, this verified 33 MW availability justifies the pricing leap.

Capital Crossovers

The deal bridges two capital worlds: distressed office equity and infrastructure yield capital. Offices in the Loop trade—if at all—at implied 9–10% cap rates. Stabilized data centers command 5–6%. That 400 bps spread explains the arbitrage. Legacy, backed by infrastructure-oriented investors, can underwrite 20-year leases to cloud tenants at investment-grade credit, while office buyers face three-year lease churn and capital drag. Blackstone, Ares, and Digital Realty have all scaled similar cross-sector bets, effectively importing infrastructure pricing discipline into CRE.

Execution Edge

Unlike most conversions, Prime and Capri didn’t build—they designed, permitted, and sold. Their value-add was intellectual and infrastructural, not physical. Yet that approach won’t always repeat. Full data center conversions typically take 24–36 months and $1,200–$1,600/SF of capital expenditure. Future players will need deeper balance sheets and early anchor tenants. Still, this flip proves planning and power entitlement can monetize faster than construction itself. Agile capital—knowing when to exit—is the differentiator.

Market Implications

The sale resets expectations for both appraisers and policymakers. For valuation, functionally obsolete offices near utility corridors now carry embedded optionality. For city hall, the lesson is structural: infrastructure dictates land value. As Chicago explores office-to-housing incentives, parallel frameworks for “office-to-infrastructure” should emerge—expedited power permitting, zoning clarity for high-load uses, and coordinated utility investment. Expect 2–3 more Loop buildings to announce data-center or hybrid tech conversions in 2026.

By late 2026, 400 S. LaSalle is slated to open as Chicago’s newest downtown data center. Leasing momentum from AI and cloud tenants could pull other investors downtown. Nationwide, data center vacancy sits near 3% with hyperscale demand pushing projected $1 trillion in investment through 2030. As grid constraints tighten, conversion feasibility will be determined less by structural retrofit cost than by who controls the next megawatt. For CRE capital, this marks the first true convergence of power engineering and real estate underwriting.

Power is the new location premium—and infrastructure is the new core.

CoStar News — “Chicago JV Flips Ex-CBOE Tower” DataCenterDynamics — “Legacy to Convert 400 S. LaSalle” GrowAnalytica — Transaction Data